News You Can Use – Barclaycard NFL $400 Cash Back & 20,000 Points Virgin America, Citi American Airlines 50,000 Miles + $150 Statement Credit, 70,000 Point Marriott, & Accor Platinum Status

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers. 1. $400 Cash Back Barclaycard NFL Card. Thanks to Million Mile Secrets reader dhammer53 for tweeting me a link to Fat Wallet which discusses a $400 Cash Back Barclaycard NFL card after spending $2,500 within 3 months.A Fat Wallet member also posted links to get the $400 statement credit after spending $1,000 within 3 months, but it is unclear if Barclaycard (unlike the other banks) will honor an expired offer/link. I didn’t see any mention of an offer expiry date in the links for spending $1,000 within 3 months.

We do know that Barclaycard currently honors the US Air card targeted to Chairman’s Preferred members even if you’re not a Chairman’s Preferred member.

The card doesn’t have an annual fee and you can redeem 40,000 points for $400 in statement credits. However, only transactions above $25 qualify for statement credits.

Barclaycard usually uses the TransUnion credit bureau, so is often a good choice for folks who have lots of credit inquires with Experian and Equifax because of many credit card applications from Chase, American Express, and Bank of America.

You earn 2X points for NFL purchases, but 1 points for everything else, so this isn’t as good as other cash back cards which offer 2% to 3%, but the $400 sign-up bonus could be useful for unrestricted airfare, hotels, car rentals etc.

If you do apply for a Barclaycard, you *may* be able to get approved for a 2nd & 3rd Barclaycard (different card such as Virgin America, Frontier, etc.). See this post by Rapid Travel Chai for more information.

2. Barclaycard Virgin America 20,000 Points. Million Mile Secrets reader Pat (thanks!) emailed me with a link to a Barclaycard Virgin America link for 20,000 points after your 1st purchase. This is better than my affiliate link for 10,000 points, so I updated the link in the Airline Credit Card tab to the better offer.However, the $49 annual fee is not waived for the 1st year and the offer ends on Monday, February 4, 2013.

3. Citi American Airlines 50,000 Points + $150 Statement Credit. A few days ago, Flyer Talk member pianistat found working links to a better American Airlines Visa and AMEX offer for 50,000 miles AND a $150 statement credit after any eligible American Airlines purchase AND 2 lounge passes. I updated the link in the Airline Credit Card tab to the better offer.This is better than the previous offer which also earned 50,000 bonus miles (and much better than my affiliate link for only 30,000 miles), but didn’t have the $150 statement credit. Usually any purchases directly from American Airlines (such as a drink or baggage fee or buying a gift card from American Airlines) will trigger the statement credit.

I updated the links on the blog to go to this better offer. Note that the landing page has expired, but the offer has worked and continues to work and is perhaps the best sign-up bonus available today!

If you do apply for 1 Visa and 1 AMEX at the same time, don’t call to get approved since calling in seems to trigger denials. Some readers are still getting approved for both at the same time, and I’m trying to find out the secret!

Please email me (or comment) if you recently applied for 2 Citi cards and were denied for the second one.

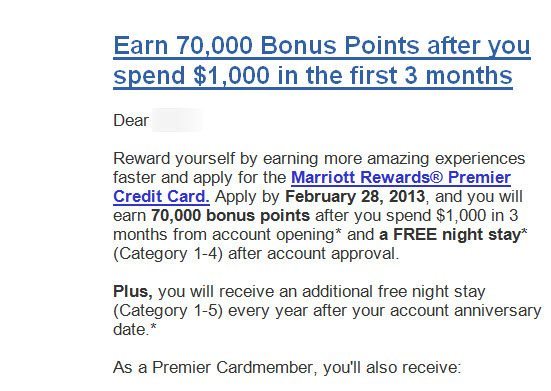

4. 70,000 Point Marriott. Million Mile Secrets reader (Wes!) forwarded an email from Marriott with a link to a 70,000 point Marriott Premier offer after spending $1,000 within 3 months. This is better than the regular offer for 50,000 points or the offer for 50,000 points and a $75 statement credit, which I wrote about previously.Note that the link doesn’t have the 70,000 points mentioned in the application page, but should almost certainly work (like previous offers).

That said, this isn’t my link, so your miles may vary. The offer ends on February 28, 2013. As always, I updated the Hotel Credit Card tab with the link.

5. Instant Accor Platinum Status. View from the Wing posts about an offer for instant Accor Hotel Platinum status. Accor platinum status isn’t great, but as Gary points out you can ask Best Western and Club Carlson to match your status.In my experience 1 year ago, both Best Western and Club Carlson didn’t ask to see proof of actually staying in the hotel – they just wanted proof of my existing elite status. But readers have been emailing that Hyatt sometimes asks for proof of staying in the hotel, but your miles may vary.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!