News You Can Use – 500 (~$10) Free Starwood Points & More..

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.1. 500 Free Starwood Points

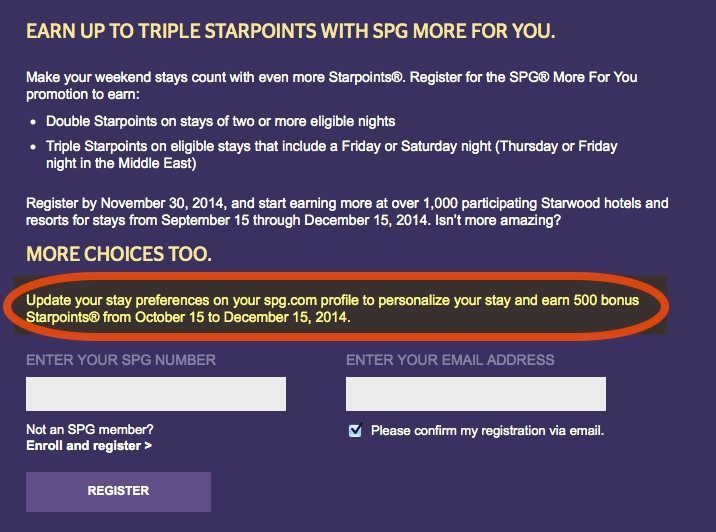

Via euflyer, you can get 500 free Starwood points by updating your stay preferences by December 15, 2014.

You have to register for Starwood’s “More For You” promotion before you update your stay preferences.

And you do NOT have to complete a hotel stay to get the points. I’d pay ~2 cents per Starwood hotel point, so 500 free points are worth ~$10 (500 Starwood hotel points X 2 cents per point).

