Stop What You’re Doing and Start Tracking Your Net Worth!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Setting goals is an important step in achieving what you want out of life, whether it’s miles & points or your financial health. But you’ve got to be able to measure your progress!

So I’ve asked Million Mile Secrets team member Meghan to share why she believes tracking your net worth is critical to achieving your personal financial goals.

Meghan: Maybe your dream is to retire early, pay for your child’s college tuition, or reach financial independence. Whatever the case, tracking your net worth will help you see the bigger picture. And make those dreams a reality!

I’ll show you a couple of tools that will help you meet your personal financial goals.

Tracking Your Net Worth

Tracking your net worth will help give you a clearer picture of how your spending and investments affect your personal financial goals.

What Is Net Worth?

Assets – Liabilities = Net Worth

There you have it! Things like savings, investments, and property count as assets. And items like mortgages, student loans, and credit card debt are liabilities. Subtracting the total of your liabilities from the value of your assets gives you your net worth.

Why Is It important?

It’s important to track your net worth because otherwise, you won’t know where you stand in terms of meeting your goals.

Plus, it can be really motivating to see your net worth number move up as you continue to make smart choices regarding your finances! And seeing the bigger picture can help you get back on track if you’ve made a few mistakes along the way…like we all do. 😉

Tools You Can Use

1. Personal Capital

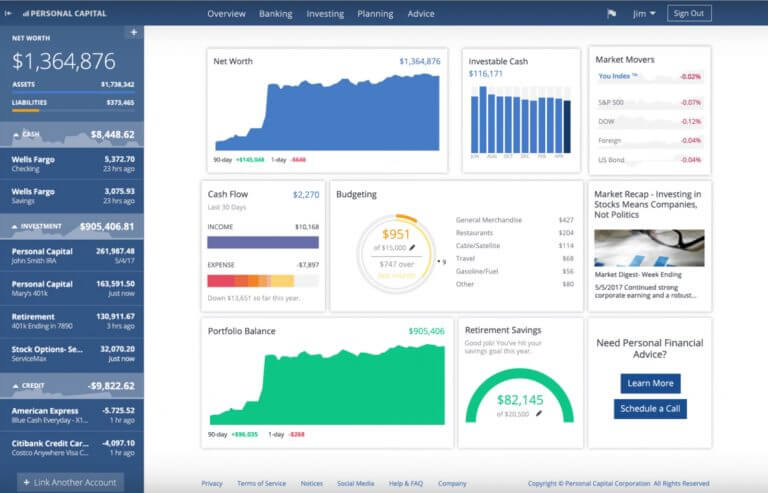

I use Personal Capital to track my net worth. It works by connecting to your banking and investment accounts.

I like it because it doesn’t take very long to set up. Once you’ve inputted everything to the system, it’s automated. And you can see everything in one place!

That said, you will have to enter your banks’ login information.

Some folks might not be comfortable with this. But Personal Capital takes the security of their software very seriously. And I’ve been using Personal Capital for 3+ years now and haven’t had any issues.

On your Personal Capital dashboard you can see things like:

- Net Worth

- Cash Flow

- Spending by Category

- Investment Portfolio Balances

- Account Balances

- Upcoming Bills

- Investment Returns

- and more!

From there, you can drill down into each category to see a more detailed view. Plus, Personal Capital will help identify opportunities you might be missing out on, like investment accounts with lower fees or lower mortgage rates.

They even offer a free consultation with a personal financial advisor! So you can chat with an expert about your goals and they can help you determine if you’re on the right track. I took advantage of this perk when I signed up and found it very helpful. It was nice to talk through things and bounce ideas around with a professional.

If you’re looking for paid asset management services, they offer that too. And are known for charging low fees. But I haven’t used that service, so I can’t speak to its usefulness.

2. Spreadsheet

If you don’t want to use an online tracker, you can use a spreadsheet instead.

Spreadsheets can be great because you can customize them however you’d like. And track whatever you want! But unless you’re somewhat of a wizard in Excel, it will be difficult to get the pretty graphs that a program like Personal Capital offers. Plus, you’ll have to input all of your information, and keep it up-to-date.

If you don’t want to create your own net worth tracking spreadsheet, there are plenty of free options online. Like this Microsoft Office template or this Google Spreadsheets template.

How Financial Goals Relate to Miles & Points

There’s a strong connection between personal finance and the miles & points hobby.

If you can save money you’d otherwise spend on vacations by using the rewards you earn from credit cards, you can invest that money instead! And the more money you can save, the closer you’ll be to meeting your personal financial goals.

Or, consider using credit cards that earn cash back. Then investing the cash back you earn!

Either way, you’re working to make the most of each and every purchase!

Bottom Line

Tracking your net worth is a crucial step in reaching your financial goals.

It keeps you accountable. And it keeps you motivated, too! Because you can (hopefully!) see that line inch up and up towards your goal.

It’s a great way to visually see that spending less than you earn is worth it!

The specific tool you use is less important than just getting started. So get going now and tweak your system later!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!