Through February 11, 2019: This Is the Best Airline Credit Card Offer — Don’t Miss Your Chance at the Best Deal in Travel

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.It’s still early January, but the best airline credit card offer of 2019 might already be here!

Until February 11, 2019, you can earn the Southwest Companion Pass AND 30,000 Southwest points by applying for just ONE of the below Chase Southwest personal credit cards and spending $4,000 on purchases in the first 3 months of account opening:

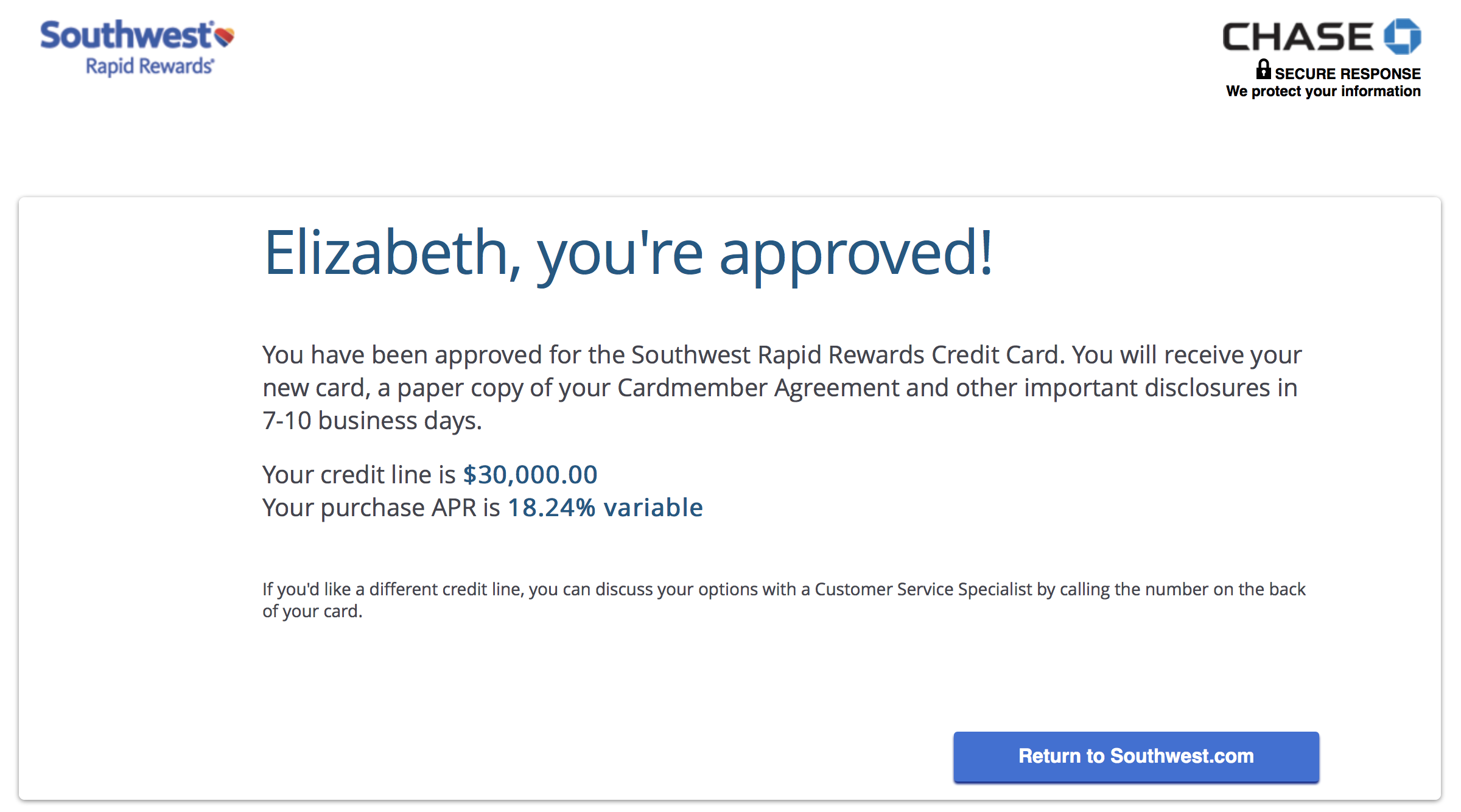

- Southwest Rapid Rewards Plus Credit Card – This card has the lowest annual fee among the Southwest personal cards. My wife applied for it today and was instantly approved!

- Southwest Rapid Rewards Premier Credit Card – This is a better option for folks traveling overseas because you won’t pay foreign transaction fees

- Southwest Rapid Rewards Priority Credit Card – This is a premium Southwest card. You’ll earn 7,500 bonus Southwest points every card anniversary and $75 in annual statement credits for eligible Southwest purchases

For all 3 card offers, the Companion Pass is promotional and will be valid through December 31, 2019. My wife already applied and was approved for the Chase Southwest Plus card. We’re excited to take advantage of the Companion Pass for the 5th year in a row!

