Is the PNC Points Card a Good Deal for Travel?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers. This page includes information about the Discover it® Cash Back that is not currently available on Million Mile Secrets and may be out of date.Million Mile Secrets reader, John Young, commented:

Do you have any information about the PNC Points Visa from PNC bank? I was targeted to earn 50,000 PNC points after spending $500. But there is NO information on their website about how many points it takes to redeem for an airline ticket.I called them and was transferred to 3 different people. None of them gave me any information on the value of the points when redeemed for an airline ticket. All they told me was it takes a minimum of 50,000 PNC points to redeem for an airline ticket.

This may be a good card or it could be the biggest credit card sham going on. I can’t tell because they won’t give me the information.

Excellent question, John! There’s a reason you don’t hear about this card very often. That’s because it’s NOT a good deal.

I’ll explain why. And give you better options for cash back and travel rewards cards!

The PNC Points Visa Is NOT a Good Deal

PNC has branches in 19 states and offers the PNC Points Visa card.The card offers 4X PNC points on all purchases. And you earn bonus points if you have certain PNC checking accounts, a minimum amount of direct deposits, and/or a minimum balance in your account.

You can redeem the points through their online rewards catalog for airline tickets, gift cards, merchandise, and more.

Even though you’ll earn 4X PNC points per $1 spent, each point is worth ~1/5 to ~1/4 of 1 cent, depending on how you redeem them.

So that effectively makes this card a 1% cash back card at best. Even with the 75% bonus you’ll receive with certain checking accounts, it still doesn’t compare to other cash back credit cards that do NOT have those strict requirements.

And as John already found out, the customer service with PNC is bad. They wouldn’t give John (or me!) any information about their PNC points program. I recommend sticking with banks that make their award redemption policies easily available!

I was able to find out (after speaking with multiple people, as John found out) that 50,000 PNC points are worth $100 toward the cost of a coach flight on any US airline. At that level, the value you’ll receive is 1/5 of 1 cent per point. So this is NOT a good card to use for Big Travel!

Other bloggers and folks on FlyerTalk have found similar results.How Do PNC Points Compare to Other Cards?

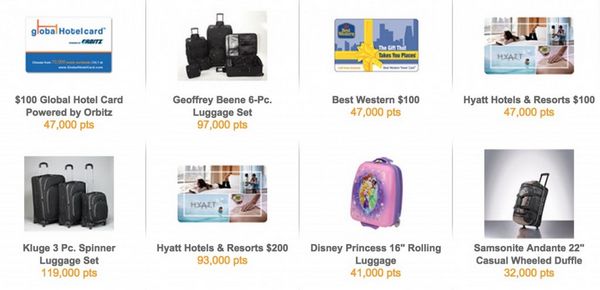

According to PNC, the most popular points redemption is for gift cards, including hotel gift cards.

Let’s take the Hyatt gift card as an example. You can redeem 47,000 PNC points for a $100 Hyatt gift card.

At 4X PNC points per $1 spent, you’d have to spend $11,750 on purchases to earn a $100 Hyatt gift card. And even if you jumped through hoops for the bonus points, the least you’d have to spend is close to $7,000.

I’ve written about other cash back cards and how much you can get back.

Here a few better options:

1. Chase Freedom

Link: Chase Freedom

You’ll always earn at least 1% cash back with the Chase Freedom. The best perk of this NO annual fee card is 5% cash back in rotating quarterly categories.

All of the points earned are worth at least 1 cent per point. You can increase their value when you pair the Chase Freedom with another card, like the Chase Sapphire Preferred, Chase Ink Plus, or (the no longer offered) Chase Ink Bold. That’s because Chase Ultimate Rewards points are valuable for Big Travel.

Even without the bonus categories and transfer options, you’d still earn more cash back than the PNC Points card.

2. Citi Double Cash

Link: Citi Double Cash Card

With the Citi Double Cash card you’ll get 1% cash back on all purchases. Then another 1% cash back on payments, as long as you meet the minimum payment. Get all the details on this card and see how it stacks up to other cash back cards in my review.

Because it earns 2% cash back, it offers a better earning rate than the PNC Points card.

3. Discover it Cash Back

Link: Discover it® Cash Back

The Discover it Cash Back card recently announced double cash back for the 1st card year for new members. You’ll have the opportunity to earn up to 10% cash back. And currently you earn $50 after your 1st purchase.

When you consider the double cash back and quarterly 5% bonus categories, it comes out way ahead of the PNC Points card. Especially the 1st year.

Check out my review of the card.

4. US Bank FlexPerks Travel Rewards Visa

Link: US Bank FlexPerks Travel Rewards Visa

This card earns 3X points when you give to a charity and 2X points on the category where you spend the most (airline, gas, or grocery) and most cell phone expenses.

If you want to redeem FlexPerks for flights, you’ll get a far better value than the PNC Points card.

5. Barclaycard Arrival Plus

Link: Barclaycard Arrival Plus

And if you want a points system with easy award redemptions, the Barclaycard Arrival Plus is a good choice.

The Arrival miles you earn with the Barclays Arrival Plus card can be redeemed starting at 10,000 miles for $100 as a statement credit towards a $100+ travel purchase (plus 5% miles back).

You effectively get 2.1% cash back on travel purchases with this card. So if you have a lot of $100+ travel expenses, this is probably the best cash back card! Although, I prefer cards that earn miles & points for Big Travel.

Bottom Line

The PNC Points Visa card is NOT a good option for cash back OR travel rewards. There are many better cards available that earn more valuable points. Like the Chase Freedom, Citi Double Cash, or Discover it Cash Back cards.

When you compare how much you’ll have to spend in purchases on the PNC Points card to similar cards, the terrible value of PNC points becomes clear.

I love to get Big Travel with Small Money and I’ll always tell you about the best deals. The PNC Points card is NOT 1 of them.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!