How to Link Chase Pay to Samsung Pay & Easily Earn Up to 10,000+ Chase Ultimate Rewards Points!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Digital or virtual wallets are a fairly new bit of technology and if you’re like me, you haven’t gotten into the habit of using them regularly yet. But they are a handy way to “carry” all of your credit cards at once and earn extra rewards. And now is a great time to set up a digital wallet because there are a few offers to earn 1,000s of extra Chase Ultimate Rewards points by using Chase Pay!

If you have the Chase Freedom® card, Chase Pay is one of this quarter’s 5X bonus categories (on up to $1,500 in combined qualifying purchases), so you can earn up to 7,500 bonus Chase Ultimate Rewards points until December 31, 2018!

And there are other bonus offers for Chase Sapphire Preferred®, Chase Sapphire Reserve®, and Chase Freedom cardholders who make certain payments through Chase Pay. With these offers, you can earn up to 2,500 bonus Chase Ultimate Rewards points or 10% cash back!

The problem is, Chase Pay isn’t widely accepted. But you can get around this problem by linking Chase Pay with Samsung Pay. I’ll show you how to do it and explain why it makes using Chase Pay much easier. Plus, you’ll be able to earn Chase Ultimate Rewards points and Samsung Rewards at the same time!

Why Is Samsung Pay Better Than Chase Pay?

To use Chase Pay you open the app, select the card you want to pay with, and a QR code is generated (those little square barcodes). You then scan the QR code to pay. It’s simple, but only a few dozen retailers (and some online sites like Wal-mart) accept Chase Pay.

Samsung Pay is different than other mobile wallets because it works with existing credit card readers. So merchants don’t need a special card reader. So, by linking Chase Pay with Samsung Pay, you’ll be able to earn the Chase Pay bonus offers at just about any retailer! And on top of that, you can earn Samsung Rewards at the same time!

Samsung Rewards points aren’t very valuable (typically worth less than .4 cents per point) but it’s just icing on the cake.

How to Link Chase Pay & Samsung Pay

You’ll need to have Chase Pay and Samsung Pay on the same device. So sorry all you iPhone users, you’re out of luck. 🙁

You can follow our step by step guide on setting up a digital wallet to get Chase Pay & Samsung Pay setup on your mobile device.

Step 1. Open Chase Pay

First, open Chase Pay and enter your username and password, which will be the same ones you use to login to your Chase account.

Then you’ll click the “Pay” button.