The Southwest Companion Pass is the best deal in travel. Over the past 4 years, it’s saved my wife and me at least $10,000 in airfare expense. Emily has the Companion Pass, too! Her family of 3 has been enjoying the savings and travel experiences they get with this deal! If you love to save money on airfare and Southwest Airlines serves your home airport, it’s hard to find a better deal than this! Plus, Southwest will soon begin flights to Hawaii, so now is a phenomenal time to earn the Companion Pass!

With the Companion Pass, you can designate a friend, partner, or family member to join you for free whenever you travel on Southwest. It doesn’t matter if your flight is booked with points or paid for with cash – your companion flies free! You just have to pay award flight taxes & fees, which usually total ~$6 each way when you fly within the US.

And earning the Southwest Companion Pass is usually a lot tougher. You typically need to earn 110,000 qualifying Southwest points or fly 100 flight segments in a single calendar year.

But with the current deal, you just need to apply for one personal Southwest credit card (Chase Southwest Plus, Chase Southwest Premier, etc.) and meet the minimum spending requirements.

Ideally, you’ll want to meet the minimum spending requirements soon after getting the card to make the most of having the Companion Pass in 2019. Because the Companion Pass won’t post to your account until you complete the spending and your billing statement period ends. So if you apply today and meet the minimum spending requirements in the first billing period, you can enjoy the Companion Pass for ~10 or ~11 months. Check out our guide post with tricks on how to meet minimum spending requirements.

Here’s a snapshot of all 3 offers, which are valid until February 11, 2019.

1. Southwest Rapid Rewards Plus

Apply Here: Southwest Rapid Rewards® Plus Credit Card

When you sign-up for the Chase Southwest Plus card, you’ll earn the Companion Pass and 30,000 Southwest points after spending $4,000 on purchases within the first 3 months of account opening

You’ll also get:

- 2 Southwest points per $1 on Southwest purchases

- 1 Southwest point per $1 on everything else

- 3,000 Southwest points after your cardmember anniversary

This card has a $69 annual fee, which is NOT waived the first year.

With this card, you’ll pay 3% foreign transaction fees. So it’s NOT a good card to use when traveling overseas!

2. Southwest Rapid Rewards Premier

Apply Here: Southwest Rapid Rewards® Premier Credit Card

When you sign-up for the Chase Southwest Premier card, you’ll earn the Companion Pass and 30,000 Southwest points after spending $4,000 on purchases within the first 3 months of account opening

You’ll also get:

- 2 Southwest points per $1 on Southwest purchases

- 1 Southwest point per $1 on everything else

- 6,000 Southwest points after your cardmember anniversary

This card has a $99 annual fee, which is NOT waived the first year. And this card has no foreign transaction fees.

3. Southwest Rapid Rewards Priority Credit Card

Apply Here: Southwest Rapid Rewards® Priority Credit Card

When you sign-up for the Chase Southwest Priority card, you’ll earn the Companion Pass and 30,000 Southwest points after spending $4,000 on purchases within the first 3 months of account opening

You’ll also get:

- 2 Southwest points per $1 on all Southwest purchases including flights, gift cards, and eligible hotel and car rental partner packages

- 1 Southwest point per $1 on every other purchase

- 7,500 Southwest points each year on your card anniversary

- $75 in annual statement credits after making eligible Southwest purchases

- 20% back on in-flight purchases like in-flight drinks, entertainment, and Wi-Fi

- 4 upgraded boardings per cardmember year

This card has a $149 annual fee, which is NOT waived the first year. And this card has no foreign transaction fees.

Note: The Southwest credit cards are subject to the Chase 5/24 rule. If you’ve opened 5+ credit cards from any bank (with the exception of certain business cards) in the past 24 months, you won’t be approved. Another important note is that it’s no longer possible to have more than one personal Southwest card at the same time.Enjoying Your Companion Pass

Once you have the Southwest Companion Pass, you can use it an unlimited number of times while it is active. With this current deal, it will be valid until December 31, 2019. The Companion Pass holder must purchase a ticket for themselves with either cash or points and then they can simply add their designated companion to their reservation to fly with them for just the cost of taxes and fees (~$6 on domestic flights).

Plus, you can still redeem your points earned from the Southwest credit cards toward free flights after earning the Companion Pass. You’ll be able to stretch the welcome bonuses twice as far, because you and a companion will be able to travel for just the cost of 1 ticket (plus taxes and fees for the companion ticket).

Because Southwest is a Chase Ultimate Rewards transfer partner, you can move your Chase Ultimate Rewards points to Southwest if you need more Southwest points for an award flight. However, transferring points from Chase Ultimate Rewards to Southwest will NOT contribute any progress towards earning the Companion Pass.

Until February 11, 2019, earn the Southwest Companion Pass (best deal in travel) and 30,000 Southwest points by applying for just ONE of the below Southwest credit cards and spending $4,000 on purchases within the first 3 months of account opening:

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!