I Saved Enough With My American Express Credit Card in 2018 for a Free Flight (And That’s Not Even Including the Miles I Earned)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.When I was living in Missoula, Montana, Delta was one of the few airlines that operated out of our very small (but charming and efficient) airport. So initially, I applied for the Gold Delta SkyMiles® Credit Card from American Express because of the nice welcome bonus. With this card, you’ll currently earn 30,000 Delta miles when you spend $1,000 on purchases in the first 3 months of account opening. Plus, you earn 2X miles for every $1 you spend with Delta and 1 mile per $1 spent everywhere else.

This was an easy way to earn a quick lump sum of miles that I could use to book a flight (or 2) on Delta. And since my husband and I were primarily flying on Delta anyway every time we traveled, it made sense to capitalize on those 2X miles. That adds up quickly. I used my initial 30,000 Delta miles to put toward flights from Missoula to Chicago for my cousin’s wedding last summer, saving us tons of cash – it’s expensive to fly from small airports!

But the icing on the cake is I was able to save $100s using discounts that are available on American Express Credit Cards.

But here’s how the savings got interesting and went beyond actually booking flights. I’ll start by explaining that I’d never used an AMEX card before, and at first, I was pretty skeptical of the promotional emails I’d receive announcing AMEX Offers.

I assumed this was some promotional scheme that I should be wary of and discarded these offers without much thought. Then I noticed that there was an offer for Aveda products right around the time I was running out of my Aveda shampoo. So I decided to take the plunge and explore this offer of $15 off $60 worth of Aveda products. And without doing anything other than purchasing the shampoo and conditioner I was about to buy anyway, I automatically saved $15.

From then on, I was hooked.

Here’s How to Save Even More With Your American Express Credit Card

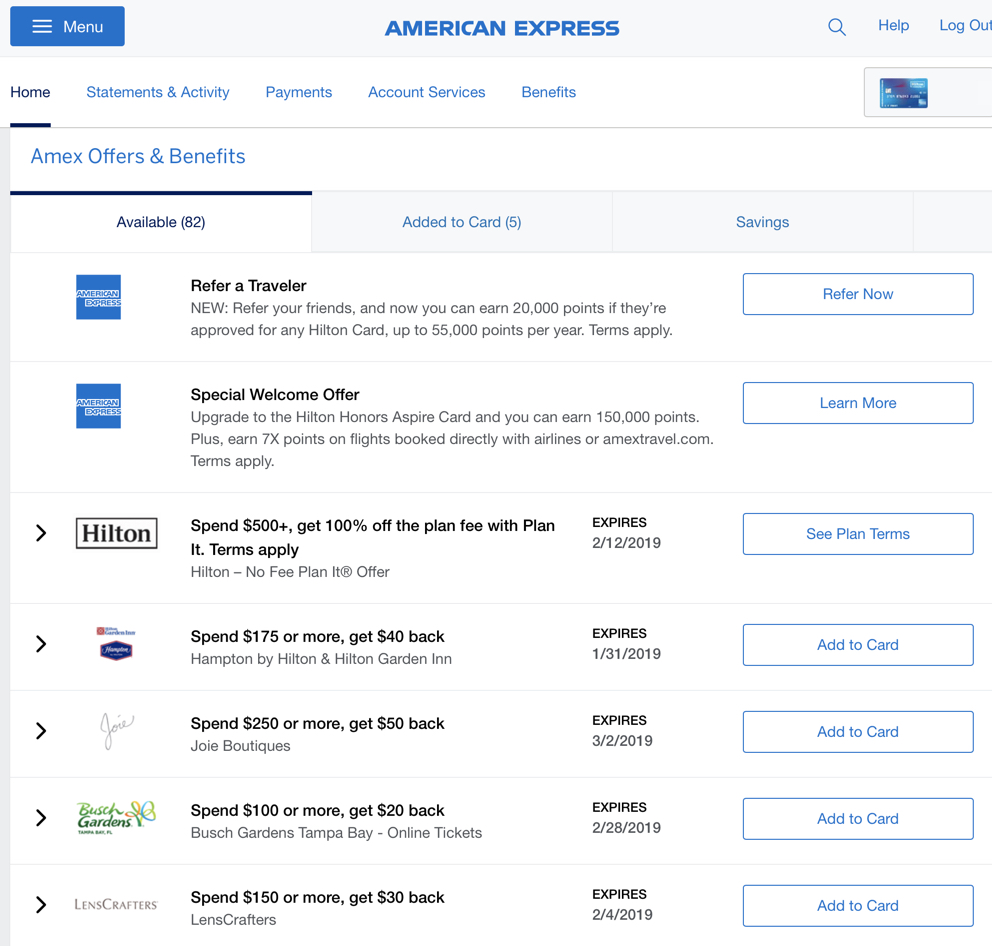

Log into your AMEX account. On the homepage, scroll down to your AMEX Offers. Look at what’s available and add anything you think you’ll use to your card. If you end up purchasing something from the vendor with the offer, you’ll save the indicated amount of money.

Most of the time you’ll need to spend a certain amount to qualify for the discount (i.e. spend $20 at Five Guys and get $5 back). The best thing about AMEX Offers is that the discount is taken after you make the purchase. The money shows up on your card as a credit, which means that you can stack your discounts.

For example, I wanted to buy a rug from Crate & Barrel but couldn’t justify the price. So I waited for it to go on sale (which it finally did). Then I signed up for their newsletter and got an additional 15% off when I checked out. Since I had added a Crate & Barrel offer to my AMEX card ($20 off $100 or more) I received an additional $20 off. I was able to capitalize on 2 significant discounts, whereas if I’d tried to use multiple discounts on the actual Crate & Barrel website I wouldn’t have been able to.

