Different Hotel Points Strategy: How I Stay at 5-Star Hotels More Often Than You (Even If We Have the Same Amount of Points)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.The strategy of many miles & points enthusiasts is to hoard the points they earn from valuable hotel credit cards and spend them for super fancy hotel stays they’d never pay for with cash. They’d rather not use points for the cheaper, more boring hotels.

But I submit that you can stay at 5-star hotels WAY MORE OFTEN if you do the exact opposite. Spend your hotel points at boring low-category hotels, and put the cash you save toward your future 5-star vacation.

You can subscribe to our newsletter for more easy-to-understand miles & points strategies and secrets.

My Strategy to Stay at 5-Star Hotels More Often

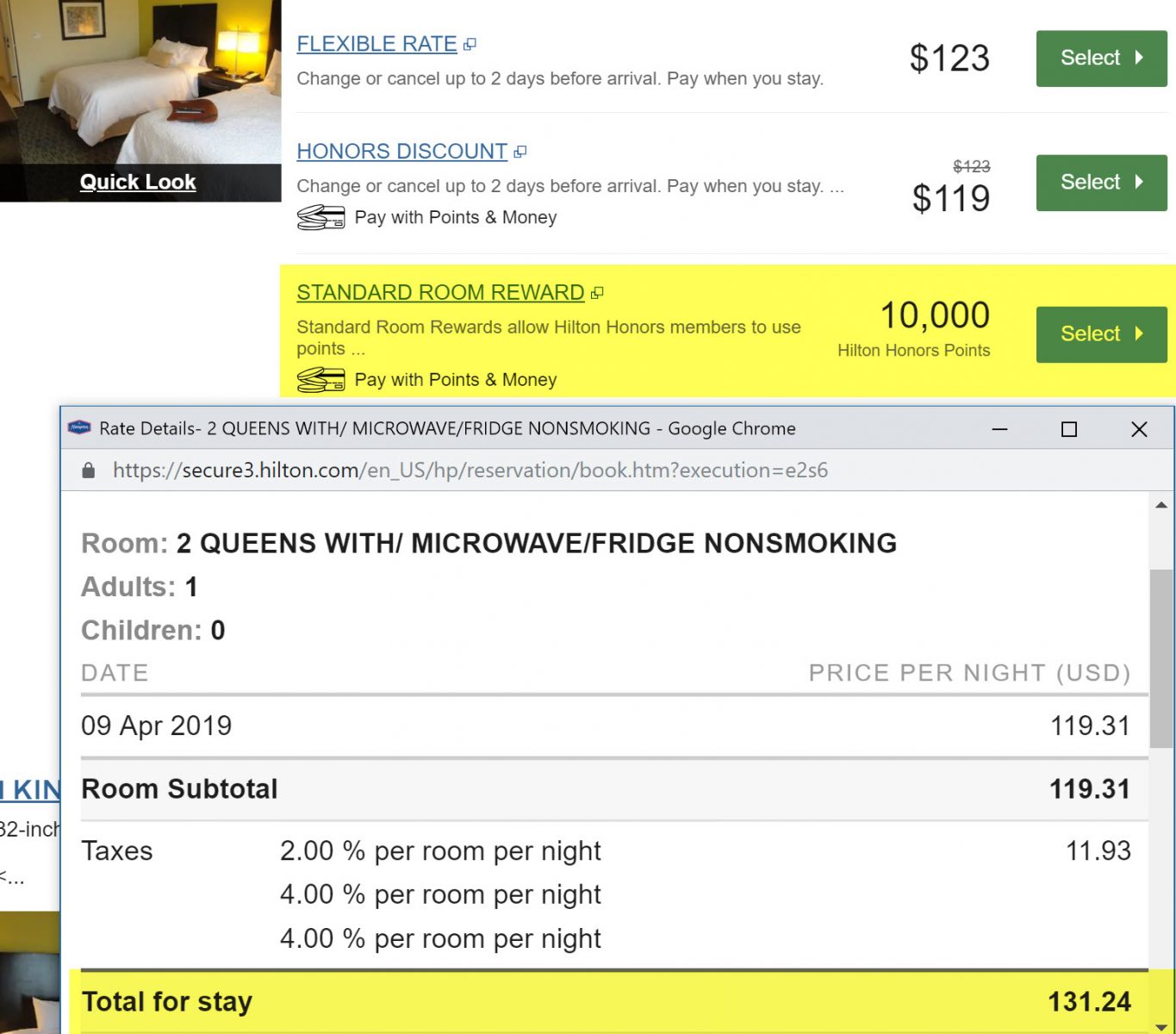

Here’s the crux of my argument: You’re almost always guaranteed to get a better value for your points by redeeming them at super low-category hotels. That’s because the base rate for hotel rooms are usually above $100 (after taxes & fees), and the points to reserve them are crazy low.For example, the Hampton Inn Ozark costs $130+ per night after taxes. But you can reserve the room for just 10,000 Hilton points.

This is probably one of those super boring hotel stays you’d rather pay for as you save your points for an exciting stay later. But it’s a great deal.

To put it in context, the Hilton Honors American Express Ascend Card currently comes with a welcome bonus of 125,000 Hilton points after spending $2,000 on purchases within the first 3 months of account opening. If you were to use that bonus exclusively at hotels similar to this, you would save ~$1,572 along your travels ($131 per night X 12 nights at 10,000 points each).

Good luck squeezing a similar value from that card bonus at 5-star hotels.

