Is American Express Bluebird’s “Send Money” the Next Amazon Payments?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers. Don’t forget to follow me on Facebook or Twitter!Bluebird Introduction

One of the best uses of American Express Bluebird is the ability to pay for transactions which can’t usually be made with a miles or points earning credit card. Transactions such as your rent, mortgage, car payment, credit card bill, tuition etc.You load your Bluebird card (which you can order online) with a points earning debit card at Wal-Mart. You can also reload Bluebird with Vanilla Reload cards which you can buy at CVS, Walgreen’s or other locations. Alternate with other credit cards so that you’re not spending too much at buying Vanilla Reloads with any one credit card.

Here’s a post on other credit cards to use with Bluebird, so that you’re not maxing out on just 1 card.

You may also be able to pay for the Vanilla Reloads with a credit card at Walgreen’s, but this isn’t always the case and could be a bit of wild goose chase.

Here’s a post on what a Vanilla Reload looks like and how to load a Vanilla Reload card to your Bluebird account.

Bluebird Send Money

American Express Bluebird lets you send money electronically from 1 person to another person outside of the Bill Pay feature which I reviewed here.At first glance, this seems similar to Amazon payments where you can send up to $1,000 with a credit card, fee free per month, from 1 user to another. Amazon payments is a great way to help with minimum spending requirements on credit cards.

You can send up to $2,500 monthly using the Bluebird “Send Money” feature, and the maximum amount per transaction is also $2,500. You can also set up payments automatically from one person to another. However, the person to whom you send money has to either have a Bluebird account or open a Bluebird account to receive money.

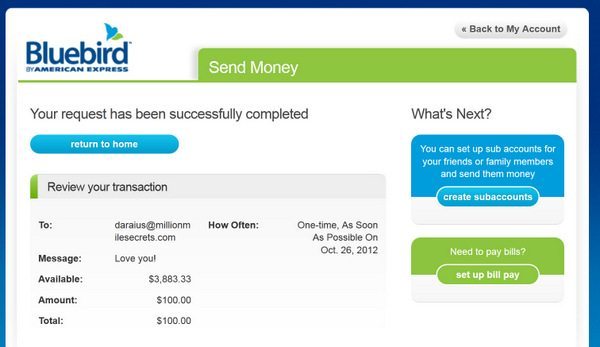

Emily transferred $100 to me, and the money immediately appeared in my account.

What’s the difference between “Send Money” and “Pay Bills”

The main difference is that the “send money” feature is NOT supposed to be used to pay a merchant, business or commercial entity for goods or services (use Bluebird “Pay Bills” for that). The terms say (bolding mine):

Payment to a merchant, business, or any type of commercial entity, or a payment (or request) sent in connection with the sale of goods or services or for payment on a debt or amount owed, is not an eligible use of Send Money and is prohibited (Pay Bills is the only currently approved means of sending payments to a merchant, business or other commercial entity via Bluebird).

I interpret this to mean that it is okay to use Bluebird “Send Money” to send gifts to others (for example Emily sent me $100 in the example below).

But it appears that you can’t use Send Money to pay for goods and services like you can with Amazon Payments.

The second difference is that the person to whom you are sending money using the “Send Money” feature needs to have a Bluebird account (or sign up for one) while the business or person to whom you send money using the “Pay Bills” feature doesn’t need a Bluebird account.

Why “Send Money” is not the next amazon payments

You can send up to $1,000 per month (ideally not exact dollar amounts) between persons with a credit card using Amazon payments, which is a good way to meet minimum spending requirements.

I’m pretty sure that Amazon knows about this (they are filled with smart, hardworking folks who mine data like no other), but chooses to allow folks to transfer money in order to build market share.

I suspect that American Express will have a lot less tolerance than Amazon if you transfer money back and forth between Bluebird accounts – especially if you share the same address.

American Express is much more conservative than Amazon and has among the best risk management systems and is also the purveyor of the financial review.

Bluebird is much too valuable to lose (because of the ability to pay credit card bills, mortgages, rent, etc.), and I certainly wouldn’t want to risk having my account shut down for transferring money back and forth between the same accounts.

How to Send Money

Here’s how to send money using Bluebird if you have a legitimate reason such as making gifts to kids in college or to family members living elsewhere.

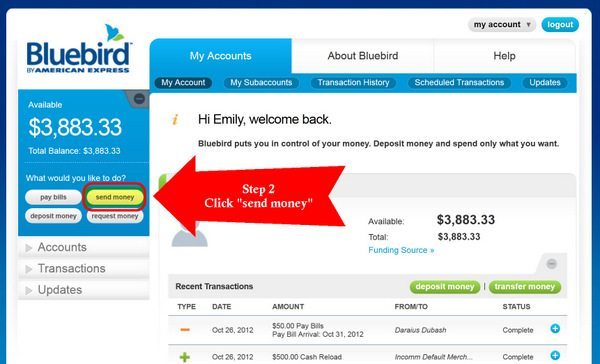

Step 1 – Log in to your Bluebird accountLog into your Bluebird account online.

Step 2 – Click on “send money”Click on the “send money” button which is on the left of the screen.

Make sure to send it to the email account associated with the receiver’s Bluebird account.

