The Ultimate Guide to Cruise Excursions

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

If you like to take excursions when you cruise, or you’re interested in booking one, did you know you can earn and use valuable rewards points from travel credit cards to save money toward your adventures? It’s true!

Most folks don’t associate credit card points with cruises or excursions, but we’re going to show you how you can make a good cruise deal even better. Without this step, you’re leaving money on the table – money you could be saving or using toward your next exploration!

Plus, paying with the right credit card offers you insurance and protection you might not get otherwise. And you’ll want to take precautions while you’re out enjoying your excursion!

Here’s our guide to cruise excursions with credit card points. And how to keep your cards safe!

The Best Travel Credit Cards to Earn Points for Cruise Excursions

Apply Here: Travel Credit Cards

If you’re not using a rewards credit card to pay for your travel expenses, you’re missing out!

Ideally, you’d use a credit card to pay for every expense, just like you would with a debit card. It’s important to pay your balance in full every month, and never spend more than you have – otherwise the interest you pay outweighs the rewards you earn.

You can earn points on every purchase, like the cruise itself and right down to the excursions!

You can book an excursion at each port of call. It’s your chance to get on land (or back in the water!) and explore more of each destination. Excursions can include:

- Walking, sightseeing, or history tours

- Nature walks

- Shopping

- Diving or snorkeling

- Casinos

- And much more!

The cost of excursions can add up fast, especially on longer cruises, and that means you can earn a lot of rewards!

Many cards include travel purchases as a bonus category. So you’ll earn more points for your cruise purchase, as well as any excursions you add to your trip. Cards that offer bonus points for travel include:

- Capital One® Venture® Rewards Credit Card – Read our review of the Capital One Venture

- Barclaycard Arrival Plus World Elite Mastercard – Read our review of the Barclaycard Arrival Plus

- Chase Sapphire Preferred® Card – Read our review of the Chase Sapphire Preferred

- Chase Sapphire Reserve® – Read our review of the Chase Sapphire Reserve

- Citi Premier℠ Card – Read our review of the Citi Premier

With these cards, you’ll not only earn points for excursions, but you can also use those points to book them!

The Best Points to Redeem for Cruise Excursions

Let’s take a closer look at the earning and redemption values of each card.

| Card | Points You'll Earn for $1 Spent on Travel | Value of Points When You Redeem for Travel (Including Excursions) | Minimum Amount Required to Redeem Points | Annual Fee |

|---|---|---|---|---|

| Capital One® Venture® Rewards Credit Card | 2X | 1 cent each | No minimum unless redeeming for a partial credit, then $25 (2,500 miles) | $95 |

| Barclaycard Arrival Plus® World Elite Mastercard® | 2X | 1 cent each | $100 (10,000 miles) | $89, waived the first year |

| Chase Sapphire Preferred® Card | 2X | 1.25 cents each | None | $95 |

| Chase Sapphire Reserve® | 3X | 1.5 cents each | None | $550 |

| Citi Premier℠ Card | 3X | 1.25 cents each (1 cent each for excursions) | None | $95 |

With each, you’ll earn 2 or 3 points per $1 spent. And get different values when you redeem your points.

1. Capital One Venture Miles

Apply Here: Capital One® Venture® Rewards Credit Card

Read our review of the Capital One Venture

For ultimate ease in earning and redeeming points for travel, consider the Capital One® Venture® Rewards Credit Card. You’ll earn 2X Venture miles per $1 spent on all purchases.

And you can redeem them for nearly any travel purchase. This gives you the most flexibility with cruise excursions, because you can book through the cruise line or independently. And there are no minimums to use your points, unless you only want a partial credit, then it’s $25 (2,500 Venture miles).

Folks love the straightforward way these points work. You can even save up your points and pay for the whole cruise, including excursions!

2. Barclaycard Arrival Miles

Apply Here: Barclaycard Arrival Plus World Elite Mastercard

Read our review of the Barclaycard Arrival Plus

Another contender for ease-of-use is the Barclaycard Arrival Plus World Elite Mastercard. You’ll earn 2 Barclaycard Arrival miles per $1 spent on all purchases. And you can use the points to offset almost any travel purchase. The only drawback is you must redeem at least 10,000 miles ($100) at a time.

