Should You Consider the New US Bank AMEX Cards?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.US Bank has launched 2 new FlexPerks credit cards, both of which earn points that can be redeemed for airline tickets, statement credits, and more.

It’s always good news when banks introduce new credit cards that get Big Travel with Small Money! Let’s see if these cards are worth considering.

What’s the Deal?

Link: US Bank FlexPerks Travel Rewards American Express Card

Link: US Bank FlexPerks Select+ American Express Card

US Bank has 2 new FlexPerks cards, both of which are American Express branded cards.

These cards earn FlexPoints, which can be redeemed for statement credits, gift cards, or paid airline flights. They can NOT be transferred to airlines.

The US Bank FlexPerks Travel Rewards American Express Card gets you:

- 20,000 FlexPoints after you spend $3,500 in purchases in the 1st 4 months of opening your account

- 3 FlexPoints per $1 you spend on charitable donations

- 2 FlexPoints per $1 you spend at restaurants and on cell phones (telecommunications services and products)

- 2 FlexPoints per $1 you spend on either groceries, gas, or airline tickets (whichever you’ve spent the most on in a billing cycle)

- 1 FlexPoint per $1 you spend on everything else

- Up to $25 statement credit per award ticket for airline expenses (checked bag fees, in-flight food and drink)

- NO foreign transaction fees

- Annual fee of $49, waived for the 1st year

If you prefer a card with no annual fee, the US Bank FlexPerks Select+ American Express Card gets you:

- 10,000 FlexPoints after you spend $1,000 in purchases in the 1st 4 months of opening your account

- NO annual fee

For an annual fee of $49 (waived for the 1st year), the US Bank FlexPerks Travel Rewards American Express Card earns a LOT more points and statement credits (which can easily offset the fee). That’s a much better deal.

What Can You Get With FlexPoints?

You can redeem FlexPoints for statement credits, gift cards, or airline tickets.

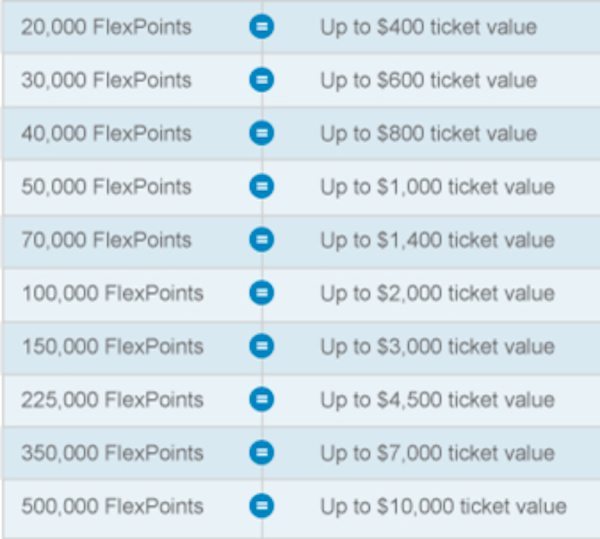

Points are worth 1 cent each when used towards statement credits and gift cards. But you could get a better value redeeming them for airline tickets.

That’s because you could get as much as 2 cents per point, and you earn airline miles on the ticket!

You can redeem points for paid flights on 150+ airlines, including most US airlines.

Keep in mind, you’ll only get the best value from your points if you can find an airline ticket for the maximum amount. For example, you’ll pay 20,000 points whether your ticket costs $150 or $400!

But if you’re looking for seats during busy travel times, or you’re traveling in a group, these cards could be a very good deal for you.

That’s because those are situations where it can sometimes be difficult to find the award seats you want. With FlexPoints, you’re buying a paid ticket with points. And you’ll earn frequent flyer miles!

However, folks who like to book Business or First Class seats won’t do well with these cards, because the number of points required depends on the cash price of the seat.

For example, a $4,500 1-way Business Class ticket to Europe costs 225,000 points (ouch!). But you could get there using other frequent flyer programs (like United Airlines) for 57,500 miles.

Note: If you’ve had a lot of recent credit card applications, US Bank is known to be picky about approving new credit!And because these are American Express cards, they’re considered different card products from the FlexPerks Visa cards. So you should be able to get these if you already have the Visa versions.

That said, I wouldn’t rush out to apply for these cards. The sign-up bonus is worth $400 (plus a $25 statement credit) at most.

There are better cards available with higher sign-up bonuses and more flexible points (which CAN be transferred to airlines and hotels).

But if you already have lots of cards and are looking for something new, these cards might be worth considering.

Bottom Line

US Bank has 2 new cards that could get you Big Travel with Small Money!

The US Bank FlexPerks Travel Rewards American Express Card has a sign-up bonus of 20,000 FlexPoints after meeting minimum spending requirements, and the $49 annual fee is waived for the 1st year.

And the US Bank FlexPerks Select+ American Express Card has a 10,000 point sign-up bonus and no annual fee.

These cards could be good for folks who like to redeem points for inexpensive coach class tickets. And you’ll earn frequent flyer miles!

But if you prefer Business or First Class, these cards probably aren’t the best deal for you.

And you can NOT transfer these points to airlines and hotels. So there are other cards I’d recommend first.

Please share your experiences with US Bank FlexPoints in the comments!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!