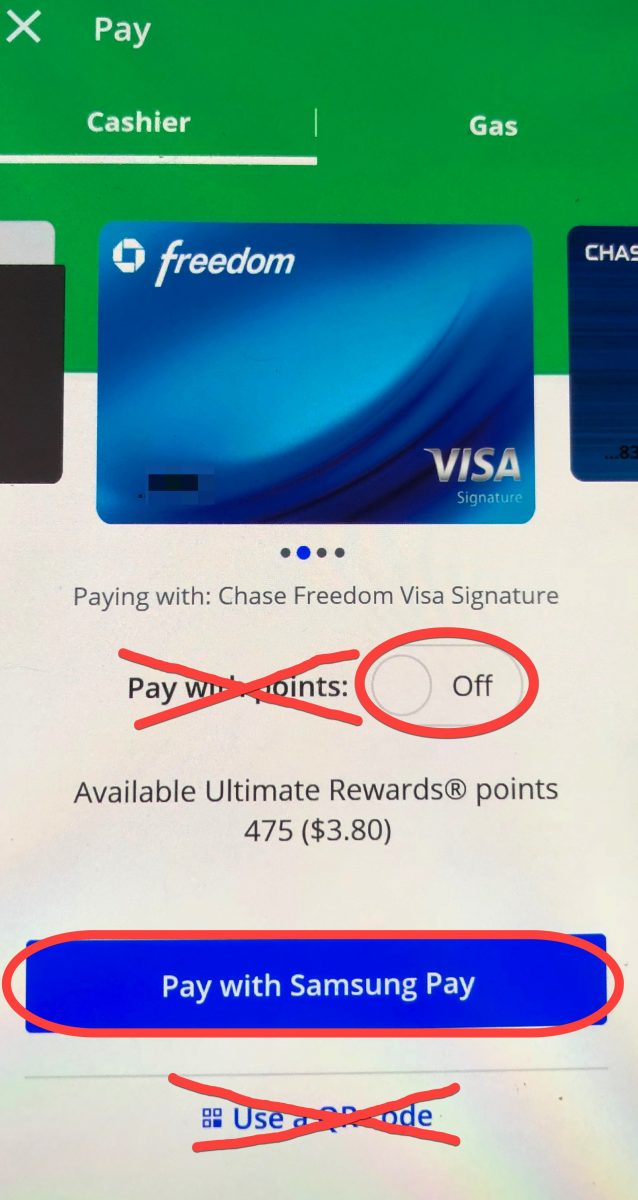

Step 2. Pay With Samsung Pay

Now you can select the Chase card you want to pay with and click “Pay with Samsung Pay.”

Step 3. Complete Your Payment

Next, you’ll be taken to the Samsung Pay app. You can use your fingerprint or enter your pin (depending on which you set up) and then hold your phone close to the card reader.

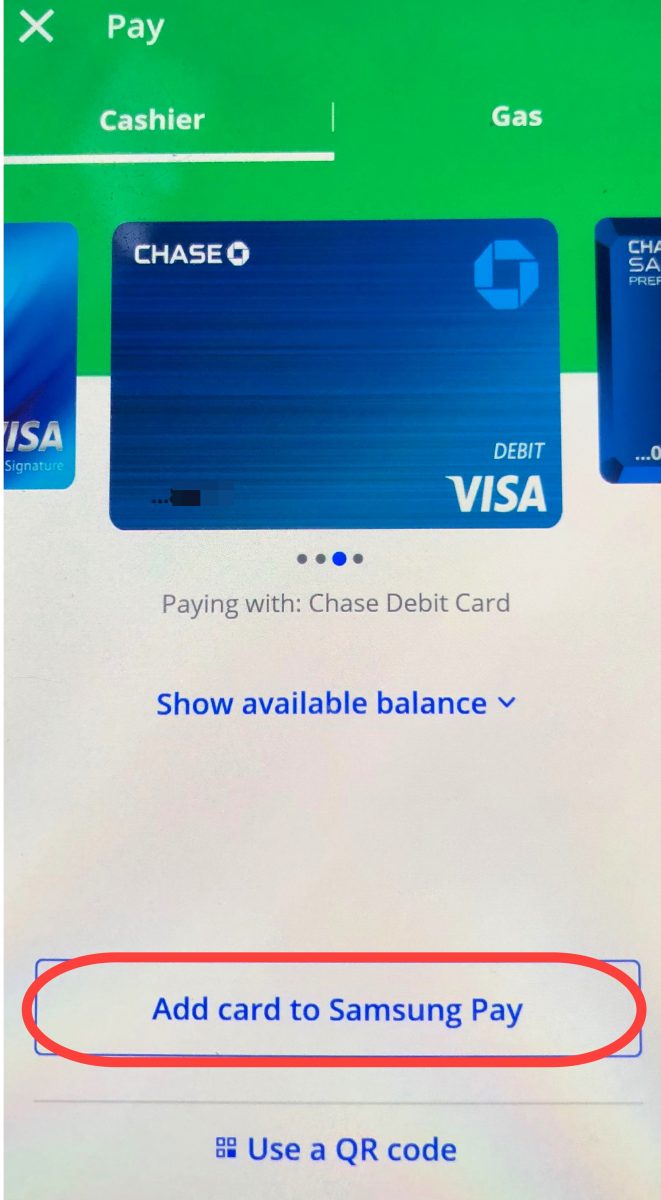

Step 4. Add Cards to Samsung Pay (If Necessary)

If you haven’t added your Chase cards to Samsung Pay, you can do it easily through the Chase Pay app. Just follow the steps above and then select the card you want to add. If it hasn’t already been added to Samsung Pay, then you just need to click “Add card to Samsung Pay” and follow the steps to easily add it.

Or, you can add cards directly in the Samsung Pay app by following the steps in our virtual wallet guide.

That’s it! Now you’ll have an easier time earning the full 4th quarter bonus for the Chase Freedom card. And you’ll have more opportunities to qualify for the spending bonus on your Sapphire (or Freedom) card!

To stay on top of all the latest money saving tips, subscribe to our newsletter!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!