American Airlines Announces Profit Warning: Good News for Folks With Flexible Credit Card Points

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

In anticipation of American Airlines’ quarterly earnings report scheduled for January 24, 2019, the airline announced that their revenue for Q4 2018 and profit for 2018 will be less than previously expected. This isn’t great news if you’re an American Airlines investor. But if you’re a casual or frequent American Airlines flyer, this might be a welcomed announcement.

Here’s why: Many investors think American Airlines (and other US airlines) have been struggling to increase fares and generate more revenue. The airline industry is super competitive and low-cost carriers are constantly introducing new routes that compete with legacy carriers. So in order to maintain demand, American Airlines has to reduce their fares or at least hold them steady. Plus, American Airlines has to introduce new routes to keep up with the competition, which also cuts into profits.

I wouldn’t feel sorry for the airlines because they’re still making billions of dollars in profit, in part, because of ridiculous fees, including seat selection fees, baggage fees, change fees, cancellation fees, reservation assistance fees, and others.

Personally, I don’t collect many American Airlines miles. I don’t have any of their co-branded credit cards, like the Citi® / AAdvantage® Platinum Select® World Elite Mastercard®. But I do fly American Airlines once or twice a year. Instead of using American Airlines miles to book a flight, I typically redeem Chase Ultimate Rewards points through the Chase travel portal. The information for the Citi AAdvantage Platinum Select card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

I don’t have to worry about blackout dates when I book this way. And if fares are expected to stay flat, I feel like I’m getting a great deal because my Chase Ultimate Rewards points are worth a fixed rate toward airfare through the portal.

While there’s no indication that American Airlines plans to devalue their miles, I’m always wary airlines will make negative changes to their frequent flyer programs to boost company profits. It’s another reason I prefer to collect flexible credit card points.

Collect Flexible Chase Ultimate Rewards Points Instead of American Airlines Miles to Book Airfare

Link: Step-By-Step Guide: How to Book Travel With the Chase Travel Portal

As a Chase Sapphire Reserve cardholder, points linked to my card are worth 1.5 cents each through the Chase portal. So a $500 round-trip ticket would cost ~33,333 Chase Ultimate Rewards points ($500 ticket / 1.5 cents). Because I don’t collect American Airlines miles, having the ability to book airfare on nearly any airline through the Chase travel portal gives me a lot of flexibility.

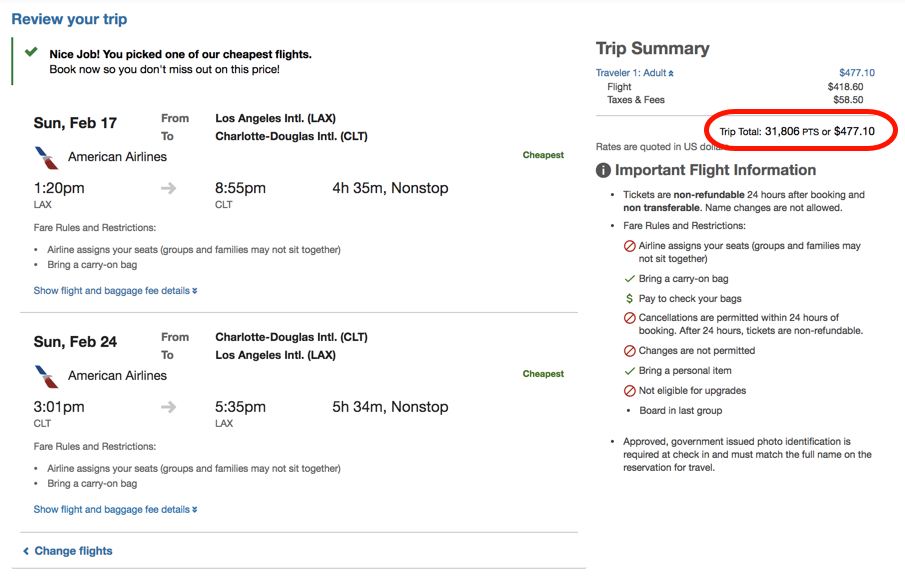

Here’s one example. I searched for a round-trip American Airlines flight from Los Angeles to Charlotte in February 2019. American Airlines is the only airline offering non-stop routes on this option. As a result, it’s difficult to find Saver award seats available on this route.

But when you book through the Chase travel portal, you don’t have to worry if award seats available. You’re essentially booking a revenue ticket as you would through an online travel agency, like Expedia or Priceline. So as long as a ticket is available for sale, you can book it through the portal using Chase Ultimate Rewards points or a combination of points and cash.

