When United Airlines Delayed My Flight, This Overlooked Card Benefit Put ~$203 Back in My Pocket!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Earlier this month I got the dreaded “your flight has been delayed until the morning” spiel from United Airlines after a solid 3 hours of being told the plane should be arriving in 30 minutes.

The gate agent told us to go to customer service for our hotel and meal vouchers. I’m not sure if he didn’t know what he was talking about or if he was trying to save himself from the hostile crowd.

But when I got through the customer service line I was told the flight wasn’t canceled, it was merely delayed until the morning. So no hotel or meal vouchers for me. I was handed a flyer with a phone number to call to book a hotel with a “discount.”

I was at O’Hare and I live in Chicago. So this wasn’t the end of the world. But it was getting late and the flight was rescheduled for early the next morning. So I didn’t want to go home. Plus I really wanted to put my Ink Business Preferred℠ Credit Card’s trip delay insurance to the test.

Chase Trip Delay Coverage

Link: Chase Ink Preferred Benefits Guide

Link: Ink Business Preferred℠ Credit Card

I had paid for the flight with my Chase Ink Business Preferred. So I looked up the card’s benefits.

The Chase Ink Business Preferred’s Trip Delay Reimbursement perk will cover up to $500 per ticket for reasonable additional expenses, including but not limited to:

- Lodging

- Meals

- Transportation

- Clothing

- Toiletries

- Medication

- Other personal use items

Prepaid expenses are not covered. So if you missed out on a hotel or connecting flight you booked and paid for beforehand, that won’t be covered by a trip delay benefit. But it might be covered if your card has trip interruption or trip cancellation coverage, which the Chase Ink Business Preferred does have. Although those perks didn’t apply to my situation.

To qualify for the benefit, you need to have a delay of 12+ hours, or one that requires an overnight stay. You also must have purchased all or a portion of the “common carrier fare” using your card. My delay was exactly 12 hours and overnight. And even though I was flying on an award ticket, I did pay for the taxes & fees with my Chase Ink Business Preferred.

If you have a Chase Sapphire Preferred® Card, the trip delay coverage kicks in with a 12-hour delay or a delay requiring an overnight stay. This is just like the Chase Ink Business Preferred’s benefit, which makes sense because they both have the same $95 annual fee.

But the Chase Sapphire Reserve® has a trip delay benefit that requires only a 6-hour delay or an overnight stay! And the Citi Prestige will cover even a 3-hour delay (though this is changing to a 6-hour delay on July 29, 2018). So you’ll want to consider paying for your flights with those cards, if you have them.

How to File a Claim

Link: File Your Chase Card Benefit Claim Online

According to the terms, you’ll need to contact Chase (888-320-9956) within 60 days of the delay and then mail the necessary documentation. But I called and the phone agent gave me a website (eclaimsline.com) to submit my claim, which is much quicker. For your claim, I would call first and talk with an agent before heading to the website to make sure you’ve got everything in order.

The documentation you need is:

- Your completed and signed claim form (can be done online)

- Proof that the travel was charged to your card

- A copy of your ticket

- A statement from the common carrier (i.e. the airline) indicating the reasons

the trip was delayed

- Copies of receipts for the claimed expenses

- Any other documentation deemed necessary to substantiate the claim

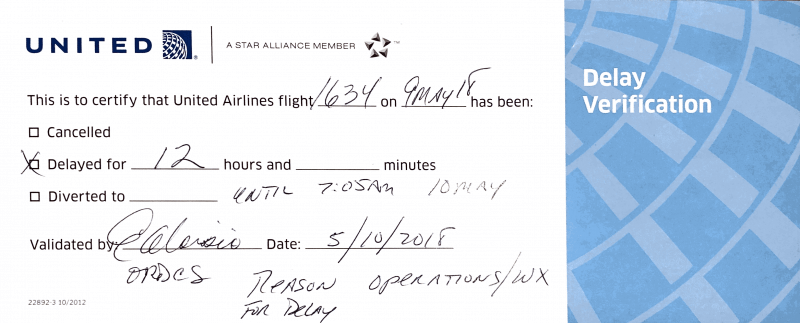

If your flight is delayed, and you think it might be covered by insurance or a card benefit, be sure to ask for a delay verification form. And then save all of your receipts! The next day I submitted the following online:

- Copies of all of my receipts

- The email receipt showing the ticket was paid for (partially) with my eligible card

- My boarding pass

- A United Airlines delay form showing the reason for the delay and length of the delay

You’ll also have to indicate how much, if anything, the airline or other insurances reimburse you for your expenses. In my case it was nothing.

Although later, after I sent a kind email asking for a refund, the 10,000 United Airlines miles I used for the ticket were redeposited into my account. But this wasn’t a reimbursement of any additional expenses I had as a result of the delay. So it didn’t affect my benefit payout.

I ended up submitting receipts totaling ~$203 for dinner, breakfast, hotel, Uber to & from the hotel, toiletries, and parking for my wife, who picked me up at my destination. I was paid in full within a week from when I submitted my claim!

The hardest part, for me, was not knowing if all of these expenses I was racking up were going to be covered. I honestly thought it would be a complicated process full of denials and calls for more documentation. But it couldn’t have been easier.

My Review of the Super 8 River Grove

I had a lot of trouble finding a hotel to book. I called Hilton, Marriott, Starwood, and IHG. But all of their locations near O’Hare were completely booked! Bad weather at nearby airports had caused lots of flights to be delayed.

Eventually, I reserved a room at the Super 8 River Grove. I was lucky because by the time I arrived, it was sold out too!

The Super 8 River Grove isn’t the type of hotel that inspires confidence when you first pull up. But the front desk lady, who wasn’t a big fan of the hotel’s owners and wasn’t shy in sharing her opinion, assured me the beds were okay to sleep in and not just on top of.

Breakfast is free, but isn’t served until 6:30 am. So I didn’t get a chance to sample it. But I’ll go out on a limb and say it’s edible.

Honestly, that’s about all you need to know about the Super 8 River Grove. It’s a perfect place to stay if you have no other options and your trip delay benefits are paying for it!

If you want more helpful hotel reviews, like this one, be sure to follow us on Facebook and subscribe to our newsletter!

Bottom Line

When your flight is delayed, you could get little to no compensation from the airline. But your credit card might have you covered!

Thanks to my Chase Ink Business Preferred trip delay benefit, I was able to get $200+ reimbursed when my flight was delayed overnight. Be sure to read your card’s benefit guide. Because even if it has trip delay coverage, the specific terms will vary.

And be sure to save all your receipts and get some form of delay verification from the airline.

Have you had success or difficulty with a trip delay claim in the past? If so, I’d love to hear your story!

Other Popular Million Mile Secrets Articles to Read

- Get a $100 dining credit with select hotels thanks to American Express Fine Hotels & Resorts perk!

- The Southwest Companion Pass is the best deal in travel!

- Book the travel of your dreams with the best American Express card!

- Take advantage of the bonuses on these Chase credit cards for Big Travel with Small Money!

- Do you have one of the best credit cards with lounge access?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!