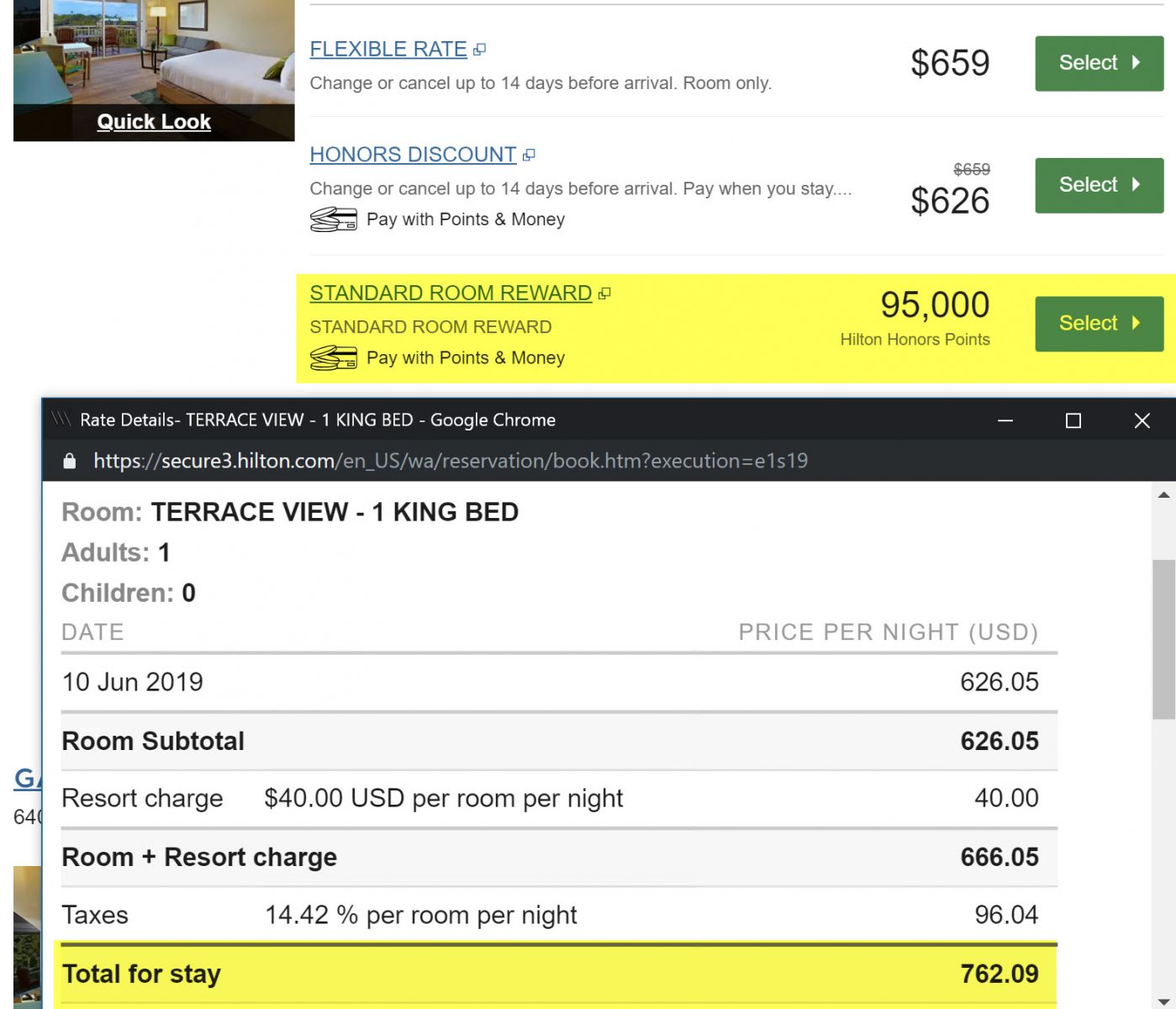

Hilton’s top notch hotels cost 95,000 points per night. Here’s a look at the VERY popular Grand Wailea, A Waldorf Astoria Resort in Hawaii.

Rooms in June cost $762, or 95,000 Hilton points, per night. If you redeemed 2 award nights here, you’d save $1,524 (almost as much as if you had used all your points for cheap hotel stays). But 2 nights would also cost you 190,000 points (70,000 points more than the cheap hotel scenario).

So What Exactly Is the Strategy?

The common hotel points strategy is: Open hotel credit cards and earn big welcome bonuses. Save bonuses for jaw-dropping hotels that you can’t afford with cash. Pay cash for the cheap-o hotels you’d book anyway throughout the year. This flip-flopped strategy is: Use points for the everyday cheap-o hotels and save that cash you would have spent toward a future 5-star hotel stay.To reiterate the above example, if you’re looking for a weekend stay at the Grand Wailea in Hawaii, use your AMEX Hilton Ascend welcome bonus on your normal uninspiring hotel stays, and deposit the cash you would have spent on that stay into your Grand Wailea Hawaii fund. With this strategy, you could achieve 2 nights at the Grand Wailea with 120,000 Hilton points instead of 190,000 Hilton points.

Come On, Man, You Just Picked Hotels and Dates That Support Your Argument

I took a peek at my recent Marriott history, and here’s what I found:

- 1 night at Courtyard Cincinnati Airport – $140 (or 17,500 points)

- 2 nights at TownePlace Suites Chicago Elgin/West Dundee – $165 (or 15,000 points)

- 1 nights at TownePlace Suites Charlotte Fort Mill – $220 (or 17,500 points)

- 1 night at the Courtyard Dulles Airport Herndon/Reston – $194 (or 12,500 points)

By using points for these stays (I didn’t use them for one of the stays, but the point still stands), I spent 62,500 Marriott points and saved $719 in cash.

