$250 Statement Credit (After Minimum Spending), up to 5% Cash Back & No-Annual Fee!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: The AMEX SimplyCash card is no longer available for new sign-ups.Don’t forget to follow me on Facebook or Twitter!

You now get a $250 statement credit when you sign-up for the American Express SimplyCash card and spend $3,000 within 3 months! $5,000 on purchases within the 1st 6 months of opening your account.

You have to be approved by April 28, 2014 September 21, 2015 January 25, 2016 April 27, 2016, to get this offer!

Link: AmericanExpress SimplyCash with $250 Credit (After Minimum Spending)

In my opinion, this is much better than the usual offer for NO sign-up bonus, and is quite good for a card with no annual fee.American Express SimplyCash

The American Express SimplyCash card is a cash back card, which is great for folks looking for flexibility!

You earn:

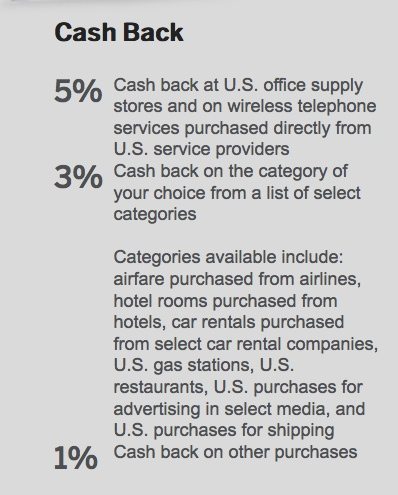

- 5% cash back at office supply stores and wireless services

- 3% from 1 of 7 categories (includes gas, airfare, hotel, etc.)

- 1% cash back on everything else

Cash back cards are a good way to pay for travel expenses that aren’t covered by miles and points (i.e. dining, excursions, and tickets to attractions).

You aren’t restricted by airline or hotel availability when you use the cash back.

You can even use the $250 statement credit for non-travel expenses!

But This is a Business Card

Many folks often aren’t certain if they are eligible for a business card. You may qualify for a business card if you own an existing business or are starting a business.SimplyCash Card Benefits

1. Sign-Up Bonus

You get $250 cash back, in the form of a credit on your billing statement, after spending $3,000 within 3 months $5,000 within 6 months on the SimplyCash card.

This is a very good sign-up bonus for a cash-back business card with NO annual fee!

Here are the 40+ ways to help complete the minimum spending requirement.

2. Annual Fee

The SimplyCash card has NO annual fee.

Many business cards have annual fees of $50 to $175, so it is nice to see a card with no annual fee.

3. 5% Cash Back at US Office Supply Stores and US Wireless Providers

Here’s where it gets interesting! It looks like American Express is targeting many of the same categories as the Chase Ink Cash and Ink Classic.

But is also letting folks choose which categories they would like to earn cash back in.

You get 5% cash back for spending at:

- US Office Supply Stores

- Wireless Service Purchases in the US

So that’s a total of $1,250 in cash back (5% cash back X $25,000 spending limit) for spending at Office Supply stores & for spending on wireless service.

You will only get 1% cash back after you cross $25,000 in each 5% category.That said, I still prefer using my Chase Ink Bold or Ink Plus for Office Supply or wireless purchases because I like earning 5X Ultimate Rewards points. I then transfer those Ultimate Rewards points to Hyatt hotel points.

But the Ink Bold and Ink Plus have an annual fee after the 1st year.

4. 3% Cash Back in 1 of 7 Categories

You can choose 3% cash back in any 1 of 7 categories:

- Airfare purchased directly from airlines

- Hotel stays (excluding timeshares, banquets and events)

- Car rental companies listed at americanexpress.com/rewards-info

- U.S. gas stations

- U.S. restaurants

- U.S. purchases for shipping

- U.S. purchases for advertising in select media

I like that you can get 3% cash back on gas, airfare, or hotel stays with a fee-free card!

Here’s a link which explains what is included in each category. There are lots of restrictions so please read this carefully. I wish that American Express wouldn’t have so many restrictions!

I also don’t like that you have to purchase the airfare directly from the airline and won’t earn points if you purchase via a third party such as Orbitz etc. Similarly, you won’t earn the full 3% cash back if you prepay for your hotel through a travel site such as Hotels.com etc. But you have to select a category within the 1st 2 months of getting the card. After that, you can only change your selection once a year, during December 1 to January 31. Also note that you will only receive 3% cash back on your first $25,000 of spending in each category per year.So that’s a total of $750 in cash back (3% cash back X $25,000 spending limit) for spending in any of these 7 categories.

You will only get 1% cash back after you cross $25,000 in each 3% category.

5. Foreign Transaction Fee

There is a 2.7% foreign transaction fee on this card.

So don’t use this card for purchases which are not in US dollars or which are made outside the US.

Bottom Line

It is nice to see American Express respond to the great offers by Chase!

A $250 statement credit on the American Express SimplyCash card may not seem like a lot, but it is a good deal for a no-annual fee card. This offer ends on April 28, 2014, April 27, 2016, so you’ve got ~3 months to decide whether to apply or not.September 21, 2015 January 25, 2016

If you apply for the Barclaycard Arrival Plus® World Elite Mastercard®, you will get another ~$420 in cash back which you can use for any type of travel expense!

I also like the 5% cash back on US Office Supply and US wireless purchases and being able to earn 3% cash back on any 1 of 7 categories including gas, airfare, and hotels!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!