If your excursion is over $100, or if you’re booking for multiple people, this isn’t an issue. And you can use your Barclaycard Arrival miles to “erase” the charge with a statement credit!

3. Chase Ultimate Rewards Points

Apply Here: Chase Sapphire Preferred® Card

Read our review of the Chase Sapphire Preferred

Apply Here: Chase Sapphire Reserve®

Read our review of the Chase Sapphire Reserve

Chase cards are great for earning valuable Chase Ultimate Rewards points. But they’re limited as far as redeeming for excursions.

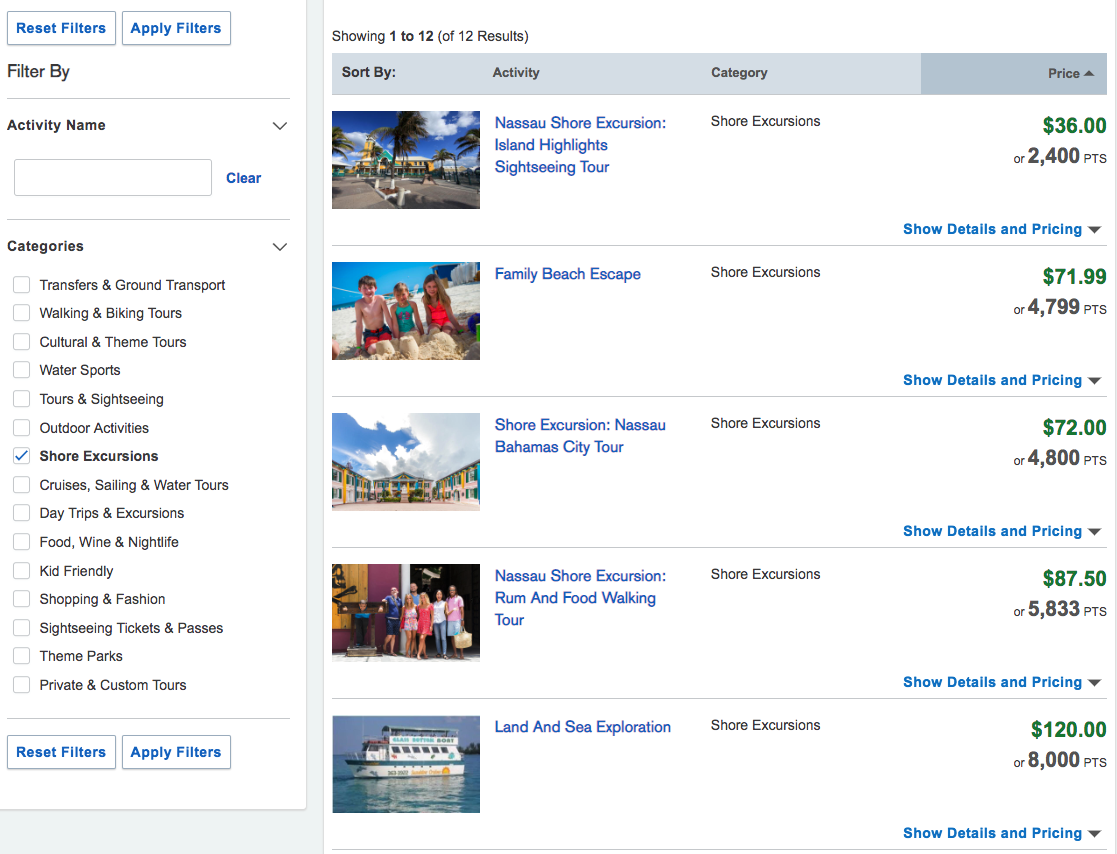

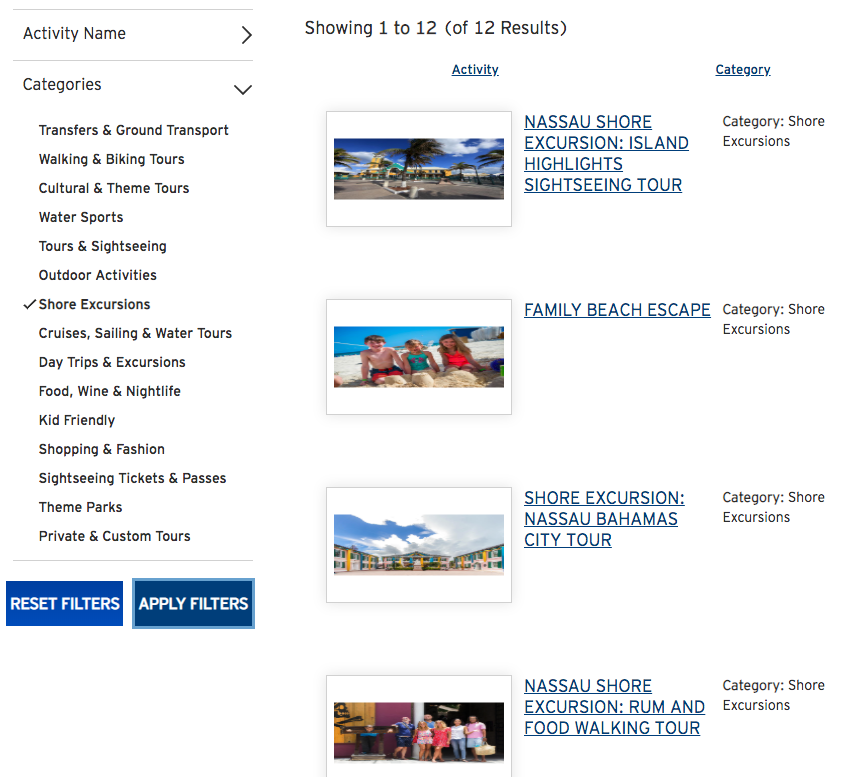

That said, when you book travel though Chase, you can use your points to book offshore excursions directly on the Chase website.

You can only choose from what’s on the Chase website. I found several options in Nassau, and could probably pick one that’s interesting, but you’d have more options booking through the cruise line or independently.

And if you don’t book through the Chase website, your points are only worth 1 cent each as a statement credit. But if you like to travel, you can use your points for award flights and award hotel rooms – which can help you get to your cruise and get a free place to stay before your ship leaves.

Plus, you’ll earn bonus points when you book excursions!

4. Citi ThankYou Points

Apply Here: Citi Premier Card

Read our review of the Citi Premier

With the Citi Premier Card, you’ll earn 3 Citi ThankYou points per $1 spent on travel, including cruises and tours. And you’ll get a value of 1.25 cents each when you book cruises through Citi, but only 1 cent each for excursions.

Again, you have to choose from a list of options, which won’t encompass all the offerings in a port. But it’s a start.

Citi ThankYou points are handy to collect for other types of travel, and can help you get to your cruise. You’ll also rack up 3X points on travel purchases!

Should You Book Excursions Through the Cruise Line or Through a 3rd Party?

