You’re Running Out of Time for the Suntrust Debit Card

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Delta Points wrote that soon may no longer be able to get the SunTrust Delta Skymiles Debit Card.

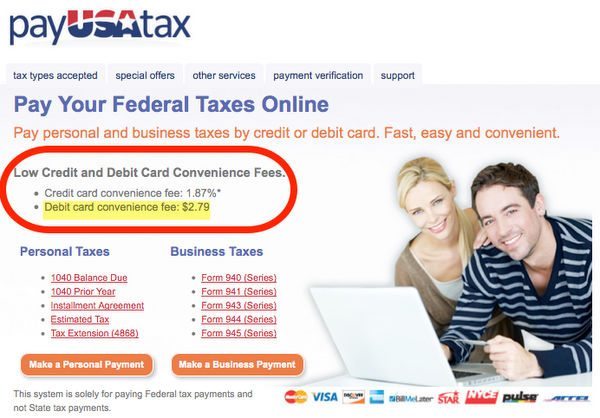

And today, View From the Wing, writes that the SunTrust debit card is no longer available on the Suntrust website! But there still might be a way to get the card. This is the best card to pay your taxes with because you pay only ~$3 for up to $35,000 in tax payments which earn ~35,000 Delta miles!

The card is being phased out quickly, but you still may be able to get one by calling Suntrust at 877-809-5248 for a personal debit card or 888-454-0611 for a business debit card. But hurry if you want one!

What’s the SunTrust Delta SkyMiles Debit Card?

Link: SunTrust Delta SkyMiles Debit Card

Link: My review of the SunTrust Delta SkyMiles Debit Card

The SunTrust Delta SkyMiles Debit Card earns Delta Airlines miles for debit transactions. You earn 1 Delta mile per $1 on all signature & PIN transactions.

There are some purchases that can’t be made with a credit card, so this is a good alternative if you want to earn Delta miles on mortgage payments, student loans, certain bill payments, money orders, or paying taxes. Or if you can’t (or won’t) get a miles-earning credit card, like the AMEX Gold Delta Skymiles (check your targeted offer for a potentially better offer), AMEX Delta Platinum, or AMEX Delta Reserve.

I wrote about this card back when the sign-up bonus was 25,000 to 30,000 Delta miles. But now, the sign-up bonus is only 5,000 miles, which isn’t very good.

But since some folks are now limited in how they can pay bills that don’t accept a credit card (because of the demise of Vanilla Reloads at CVS), this might be a good option for them.

How Do You Get the Card?

To apply for the card, you must have a SunTrust checking account (but not all types of accounts qualify). Depending on the type of account, you may have to pay monthly maintenance fees of $12 to $25, unless you keep a minimum balance each month.

If you live in an area without SunTrust branches, you may be able to open an account by chatting online with a SunTrust representative. Or, you can call Suntrust at 877-809-5248 for a personal card or 888-454-0611 for a business card (this is currently the best way to get the card).

Some folks on this FlyerTalk thread report not being able to get an account, or having their account shut down because they don’t live in a state with SunTrust branches. But others say they’ve not had any issues.

There’s no online application form for the card any more – you have to apply over the phone or in person once you have an account. You’ll have to decide if you want the personal or business version of the card.

The personal version gives you:

- 5,000 miles after your 1st purchase

- 1 miles per $1 you spend on regular purchases

- 2 miles per $1 you spend on Delta Airlines

- $75 annual fee, NOT waived for the 1st year

The business version has a higher annual fee and earns fewer points per $1 you spend! You’ll get:

- 5,000 miles after your 1st purchase

- 1 miles per $2 you spend on regular purchases

- 1 miles per $1 you spend on Delta Airlines

- $120 annual fee, NOT waived for the 1st year

What’s the Card Good For?

I would NOT get this card just for the sign-up bonus. Paying $75 to $120 per year, plus possible monthly account maintenance fees between $12 and $25 is NOT worth it for only 5,000 Delta miles.

1. Bills

But, if you have a lot of expenses that can’t be paid with a credit card, this card could be worth it. You could go to the Walmart Money Center and use the BillPay feature to pay student loans, car loans, mortgage, or utilities. Or if you need to send someone a money order, you could pay with the card!

2. Money Orders

Some folks buy money orders with the Suntrust debit card and then deposit those money back in their account. They earn Delta miles for buying the money orders for a very small fee!

Buying & depositing Money Orders in large denominations could arouse suspicion, so be careful.

3. Taxes

Another great use of the card is to pay your taxes. You pay only ~$3 for a Federal tax payment of up to $35,000 (which earns 35,000 Delta miles). This is much better than paying an ~2% fee for using a credit card to pay your taxes!

Note that the card has a daily limit of $35,000 per day. Giving you 35,000 miles for a $3 fee is certainly unprofitable for Suntrust, so it isn’t surprising that they are getting rid of the Delta debit card!

Bottom Line

The SunTrust Delta Debit Card may soon no longer be offered, but existing cardholders will get to keep their card.

The sign-up bonus on this card is only 5,000 miles, and you have to 1st apply for a checking account with SunTrust. Then you’ll pay monthly maintenance fees of up to $25 and an annual fee of $75 to $120. So I wouldn’t rush to get the card just for the sign-up bonus.

But if you’re looking for a way to earn miles on loans and bills that can’t be paid with a credit card, this card might be a good option for you. Or if you have a lot of taxes to pay, this is one of the best cards to use!

This won’t last long, but you can apply for the card by calling Suntrust at 877-809-5248 for a personal debit card or 888-454-0611 for a business debit card.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!