Chase Ink Bold Being Discontinued…but When?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: The Chase Ink Plus 70,000 point offer is no longer available, but check Hot Deals for the latest offers! Update: The Chase Ink Bold card is no longer available for new sign-ups.Via MileValue, the Chase Ink Bold business card will be discontinued as of November 16, 2014. And some folks report that you can no longer apply in a branch, only online.

There seems to be some confusion as to whether the card is actually still available. There are no longer affiliate links which earn us a commission for the card, but it appears to still be active on the Chase website.

I did some digging and got conflicting information. I’ll explain!

Can You Still Apply?

Link: Chase Ink Bold

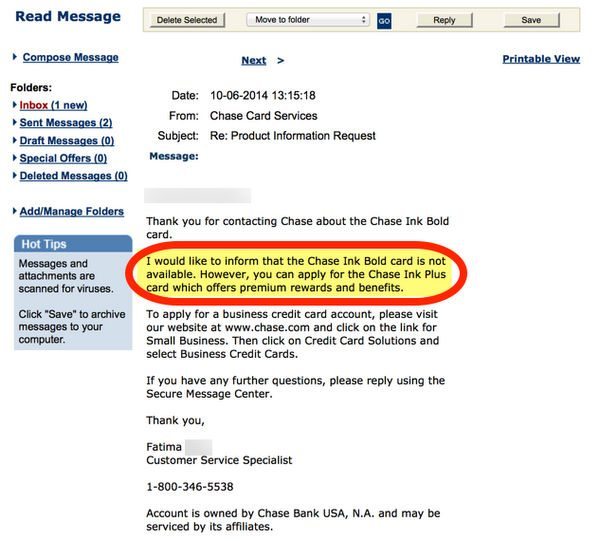

I sent a secure message to Chase asking when the Chase Ink Bold would be discontinued, and if it was still available to new applicants.

The response from Chase was surprising! The representative said that the card is already NOT available!

The online application still seems active. 🙂

Then I called a Chase branch to ask you could still apply for the card in-branch, and the employee said that it was still available there!

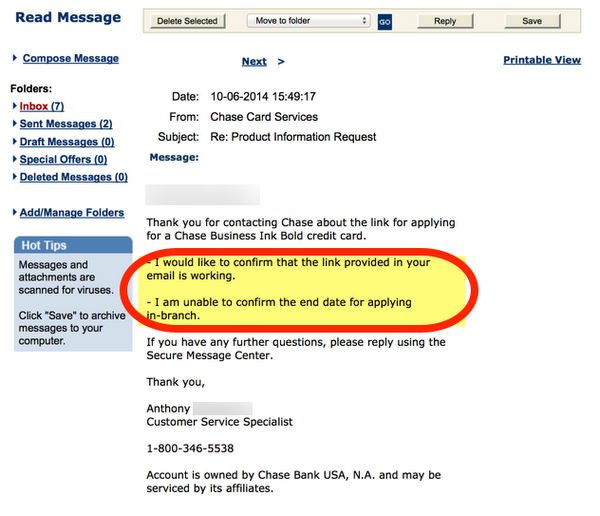

I sent another secure message to Chase asking for clarification, and this time the employee said you could still apply online, but couldn’t confirm being able to apply in-branch. I then went to a branch, and the card wasn’t available in the branch.

Most likely Chase is in transition with this card and the window of opportunity to apply is getting very small!

Should You Apply for the Chase Ink Bold?

Maybe. But it depends on which other business cards you have with Chase!

If you don’t have the Chase Ink Bold or Chase Ink Plus, you might want to skip the Chase Ink Plus for now and apply for the Chase Ink Bold, because it’s most likely disappearing soon.

The most recent offer for the Chase Ink Bold gets you 50,000 Chase Ultimate Rewards points after you spend $5,000 in the 1st 3 months. And the $95 annual fee is waived for the 1st year.

There’s a limited time offer for the Chase Ink Plus card. You’ll get 70,000 Chase Ultimate Rewards points after you spend $5,000 in the 1st 3 months.

Note: The Chase Ink Plus 70,000 point bonus offer ends on October 19, 2014.The annual fee of $95 is NOT waived, but I’d happily pay that for 70,000 Chase Ultimate Rewards points! That’s because 70,000 points is worth ~$875 when redeemed for travel, and potentially a lot more when transferred to airline and hotel partners.

But if you already have the Chase Ink Plus card, it might be worth it to apply for the Chase Ink Bold while you still can.

The 50,000 point sign-up bonus is still very good, and I’m not sure if Chase will replace this card with another that has such a large bonus for signing-up!

Bottom Line

The Chase Ink Bold business card is being discontinued, but it’s unclear when.

My best guess is that Chase is in the process of phasing this card out. The online application is currently still active.

If you miss out on the Chase Ink Bold, there’s a better (limited time) offer for the Chase Ink Plus that gets you 70,000 Chase Ultimate Rewards points after meeting minimum spending requirements.

If you’ve recently been able to apply for the Chase Ink Bold, please let me know in the comments!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!