Alaska Airlines miles and elite status now easier to earn (temporarily)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Alaska Airlines has made three big changes to the way you earn both redeemable miles and elite qualifying miles. Two of them have to do with their personal and small business airline credit cards. The other pertains to those who fly Alaska Airlines regularly.

Let’s look at the changes to see if you benefit. If you’re chasing Alaska Airlines elite status, you’ll love this.

Three temporary improvements to the Alaska Airlines program

Earn elite qualifying miles from credit card spending

Between June 1 and September 30, 2020, you’ll earn 2,500 elite qualifying miles for every $5,000 you spend with your Alaska Airlines Visa® Business credit card or Alaska Airlines Visa Signature® credit card. You can earn a maximum of 10,000 elite qualifying miles with this temporary benefit.

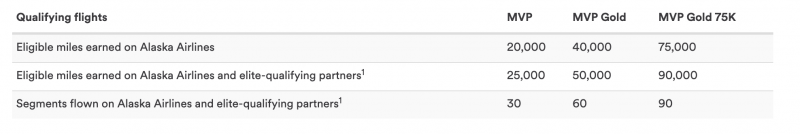

In other words, if you spend $20,000 on your card, you can get halfway to Alaska Airlines MVP status without even stepping on a plane.

50% bonus on elite miles when flying Alaska Airlines

If you are flying Alaska Airlines any time between June 1 and December 31, 2020, you will earn 50% more elite qualifying miles than normal. Even if you booked your flights before this change, you’ll still get a 50% bonus — as long as you’re flying within the promotional dates. You don’t have to register for this deal — however, you’ll only get the bonus when you fly Alaska Airlines (not their partners).

Double miles for restaurant purchases

Alaska is joining the already sizable crowd of programs that allow you to earn bonus points in non-travel related categories due to the slow travel situation.

Between June 1 and July 31, 2020, Alaska Airlines Visa cardholders will earn 2 miles per dollar at restaurants (including takeout and delivery). This applies to the personal version of the card only. You’ll earn 2 miles per dollar on the first $1,500 in qualifying purchases only.

Let us know what you think of these changes! And subscribe to our newsletter to stay informed about credit card benefits changes like this in the future.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!