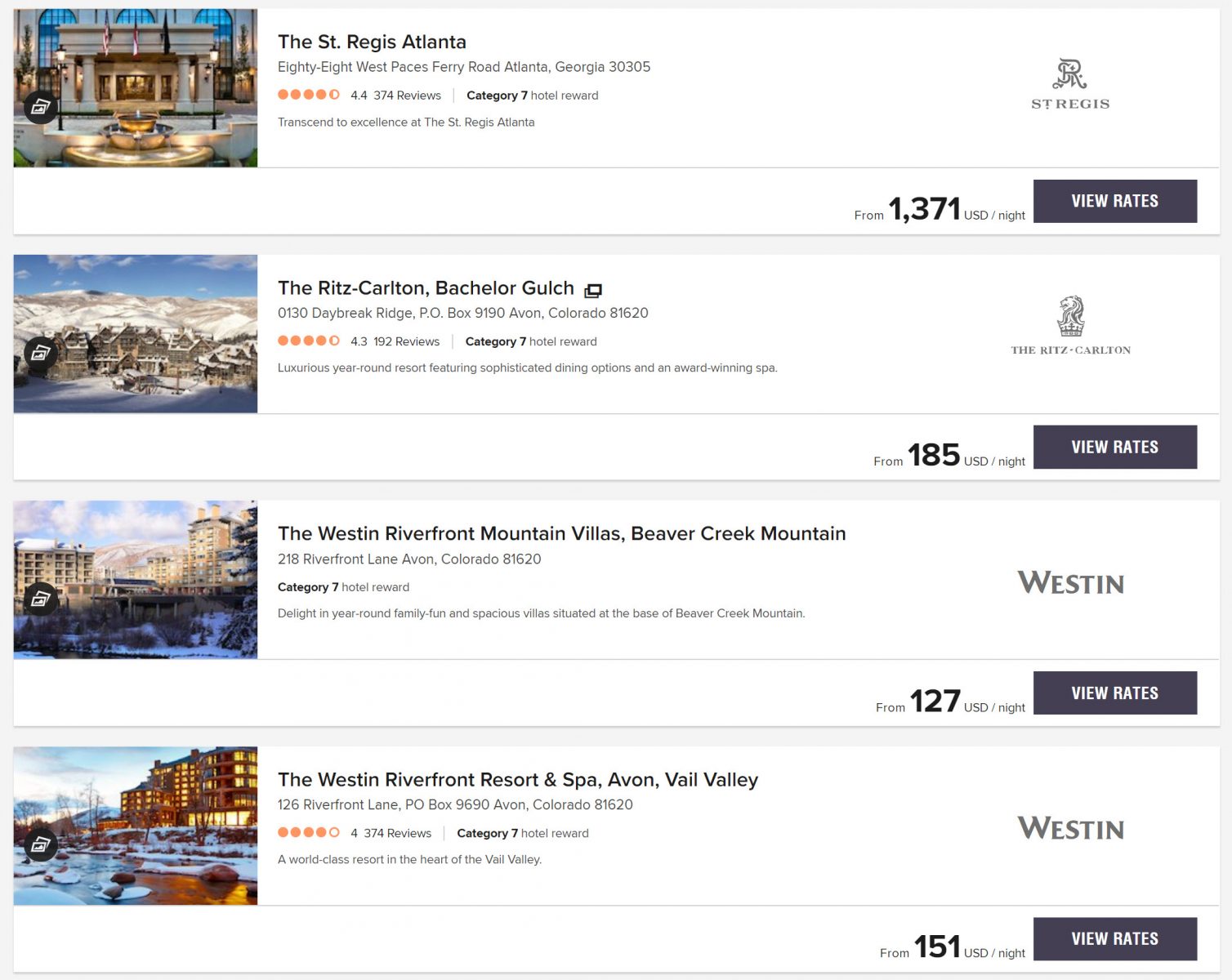

You probably know that if you want to stay at Marriott’s most aspirational hotels, you’ll drop at least 60,000 Marriott points per night (Marriott’s highest category hotels cost 60,000 and 85,000 points).

I’ll wager that the $700+ I saved by using points for my everyday travels are a better deal than had I paid for all my stays and reserved a 5-star Marriott hotel for 60,000 points.

I can now take that $700 and spend it on multiple nights at plenty of Marriott’s 5-star hotels.

The 2 Drawbacks of This Strategy

Elite Night Credits

Not all hotels offer elite night credits for award stays. If you’re chasing elite status, it might not be best for you to use points for your cheap and frequent hotel stays.

Bonus Award Night Perk

Some hotels will give you a bonus night for staying 4 or 5 consecutive award nights. For example, if you book 4 nights at a 5-star Marriott hotel, you’ll get a 5th night for free. This can tilt the needle in favor of saving your award nights for your desired 5-star hotel.

However, if you’re paying with cash, you’re able to book through platforms like AMEX Fine Hotels & Resorts, Virtuoso, or other luxury websites that will give you bonus amenities like:

- Spa credits

- Restaurants credits

- Room upgrades

- Free breakfast

- 4th night free

Amenities differ based on the hotel, but I’ve been very surprised how many hotels offer the 4th night free when booking through one of these websites. That’s another benefit of booking with cash instead of points.

Bottom Line

Don’t spend your points on 5-star hotels. Spend them on low-category hotels for which you’d normally pay money, and then SAVE THAT MONEY FOR YOUR DREAM HOTEL. I can almost guarantee you’ll reach your luxury travel goals faster this way.

I don’t hear this strategy touted enough; most assume that the smartest decision is saving points for the 5-starsiest hotels. I just virulently disagree.

Let me know what you think! And subscribe to our newsletter to have miles & points advice sent to your inbox. More tips = more trips!

[gravityform id=”3″ title=”false” description=”false”]Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!