I Saved ~$250 Off a Meal at the Ritz-Carlton Santa Barbara Using the AMEX Starwood Luxury Card

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

I recently spent a long weekend visiting my sister in Santa Barbara – the land of endless sunshine. I absolutely love spending time there (and seeing her, of course 😉 ). And luckily for me, she works at The Ritz-Carlton Bacara, Santa Barbara, a stunning resort overlooking the Pacific Ocean.

To celebrate our visit we made reservations at the hotel’s fine dining restaurant, Angel Oak. Knowing it would be a pricey, albeit delicious meal, I was already anxious about the expense. But then remembered that I’d just recommended that my sister upgrade her Starwood Preferred Guest® Credit Card from American Express card to the Starwood Preferred Guest® American Express Luxury Card because she’d been targeted for a 100,000-point welcome offer after meeting minimum spending requirements.

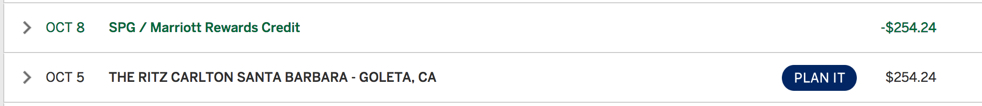

Plus, one of the card’s benefits is an annual $300 statement credit valid for purchases at participating Marriott hotels! It’s perks like these that make utilizing the best credit cards for travel all the more worthwhile!

Before the trip, I double checked with an AMEX chat rep to ensure that a charge from the hotel’s restaurant would, in fact, qualify for the credit. And we had an incredible meal!

I truly believe that getting into the miles & points hobby has allowed me to enjoy experiences like these even more. Because I’m less worried about splurging on things I otherwise couldn’t afford. And I can tell you I’ll hold the memory of the meal we had while watching the sunset with me forever!

Plus, I was happy to see that the credit showed on my sister’s statement within 3 days. The terms state that the annual $300 statement credit at participating Marriott hotels can take up to 8 to 12 weeks. So seeing it so quickly was a nice surprise.

If you’re ever in Santa Barbara I’d highly recommend a stay at The Ritz-Carlton Bacara, or even just a meal at Angel Oak. You won’t regret it!

What perks from some of the best credit cards for travel do you enjoy using most? Let me know in the comments!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!