In my sample search, I selected a round-trip itinerary that costs ~31,800 Chase Ultimate Rewards points. If I collected American Airlines miles, I would need to use 60,000 miles to book the same ticket as an award flight. That’s because low-level Saver award seats aren’t available for the times I selected. It depends on the price of your desired flight, but if fares are expected to stay low, you can increase your booking options and still get good value by collecting flexible Chase Ultimate Rewards points.

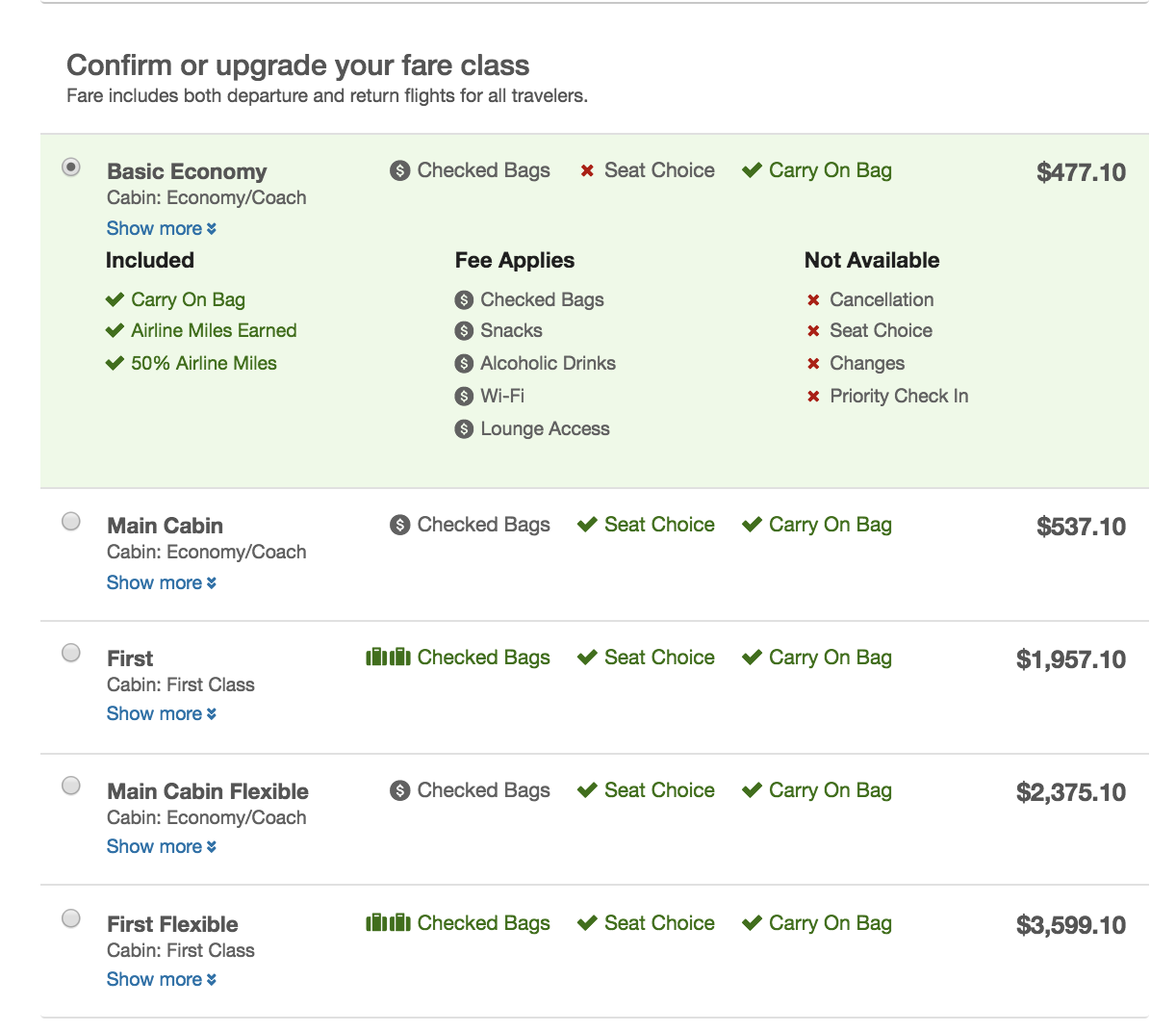

And via the Chase portal, it’s also easy to change your fare class during the booking process and still pay with points. For example, during my sample search, you can select Basic Economy, Main Cabin, First Class, etc.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!