Use This Free New Tool to Help Monitor Your Credit

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers. This page includes information about the Discover products that are not currently available on Million Mile Secrets and may be out of date.I recently wrote about how everyone can get their Experian FICO score for free with Discover’s Credit Scorecard.

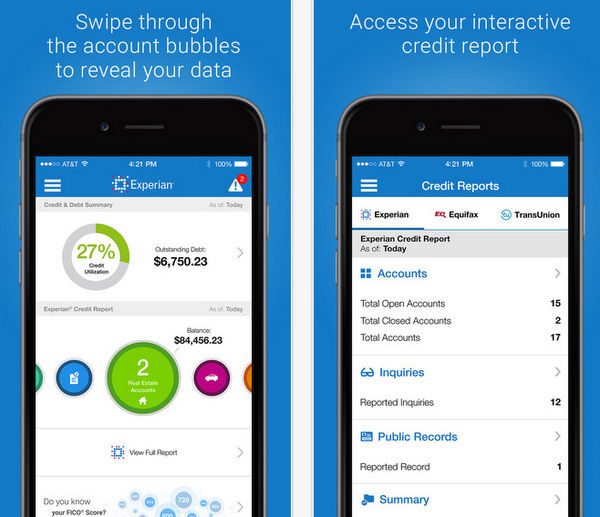

And now, via FrequentMiler, Experian released a credit monitoring app for iPhone and Android that gives you your Experian credit report for free!

The app is convenient and easy to use, because it will notify you if there’s activity on your report. And it’s the only service that offers you unlimited, free access to your Experian credit report.

But don’t pay for in-app purchases, like FICO scores and reports from the other credit bureaus. Because there are ways to get those for free, too!

I’ll explain more about why the app might be a useful tool. And the other ways to get your credit reports and FICO scores for free.

Free Experian Credit Report With Experian’s New App

Link: Experian App for iPhone

Link: Experian App for Android

Keeping track of your credit score is very important in the miles & points hobby. Because having a higher score improves your likelihood of getting approved for credit. So you can earn more sign-up bonuses!

To help folks monitor their credit, Experian recently released an iPhone and Android app that gives you your Experian credit report for free.

The app is helpful because it notifies you when there’s activity on your report, like a hard credit inquiry. And because it’s the only way to get your Experian credit report for free, whenever you want it.

Once you’ve downloaded it, it will ask for details like your name, address, and social security number, to verify your identity. And your Experian credit report will automatically be updated every 30 days.

A team member downloaded the app to her iPhone and said it’s easy to use.

She noticed there were in-app purchases available as well.

For example, you can get your Experian FICO score for ~$10, or your reports and FICO scores from all 3 credit agencies for ~$30.

So, it looks like Experian is hoping people will pay for their other scores and reports through the free app.

But don’t make that mistake! Because you can get your other scores and reports for free too.

How to Get Your Credit Scores and Reports for Free

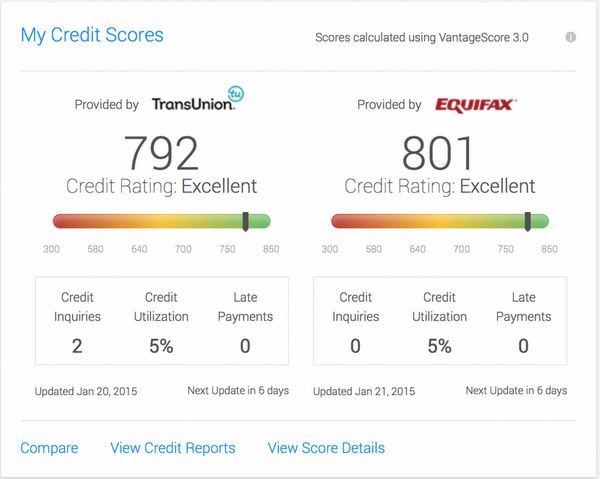

AnnualCreditReport.com will give you a free credit report from each credit bureau once every 12 months. But it won’t include your actual FICO score.Credit monitoring sites like CreditKarma and Credit Sesame allow you to view your credit data and score. But they provide only an estimate of your score, or a “FAKO” score.

You can, however, get your full TransUnion and Equifax reports for free from CreditKarma.

There are also a number of credit cards offering folks access to free FICO scores from the 3 different bureaus.

Cards that give you your Experian FICO score for free include:

- AMEX personal cards (like the AMEX Starwood Preferred Guest or Premier Rewards Gold)

- Chase Slate

And these cards come with your TransUnion FICO score:

- Discover it® Cash Back

- Discover it® Miles

- AAdvantage Aviator (no longer available)

- Hawaiian Airlines card

Citibank cardholders can view their free FICO score from Equifax with cards like the:

Bottom Line

The new iPhone and Android credit monitoring apps from Experian are the only way to get your updated Experian credit report for free throughout the year.

But don’t purchase your credit scores and reports from the other credit bureaus through the app!

Because certain credit cards, like the Starwood Preferred Guest personal card, Chase Slate, and Discover it Cash Back, give you either your TransUnion or Experian score for free. And Citi cardholders can view their score from Equifax for free.

You can also use sites like CreditKarma and Credit Sesame to monitor your credit.

And don’t forget, use AnnualCreditReport.com to get a free credit report from each credit bureau once every 12 months.

If you’ve downloaded the app, let me know if you find it useful!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!