Capital One CreditWise review

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

In addition to its lineup of credit cards, Capital One offers a way to monitor and track your credit report and score with a tool it calls CreditWise. It comes with a handy simulation tool to help you learn how opening a new account or missing a payment affects your credit score. So if you’ve got your eye on some of the best credit cards for travel, and want to improve your chances for approval, you can use this tool to find out how to improve your credit score.

Anyone can register for an account with CreditWise even if you don’t have an account with Capital One. It’s free to use and will not have an impact on your credit score.

CreditWise is free for everyone

Capital One’s credit monitoring tool is free and you don’t have to be a Capital One cardmember to get access.

Registering your account takes just a few minutes. You’ll need to provide some of your personal information — name, date of birth, address and Social Security Number. You may also be asked a few questions to verify your identity such as, the name of your current mortgage lender, an address where you previously lived, or when you paid off a car loan.

Using CreditWise won’t affect your credit score

When you request your own credit, it’s considered a soft pull and will not be visible to other creditors. Soft pulls do not affect your credit score, so you don’t have to be concerned that using this tool will lower your credit score.

Once you know your score and understand your ability to be approved, there are a number of Capital One cards to consider. Among our favorites are cards that earn Capital One miles. These are flexible points that can be redeemed for travel purchases or transferred to any Capital One transfer partner for even more value.

Here are some of the best ways to use Capital One miles.

Access to your TransUnion credit report and credit score

The CreditWise tool uses the data from one of the three major credit bureaus, TransUnion, to give you your credit score and a high-level overview of your credit profile. The main dashboard summarizes things like your on-time payments, recent credit inquiries, new accounts, age of your oldest account and the amount of your available credit. All of these items help you spot potential errors and figure out what’s helping and hurting your score. For instance:

- Payment history is a huge part of your credit score, so a quick glance at this and you can easily see if any unexpected late payments have popped up

- Because the length of your credit history is a factor in your credit score, being able to quickly identify your oldest trade line could help you ensure it does not get closed for inactivity

- Recent credit inquiries and new accounts could tip you off to any unauthorized credit checks, and quite possibly any signs of identity theft

Perks of CreditWise

Check your credit score and TransUnion credit report

Your credit score is an important number that has a big impact on your chances of being approved for a loan or credit card. CreditWise gives you access to your TransUnion credit score which can give you an idea of your chances for approval for a certain credit cards.

The score is based on the VantageScore 3.0 model which ranges from a low of 300 to a high of 850. It’s important to keep in mind that banks may use a slightly different version of a credit score when they review your application, so don’t be surprised if it doesn’t match exactly what banks pull. In most cases though, the scores will be similar.

Update your credit score weekly, not monthly

Many free credit monitoring services that are available to the public only let you refresh your credit report once a month. That can be a long time to wait to see the impact of any changes, corrections, or updates to your credit score. And if you want more frequent updates, you’ll typically have to pay for some kind of subscription.

However, with the Capital One CreditWise tool, you can refresh your credit score once every seven days. And you can always use the credit score simulator while you wait for the next update.

Credit score simulator

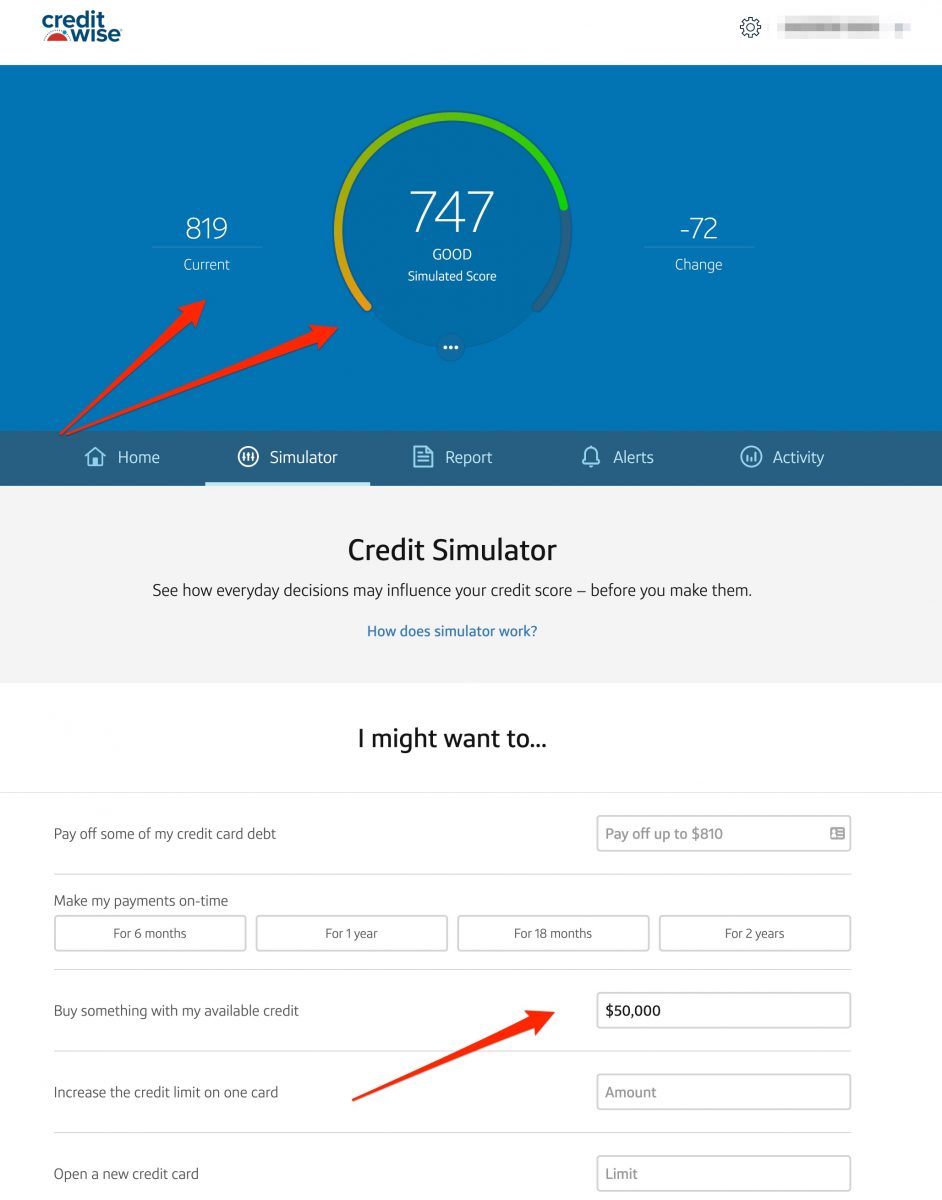

CreditWise comes with a handy credit simulator tool to identify measures that will have an impact on raising your credit score. Simply enter a hypothetical scenario to see your simulated new credit score. You can play with a variety of scenarios like paying down debt, making on-time payments for a certain number of months, increasing the credit limit on a card or opening an account.

Bottom line

Capital One’s CreditWise tool helps you keep track of your TransUnion credit report and score for signs of possible identity theft. It also shows you what’s helping and hurting your credit score if you’re trying to boost your score to apply for one of the top credit cards for travel. It’s free for everyone to use and does not hurt your credit score.

For more tips on how you can score big travel with credit cards, sign up for our newsletter here.Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!