Now that we know how to earn and use points for excursions, let’s look at how to book them in the first place.

Excursions are activities you can enjoy when your ship docks at a port. It’s your chance to get out and explore the local culture of each destination. Most folks don’t factor in the cost of excursions, and they can definitely add up. But you’ll want to see as much as you can in each port city because that’s part of the magic of cruising!

When you book your cruise, you’ll have the option to add excursions either directly through the cruise line or through the travel agency you used, before or after you board. If you want to get a feel for the ship and destinations, you might wait and book onboard. But if you like to plan in advance, you can go ahead and book while you’re still on land. 😉

Or, you can take the reins and book them yourself directly through a local tour company. Because either way, the ship’s gonna dock, so you might as well get out and explore!

Pros and Cons of Booking Through the Cruise Line vs Independently

Team member Scott took a cruise around the British Isles and wanted to do an excursion. But he found it difficult to find reviews and ratings of those sold directly by the cruise line. That said, the cruise operator wants you to enjoy your cruise, and try their best to use reputable vendors to recommend to guests.

You might find those tours crowded, though. It can be hard to secure a spot, or worse, even sell out. And you may not always get the best price. If an excursion is sold out, you might decide to book on your own, or just explore the port without a group.

But there is one huge perk to booking an excursion through the cruise line. In the event the tour runs over its allotted time, the boat won’t leave without you! That perk alone might be worth paying extra.

Because if you go rogue, the ship WILL leave, whether or not you’re onboard. Although the tour company you’re with will make every effort to get the ship to wait, some folks might not want to risk it.

