You Can Spot a Fake Credit Card Yourself!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

I’ve written about how the numbers on a credit card actually contain a lot more information than most folks think. For example, you can find out the card category (Visa, MasterCard, etc.), issuing bank, country, and even type of card (World MasterCard, Visa Signature, business, etc.) just from the 1st 6 digits!

But did you know you can use the last digit of almost any credit card number to figure out if the card is a fake? All it takes is a little bit of math. I’ll show you how!

How Do You Do It?

The last digit of any credit card number is called the check digit or checksum. Its only purpose is to validate the credit card number.

Credit card issuers use a formula called the Luhn Algorithm to create the check digit. And you can use the same formula to figure out if a credit card number is phony!

Let’s use the generic credit card number from the Barclaycard Arrival Plus World Elite Mastercard website as an example:

Here’s how to do it (math alert!). 😉

1. Drop the Last Digit (the Check Digit)

First, drop the last digit from the card number. So 5412 7500 1234 5678 becomes:

5412 7500 1234 567

2. Reverse the Digits

In this case, reversing the digits gives us:

765 4321 0057 2145

3. Multiply Odd Digits by 2

Starting with the 1st digit, multiply every other digit by 2. So now we have:

(14) 6 (10) 4 (6) 2 (2) 0 (0) 5 (14) 2 (2) 4 (10)

4. Subtract 9 From Any Numbers Over 9

Then, subtract 9 from any double digit number that results. For example, the 1st number is now 14, and 14 – 9 = 5 So now you get:

(5) 6 (1) 4 (6) 2 (2) 0 (0) 5 (5) 2 (2) 4 (1)

5. Add All the Numbers Together

Add all the numbers. So in this case:

5 + 6 + 1 + 4 + 6 + 2 + 2 + 0 + 0 + 5 + 5 + 2 + 2 + 4 + 1 = 45

6. Add the Check Digit

Remember the check digit we dropped at the beginning? In this case, it was 8. Add it back to the sum:

45 + 8 = 53

7. Is the Number Divisible by 10?

If the final number is divisible by 10, then it could be a valid credit card number.

If it’s NOT divisible by 10, it’s definitely NOT a real credit card number. In this case, 53 is NOT divisible by 10, so it’s a fake credit card number!

Here’s another way of looking at it. The check digit is the number you would have to add to the sum (from running the card number through the algorithm) to make a number divisible by 10.

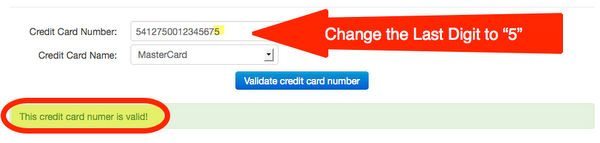

So in our example, the sum was 45. The check digit would have to be 5 for this to be a valid credit card number, because 45 + 5 = 50, and 50 is divisible by 10!

Neat, huh?

If You’re Not in the Mood for Math

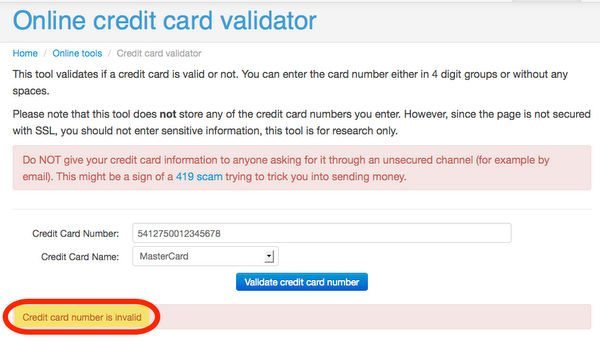

Instead of doing the math yourself, you can also enter a credit card number into this free Online Credit Card Validator. It’ll run the calculations for you and tell you if a card number is (potentially) valid or definitely fake.

If you enter the Barclaycard Arrival Plus example, this tool tells you right away it’s invalid.

But if you change the last digit to a 5, it says it is valid.

Bottom Line

A credit card number is not just a random sequence of digits. And the last number, the check digit, is used to validate the credit card number.

By doing a little math (or using a free online tool), you can figure out if a credit card is fake.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!