$1,000+ Saved! My Strategy for Using Shopping Portals and Special Amex Credit Card Discounts

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

INSIDER SECRET: One of the easiest ways to save money (or earn miles and points) is to go through a shopping portal for all online purchases.

Whenever anyone asks how I got into the miles and points hobby, I explain that it all started with an interest in personal finance. I was reading a lot about savings and retirement and I happened upon a blog that discussed how miles and points could be used as a savings account — a way to make travel dreams a reality.

My obsession with earning rewards for the purchases I was already making grew from there and one of the first things I started doing was shopping through a shopping portal to earn miles, points and cash back. Most of the time I find that the cash-back rate is much better than the travel-rewards bonuses, so I end up using portals like Rakuten and TopCashback a lot. I use them more than, say, the American Airlines shopping portal.

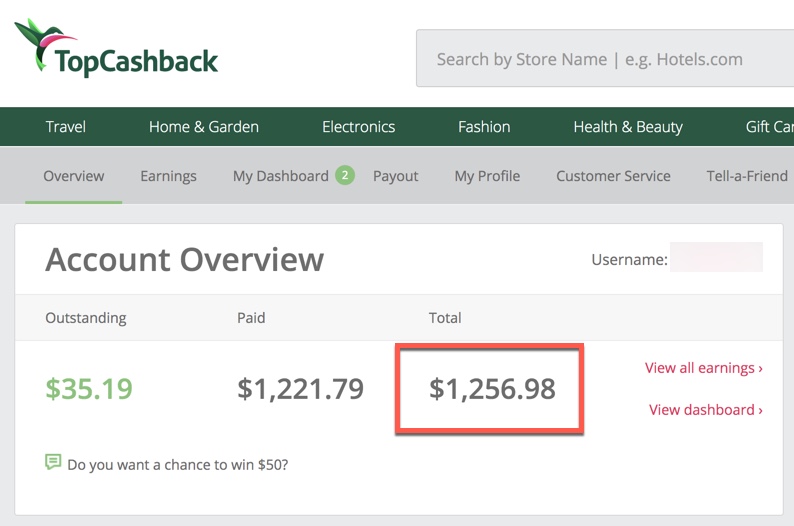

In fact, I’ve become so accustomed to using a shopping portal that over the past 18 months or so I’ve earned over $1,000 in cash back just by making a majority of my online purchases through TopCashback. Before, I was consistently using Rakuten (formerly ebates) and earned tons of cash back through that portal, too.

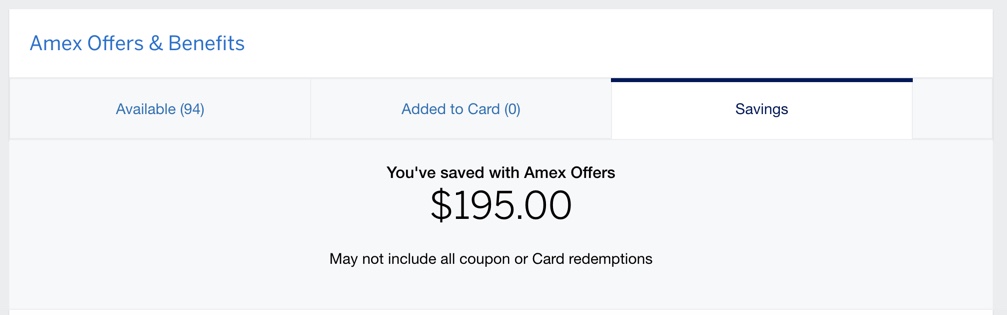

In addition to getting free money through shopping portals, I regularly use Amex Offers from the Amex cards I hold. These are targeted statement credits or bonus points you can earn when you enroll your card and spend a certain amount at qualifying merchants, including hotels, airlines and shopping.

- Hilton Honors American Express Card – 90,000 Hilton points after spending $2,000 in the first three months of account opening

- Hilton Honors American Express Surpass® Card – 130,000 Hilton points and a free weekend night after spending $4,000 in the first four months of account opening (formerly the Hilton Ascend card)

- The Hilton Honors American Express Business Card – 130,000 Hilton points and a free weekend night after spending $5,000 in the first four months of account opening

The offer for the Hilton Honors Aspire Card from American Express remains at a 150,000-point bonus you can earn after spending $4,000 in the first three months of account opening.

The information for the Hilton Aspire card and Hilton Surpass card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Bottom line, it’s incredibly important to remember to take the time to make those few extra clicks to save big. The little things can really add up.

For the latest tips and tricks on traveling big without spending a fortune, please subscribe to the Million Mile Secrets daily email newsletter.

Featured image courtesy of lenetstan/Shutterstock.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!