The biggest advantage to booking on your own is you’ll have more options. You also might find a better price and be part of a smaller group.

Here’s more to consider:

| Pros of Booking Through Cruise Line | Cons of Booking Through Cruise Line |

|---|---|

| - Charge everything to your room and pay one time | - Price may be cheaper elsewhere |

| - Ensure your excursion counts as a travel charge | - Tours may be crowded or sell out |

| - Choose from a curated list of options | - You won't get every option available in each port |

| - Pay a flat fee without hidden or surprise expenses | |

| - Boat won't leave without you if tour runs over time | |

| Pros of Booking Independently | Cons of Booking Independently |

|---|---|

| - Research to your heart's delight | - The boat won't wait if you don't show up to board on time |

| - Compare prices for similar tours | - You'll make several smaller payments instead of one itemized bill |

| - Have more customization options | - Purchases should code as travel, but it's up to each provider to list their merchant information |

| - Enjoy smaller tours for a more personalized experience | - Little recourse if tour isn't to your liking |

| - Support the local economy directly | |

| - Snag a spot on a "sold out" tour, especially if there's a last-minute cancellation |

If you’re a first-time cruiser or want simplicity, you might book through the cruise line. But if you like to research, or you’re familiar with the port city, booking independently can be a fun diversion. Either way, you’ll have a great time!

Protect Your Valuables and Credit Cards While You’re Exploring

If you have anything valuable, like a laptop, tablet, or multiple credit cards, you’ll have to decide whether to leave it on the boat or lug it around with you all day. If you take a hiking tour, for example, you might not want to weigh yourself down.

When I travel, I like to carry more than one credit and debit card. I leave a credit and a debit card in my room, and take another credit and debit card out with me.

That way, if something happens, it’s not a total wipeout, and I can still access cash and credit until I get home.

You can leave your valuables in your cabin’s safe. And be smart when you’re out to avoid travel scams – watch for pickpockets and folks acting unusual, stay out of dangerous areas, and stick to a group.

And here’s a special note about your passport. You might consider keeping it with you, especially if your ship is touching ports in multiple countries. If something were to happen and you needed to get back to the ship, you’d have a lot more trouble if you got separated from your passport. Many jackets have special passport pockets. And you can always wear an always-in-style fanny pack!

Plus, some cruises might require your passport to even board after an excursion – so definitely check.

It’s also a good idea to leave copies of your passport in your room – in a secure location, of course – in case something happens while you’re off the ship. That way, you’ll have records of everything to help you sort out next steps.

Why You Should Travel With a Credit Card

Link: Best No Foreign Transaction Fee Credit Cards

Link: Best Travel Insurance Credit Cards

To start, you should absolutely have a card that doesn’t charge foreign transaction fees for shopping overseas. The nasty fees can add ~3% to everything you buy, and we hate paying them!

Plus, some cards come with trip cancellation & interruption insurance, which can help you if you get a sudden illness, experience a natural disaster, or have another covered reason. And before you depart, you’ll want to check if your medical insurance will cover you in the countries you’ll visit. Each country has their own rules, and so does each insurance provider.

Finally, most credit cards will come to your aid if you have fraudulent charges, either at home or on a trip. That can give you more financial protection than if you use a debit card.

Bottom Line

You can absolutely earn and redeem points when you book cruise excursions, either through the cruise line or through a 3rd party. Either way, the purchase should code as travel, and many travel credit cards earn bonus points for travel purchases. And others allow you to redeem your points for travel, including:

- Capital One® Venture® Rewards Credit Card

- Barclaycard Arrival Plus World Elite Mastercard

- Chase Sapphire Preferred® Card

- Chase Sapphire Reserve®

- Citi Premier℠ Card

The biggest pro for booking through the cruise line is they’ll wait for you if the tour runs long. But you might not get the full list of options, and tours can be crowded.

Booking independently will give you more choices, and potentially better prices. But I’d only recommend going this route if you’re familiar with the port city, or want a smaller group experience.

Booking excursions with a great cards can provide built-in trip insurance, depending which card you have. And if you’ve been paying foreign transaction fees, it’s time to cut those out!

Be smart with your cards while you’re out exploring. With preparation, you can save money, enjoy rewards, and have incredible excursions on every cruise!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!