Here Are All of the Ways I Saved Money Using My American Express Credit Card in 2018

These are the AMEX Offers I was able to take advantage of, but many of them are no longer available. And AMEX Offers can be targeted, so while I got these offers you may have access to totally different ones.

Travel

Lyft: I’d always been prone to using Uber over Lyft. But that changed when I learned that, as a new user, I’d receive a $20 credit when I linked my Delta account to my Lyft account. Plus, once you link your accounts, you’ll receive 1 Delta mile for every $1 you spend on US Lyft rides (and 2X miles per $1 for airport rides)! And there are often AMEX Offers for Lyft or Uber rides on top of that! Airbnb: Most of the time when I’m traveling, I try to stay in Airbnbs instead of hotels. Often, they’re less expensive. Staying in an Airbnb is also a great way to really feel like you’re a local in the city you’re exploring. When I traveled to Washington, DC last spring, I booked a cute garden level apartment in Georgetown. It was in a cool neighborhood where you could easily walk to bars, shops, and restaurants. Better yet, there was an AMEX Offer for $50 back after spending $200+ with Airbnb. When I made the reservation on my AMEX card, I was automatically credited that $50 back without having to do anything other than add the deal to my card. Hilton: Recently, I traveled out to Palo Alto for work, and since it was a last-minute trip, finding an Airbnb was a bit tricky. I ended up reserving a room at the Hilton for 3 nights because I knew I’d save $50 (off any purchase of $250 or more) with my AMEX Offers. It felt really rewarding to save money while staying in a nice hotel. Savings with AMEX Offers: $20 (Lyft), $50 (Airbnb), and $50 (Hilton) Total savings: $120Home Improvements & Furnishing

In early September, Spencer and I moved from Missoula, Montana back to Boulder, Colorado. Anyone who has gone through the process of moving understands how time-consuming and difficult every detail can be. From hiring movers to packing up an entire house, to driving a 23 foot U-Haul (thanks, Spencer!) to unloading and unpacking everything at your final destination…it’s not fun.

But what is fun is getting rid of all the old junk you’ve stashed away and starting over with a blank slate of a house to redecorate. Fun and potentially quite expensive.

There were a few items I was holding out on, hoping they’d go on sale, like the rug I mentioned from Crate & Barrel. I also found offers with Nest ($40 off a purchase of $199 or more) and Wayfair ($20 off a purchase of $100 or more). We needed to upgrade the thermostat and smoke detectors when we moved in, and we prefer using Nest because it’s so easy to keep track of what’s going on in our house when we’re away.

So having that credit with Nest felt like a nice bonus. We also found a bookshelf that fits perfectly in our living room on Wayfair and saved another $20 there. Saving a little bit of money on home furnishings and updates eased the burden of buying the more expensive items (hi, new dining room table).

Savings with AMEX Offers: $20 (Crate & Barrel), $4o (Nest), $20 (Wayfair) Total savings: $80Personal Items

What started off as a $15 savings on my Aveda shampoo grew into a fascination around how much I could save on everything else in my life.

I started a new job recently and wanted to branch out of my comfort (very comfortable) zone when it came to clothing. I’d always wondered about Stitchfix but was deterred by the $20 styling fee. It seemed risky to let someone else pick out my clothes for me and then charge me $20 if I didn’t like anything. But here’s where AMEX Offers helped me redefine that logic a bit.

With the AMEX Offer I had, I could spend $50+ with Stitchfix and get $25 back. So that means you’re only paying $25 for $50 worth of clothes. And $25 is only $5 more than the styling fee (that you’re charged if you send everything back). So why not just keep at least $50 worth of Stitchfix items and pay only $25? Does that make sense? Basically, for me, it meant taking a risk and trying out some new styles that I actually ended up really liking.

Savings with AMEX Offers: $15 (Aveda), $25 (one month of Stitchfix), $10 (J Crew, $10 off $50 worth of clothes) Total savings: $50Food & Drink

There are a ton of different offers available for restaurants like Rock Bottom Brewery and Dean & Deluca, but the offer I used most frequently was at Starbucks. With the AMEX Offers I had on my account I saved $10 this year at Starbucks.

Savings with AMEX Offers: $10In 2018, I saved $260 and I earned 1,360+ miles (from the purchases) just by using my AMEX Offers (that’s not counting all of the other miles I accumulated this year by using my AMEX credit card). I promise, if I’d tried to save more, I could have – there were so many offers I didn’t take advantage of. My strategy was to try and only use offers I would have used anyway. In other words, although I probably could have rationalized spending $500 at Saks 5th Avenue to save $100, I didn’t. 😉

Right now, I can book a ticket from Denver to New York City for just $264 on Delta earning 2X miles per $1 spent with my Gold Delta SkyMiles® Credit Card from American Express and spending just $4 more than I saved with my card this year. That feels like a secret worth sharing.

Now that I’ve tapped into the amazingness of AMEX Offers, my entire mindset has shifted around how to use my credit card. Every time I receive an email with my AMEX Offers, I open it immediately, excited to see what vendors I’m already using that have been added to the list. It’s exciting to see how I can save money by simply adding a new offer to my card, especially when the offer covers a purchase I probably would have made anyway.

Have you taken advantage of any of these AMEX Offers? Which are your favorites? How much money do you think you’ve saved this year? Let me know in the comments section below!

To learn about more money saving tips, subscribe to our newsletter.Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!