“Every Single Goal Is Achievable If You Set Your Mind to It”

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Welcome to the first installment of our personal finance blogger interview series, where experts in the field share their knowledge of this important topic!

Personal Finance Blog Interview: The College Investor

Robert created The College Investor to help folks get out of student loan debt and start investing for their future. You can follow him on Facebook and Twitter.

Why did you start your blog? What’s special about it?

Honestly, I started The College Investor sitting in the back row of my college class because I was bored. Since I was a kid, I’ve loved earning money. And once I learned about investing – I’ve focused on how to make more of it to invest.

In college, I was really passionate about investing. I tried to connect with others at my school’s Investing Club. But everyone I met really just wanted to trade penny stocks – and that wasn’t my thing.

When I started my blog, I really just wanted to share my thoughts on investing with others. After it started gaining traction, I started getting feedback that my readers wanted to invest, but were struggling with student loans and other aspects of personal finance.

Over time, the website has evolved into being a top resource for people with student loan debt. My goal is to help people overcome their debts so they can start investing and building wealth for the future. And the sooner, the better!

What’s one thing people can do to better understand their own finances?

The #1 thing I tell people is that they have to be organized. It all starts there.

90% of people I help who are struggling with student loan debt don’t keep track of their income and expenses. If you don’t know what’s coming in and what’s going out, you’ll never be successful with money.

There are a lot of great free tools out there that can help. I recommend people use Mint.com or Personal Capital to track their income and expenses.

Once you get a clear picture of your money, you can start making informed decisions about it.

Do you prefer frugality or do you believe in focusing more on growing your income, in order to reach your financial goals?

I’m a big believer in growing your income, but you can’t skip the basics. Once you get organized, if you can’t afford the fat, cut the fat.

However, I’m strongly for earning more money – and it’s been the cornerstone of my financial success since I was a kid. Because you can only cut your budget so much, because you still need to live, eat, get to work. But your ability to earn is limitless.

Plus, today, there are so many ways to earn more in your spare time. The internet and smart phones have opened up a world of options for making extra money. You just have to put in the time and effort to make it happen.

What’s your best advice when it comes to planning for retirement?

The best thing you can do when it comes to saving for retirement is to start early. Even if you start with a small amount, the earlier you start saving and investing, the quicker you’ll achieve your goal of having enough saved for retirement.

Here’s a great example:

Let’s say your target retirement number is $1,000,000.

If you start saving at age 22, you can become a millionaire by 62 by simply saving $300 per month (this assumes an 8% rate of return).

If you wait a decade, and start your retirement savings at 32, you now need to save $680 per month to achieve the same goal.

Ten years makes a huge difference! So, even if you can only start with a small amount, just start!

Is there any tool or trick which you’ve found especially useful for personal finance?

The best thing you can do is be organized. My favorite tools for financial organization and tracking income and expenses are Mint.com and Personal Capital. Both have great websites and mobile apps to track your money.

If apps aren’t your thing, a spreadsheet can still be a great tool to track your money. Or, if a computer-based system isn’t your thing, get a notebook.

The big thing is, just keep track of your money!

What do you now know about personal finance which you wish you knew when you started out?

The biggest lesson I’ve learned in almost 10 years of helping people is how much bad advice is out there. And how many “advisors” charge huge fees (many times without disclosing them fully) to “help” clients.

Personal finance, debt, and even investing is pretty simple.

Income – Expenses = Savings

For investing, I like to keep it simple with low cost index funds for the long run.

Don’t get me wrong, if you need some accountability or help, meeting with a financial advisor can be valuable. However, too many advisors aren’t up front about commissions and fees, don’t act as a fiduciary to their client (meaning they act in your best interest), or simply don’t educate.

For example, I was recently helping a reader assess how much they were paying in fees. He simply thought he was paying $108 per year to his advisor to help with him his $200,000 portfolio. What he didn’t realize was he was actually paying $11,000 in fees! His advisor was fleecing him with fees and commissions.

I showed him how we could setup an almost identical portfolio for just $176 in fees! That’s almost a 99% reduction in costs! It’s insane this still happens – but I see it every day.

Nobody in this world will care more about your money than you do. Nobody.

You spend time watching TV, or reading blogs, or scrolling Facebook and Instagram. Spend some time looking at your own money, researching the basics of investments, and getting organized.

With ~1 hour of your time, you’ll quickly realize how easy it is to do most things yourself. And, for much cheaper.

Do you participate in the miles & points hobby? And if so, how do you think it relates to personal finance?

I love miles and points and I’ve been in the hobby since I got my first credit card in college.

I’m a huge believer in putting all your expenses on a credit card, BUT treating it like a debit card and paying it in full every month.

I’m also a huge believer in getting rewarded for your spending. I used to do a simple cash back card and get that money deposited into my brokerage account (with the Fidelity Cash Back Card). For my business, I rely on my AMEX Business Platinum® Card from American Express, which has great benefits I leverage when I travel.

In general, if you can manage your spending and treat your credit card like a debit card, there’s no reason not to take advantage these kinds of deals. It’s also be a great way for more frugal people to reward themselves with the “extra perks” they might get through points for travel.

What would your readers be surprised to know about you?

I think most of my readers are surprised by the fact that I only recently left my day job. I started TheCollegeInvestor.com in 2009, and until about 4 months ago, it was just a side hustle.

However, I was able to balance the site extremely well with my day job as a retail store manager, even when I travelled for blogging conferences. And most people found this surprising.

I’ve been blessed to continue to grow this business and have it allow me to achieve financial independence at an early age, so I can spend more time with my family.

Any parting words?

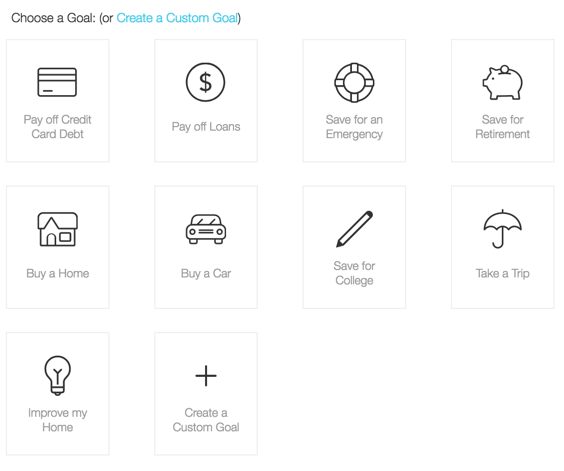

Every single goal is achievable if you set your mind to it. Honestly, we all waste a lot of time in the day if we really think about it. Can you leverage that time to achieve your goals?

Maybe your goal is to be debt free? Maybe it’s to travel more? Maybe it’s to achieve financial independence at a certain age?

Well, take that goal and figure out the steps required to achieve it. And and start making small progress everyday.

Think about this – when you start working out in the gym, if you look in the mirror on day one, there’s no change. You look on day two, there’s no change. It takes months of work. The same is true with anything you pursue.

Don’t give up on day one, no matter what your goal is.

Robert – Thanks for sharing your thoughts on personal finance and telling us more about your blog!

If you’d like to be considered for our interview series, please send me a note!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!