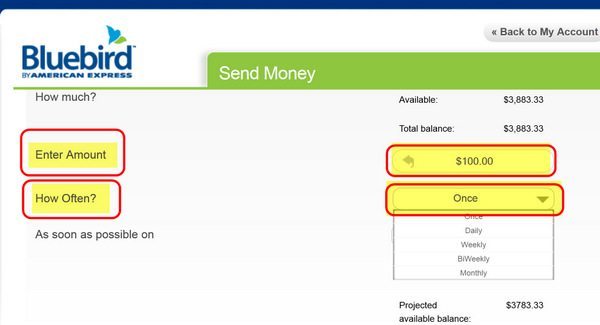

You can also set the payment for a future date.

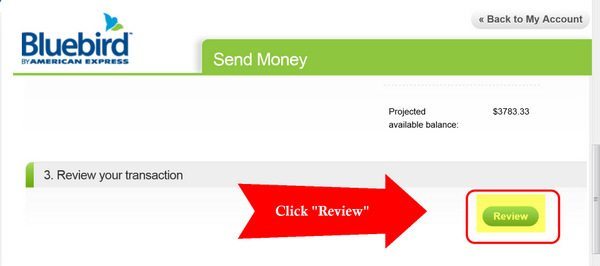

Then click the “Review” button.

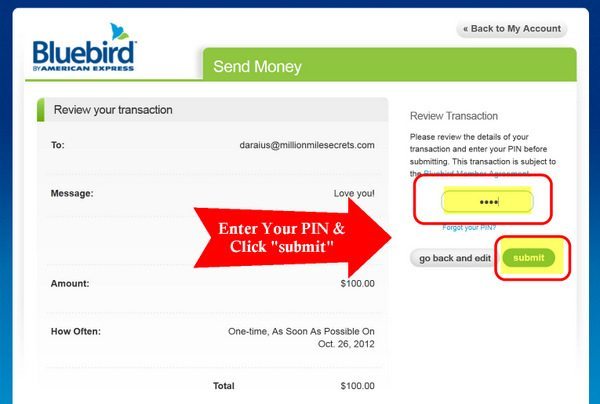

Enter your PIN number and then hit submit.

You will see a confirmation for your payment.

How to Receive Money

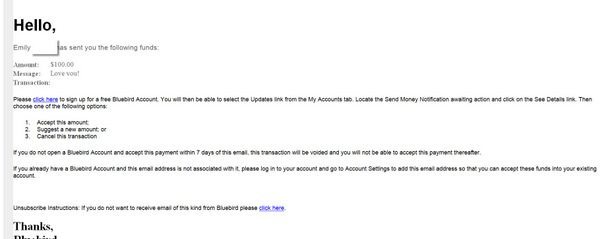

I immediately received an email that Emily had sent me money.

Here’s what I did to receive the money from Emily’s account.

Step 1 – Log in to your Bluebird accountLog into your Bluebird account online.

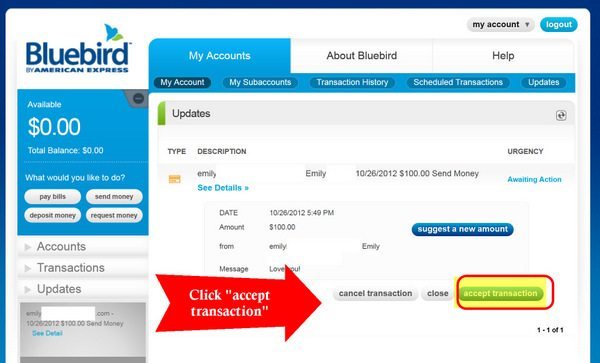

Step 2 – Click on “updates”Click on the “Updates” button which is at the bottom left of the screen. You can also scrolls down the main page to see details of the transaction

I had the option to:

- Suggest a new amount

- Cancel the transaction or

- Accept the transaction

I clicked on “accept transaction”

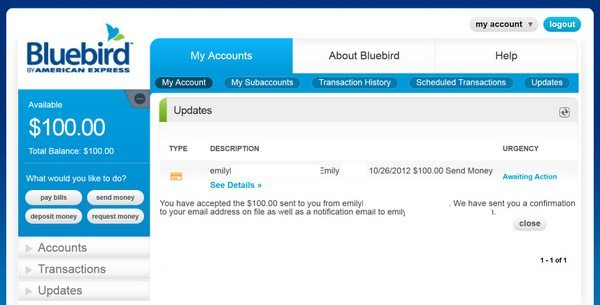

The next screen indicated that I had received $100 from Emily and my account balance increased by $100 immediately.

Bottom Line

I wouldn’t abuse the American Express Bluebird “Send Money” feature to send money from person to person.

Bluebird opens up a lot of other ways to complete minimum spending on credit cards & to earn 5X Ultimate Rewards points on almost all purchases by allowing you to pay your bills (including rent, mortgages, and loans) & withdraw money from an ATM.

I’d rather use Bluebird for paying bills and increasing the amount that I can spend on a credit card than to transfer money from person to person via Bluebird.

In my opinion, Amazon Payments is much better for transferring money for free from 1 person to another with a credit card.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!