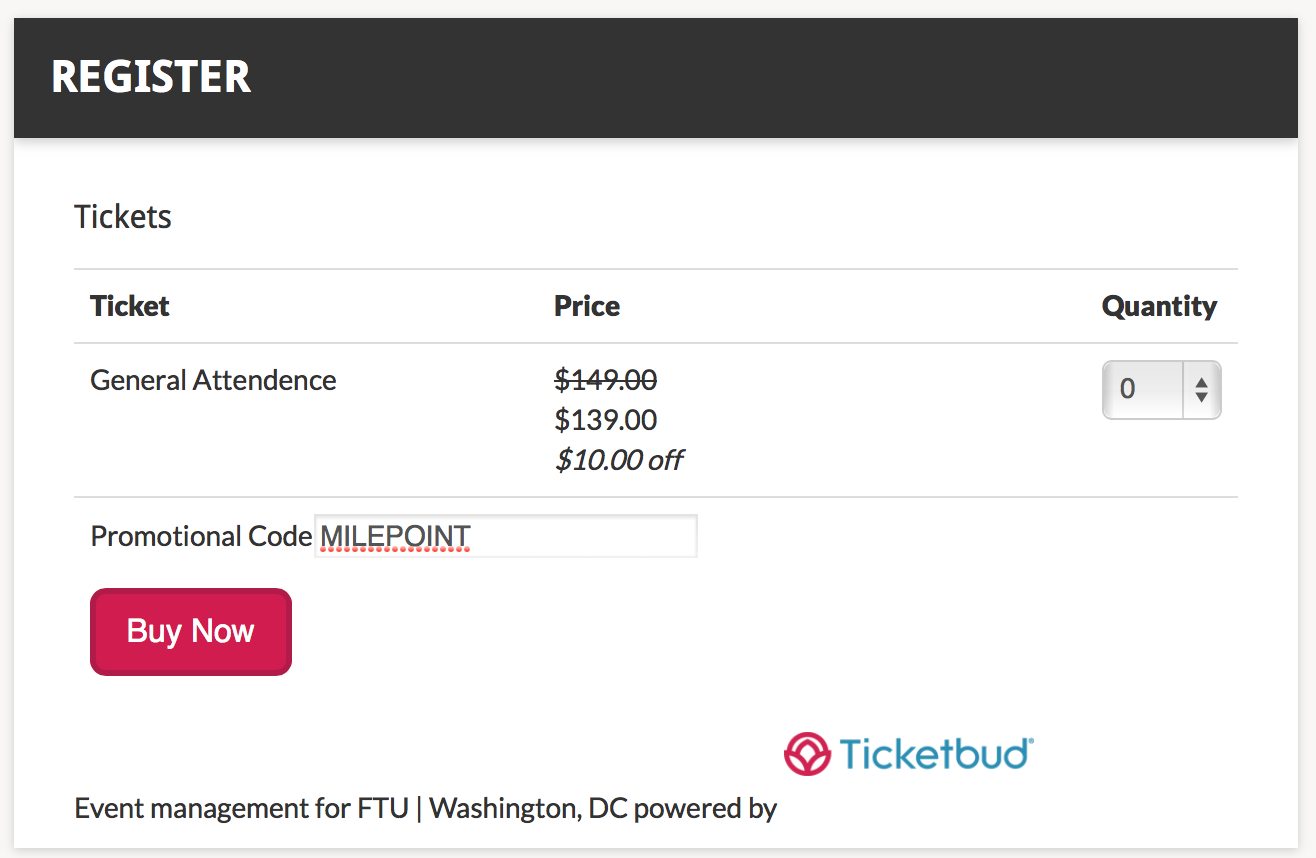

2. Save $10 on FTU

The Forward Cabin reports that folks can use promotional code “MILEPOINT” to save $10 on registration to Frequent Traveler University in Washington, DC, December 5, 2014, to December 7, 2014.Here is why so many folks will be attending this year’s FTU. And now you’ll get free Hyatt Platinum status (free internet & room upgrades when available) through February 16, 2015, with your registration.

3. 7,500 Bonus Marriott Points

Via Loyalty Traveler, you can get 7,500 Marriott points when you book a 2 night or more stay between November 15, 2014, and January 11, 2015.

Be sure to use promotional code “M41” to make your booking. Marriott Points are worth ~0.5 cents each, so 7,500 Marriott points are worth ~$38 (7,500 Marriott Points X 0.5 cents per Marriott point).

However, check to see if you can get a cheaper rate without using the promotion code or on other sites such as TravelPony or Kayak. The cheaper price could be worth giving up the 7,500 Marriott points.

Participating cities and states include:

- Atlanta, Georgia (blackout dates apply)

- Chicago, IL

- Iowa

- Kansas City, Missouri

- Minneapolis, Minnesota

- New Orleans, LA

- Tennessee

You can redeem 7,500 Marriott points for 1 free night in a Category 1 Marriott hotel.

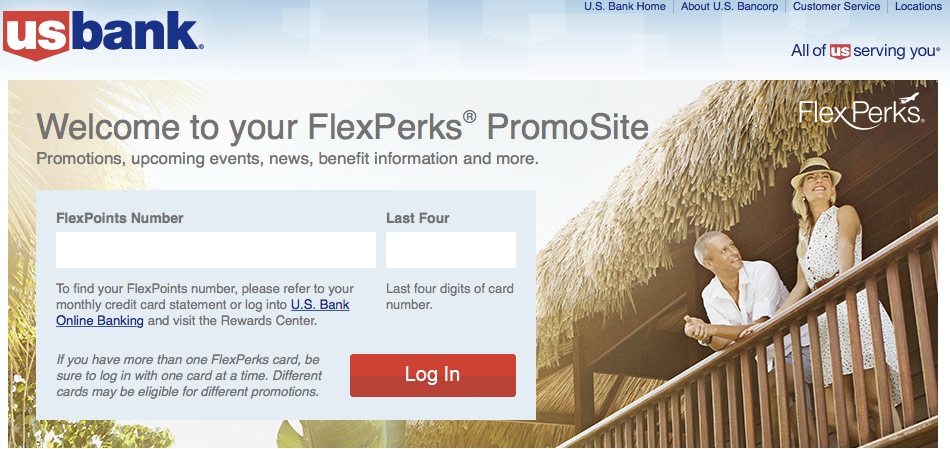

4. 1,000 Bonus US Bank FlexPerks Points (Possibly Targeted)

Via Mommy Points, you could earn 1,000 US Bank FlexPerks points when you enroll your US Bank FlexPerks card in Visa Checkout by November 30, 2014.

This could be a targeted offer so check your US Bank FlexPerks account to see if you were targeted. I’d pay ~1.3 cents per FlexPerks point, so 1,000 FlexPerks is worth ~$13 (1,000 Flex Perks X 1.3 cents per point).

Visa Checkout lets you use 1 account to pay for online purchases at places, like Staples. You can add credit and debit cards to your Visa Checkout account to pay for your purchases.And when you add your US Bank FlexPerks cards to your Visa Checkout account by November 30, 2014, you could get 1,000 US Bank FlexPerks.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!