Use the No-Annual-Fee MileUp Card’s Sign-Up Bonus to Pay ~$6 for an Expensive Short Flight!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Citi is an MMS advertising partner.

Wouldn’t it be nice to pay ~$6 for a short flight that usually costs $100s? Award flights 500 miles or less in the contiguous US states and Canada on American Airlines only require 7,500 miles.

The sign-up bonus on the American Airlines AAdvantage MileUp℠ Card is 10,000 American Airlines miles and a $50 statement credit after you spend $500 in purchases in the first 3 months of account opening.

That’s more than enough for a short, otherwise expensive, one-way award flight. And an excellent offer for a card with no annual fee!

I’ll share why I like this deal so much!

Earn Enough Miles for a Short Award Flight With This No-Annual-Fee Card

Apply Here: American Airlines AAdvantage MileUp℠ Card

Read our review of the Citi American Airlines MileUp Card

With the American Airlines AAdvantage MileUp card, you’ll earn 10,000 American Airlines miles and a $50 statement credit after spending $500 on purchases in the first 3 months of account opening. You’ll also get:

- 2 American Airlines miles per $1 on eligible American Airlines purchases

- 2 American Airlines miles per $1 at grocery stores, including eligible grocery delivery services

- 1 American Airlines mile per $1 for all other purchases

Plus, there’s no annual fee!

Anyone can apply for this card because it isn’t impacted by Citi’s strict application rules. And it could be worth it for the 2X bonus at grocery stores alone! Here’s our full review of the MileUp card.

Short Flights Can Be Expensive, but Miles Bring the Cash Cost to ~$6

If you want to get away for the weekend, would you rather fly or drive? That’s my eternal dilemma. From Dallas, I’ll sometimes drive to Austin if I’m bringing my dog or hauling a bunch of stuff.

But other times, I don’t want to put the miles on my car and would rather fly and not have to deal with parking. Dallas to Austin is ~200 miles each way. It takes 3 hours to drive, and about the same amount of time to fly. For anything beyond that, I’d definitely rather fly.

You can use 7,500 American Airlines miles for award flights of 500 miles or less. And these short flights can be expensive!

For example, Dallas to Memphis is 425 flight miles – just short enough to qualify for a low award price! And this flight varies from ~$100 each way to $300+. It’s a 7-hour drive, so flying is much easier.

The 10,000-mile sign-up bonus on the American Airlines AAdvantage MileUp card is more than enough to cover this flight. And instead of paying hundreds, the only cost is ~$6 for taxes and fees.

You can search for award flights directly on the American Airlines website.

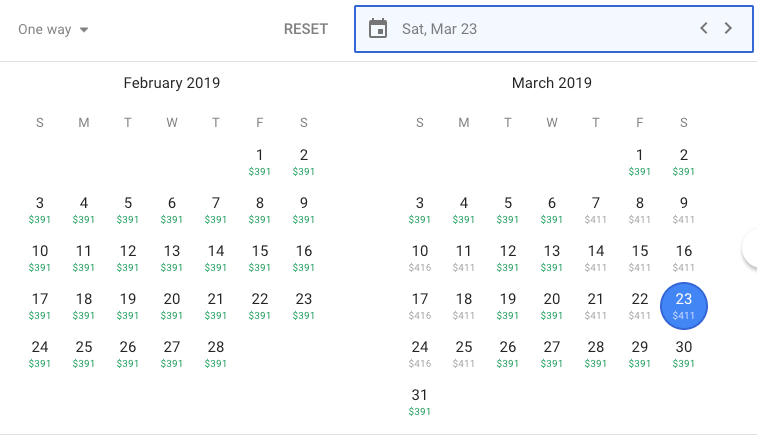

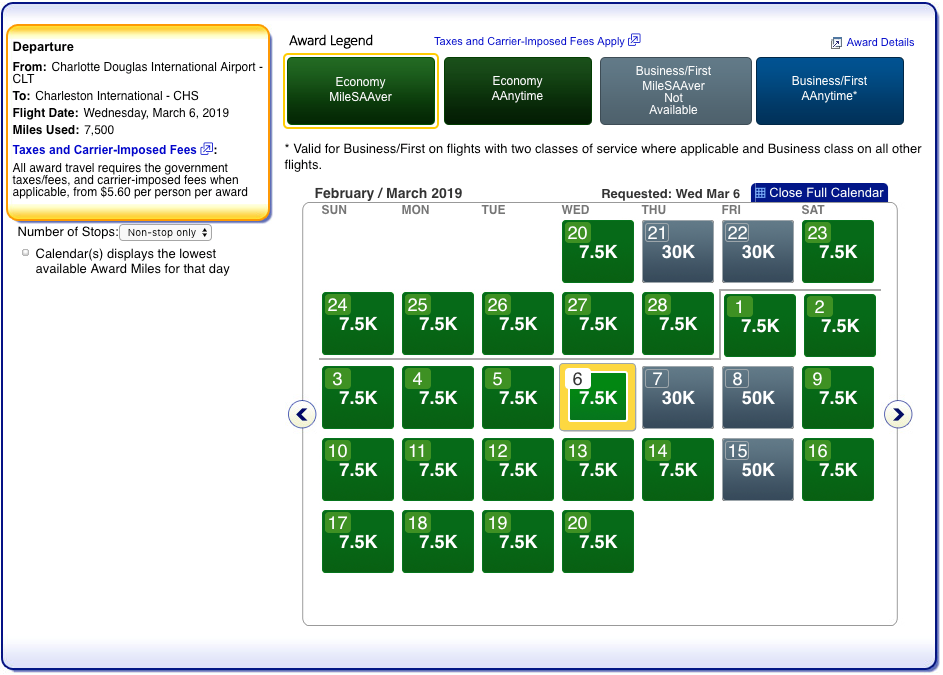

For example, flights from Charlotte to Charleston are ~$400 every day in February and March 2019. Or you could just drive for 3 hours.

But if you’d rather fly, you can. Award seats are open nearly every day!

You could use 7,500 American Airlines miles to cover the flight. And if you earn 10,000 American Airlines miles with the American Airlines AAdvantage MileUp card, you’d still have miles left over.

That’s a fantastic deal from 1 sign-up bonus!

Of course, if the flight you want is cheap with cash, it’s better to save your miles so you get more value from them. Or, you could save them up for a longer award flight.

Having miles in your account can help if you need to travel suddenly. Same-day or next-day flights typically have award seats, and can be extremely expensive. So deals like this can help you if there’s an emergency and you need to get home right away.

Or you could take a spontaneous trip just to have a fun getaway!

Bottom Line

We’re fans of the American Airlines AAdvantage MileUp card! There’s a sign-up offer for 10,000 American Airlines miles and a $50 statement credit after spending $500 on purchases in the first 3 months of account opening. That’s enough for a short one-way flight on American Airlines, and a great deal for a card with no annual fee.

If you spend a lot at grocery stores, it’s definitely a keeper. Here’s our complete review of the Citi American Airlines MileUp card.

Have you used American Airlines miles to cover the cost of a short, expensive flight?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!