Southwest Rapid Rewards shopping portal – Get closer to a Companion Pass with your online purchases

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

The best way to earn Southwest points without flying is by opening a Southwest credit card, These card bonuses are great because they count toward earning a Southwest Companion Pass. But this isn’t the only way to get the job done.

You can also earn points by making your online purchases through the Southwest Rapid Rewards shopping portal. Online shopping portals are a great way to earn extra rewards for things you were going to buy anyway. So let’s take a look at what the Rapid Rewards shopping portal is, how to use it and why you would want to use it.

Southwest Rapid Rewards shopping portal

Before you can take advantage of the Rapid Rewards shopping portal, you’ll need to setup a Southwest account. Once you’re logged into your Southwest Rapid Rewards account follow these steps to start earning bonus points.

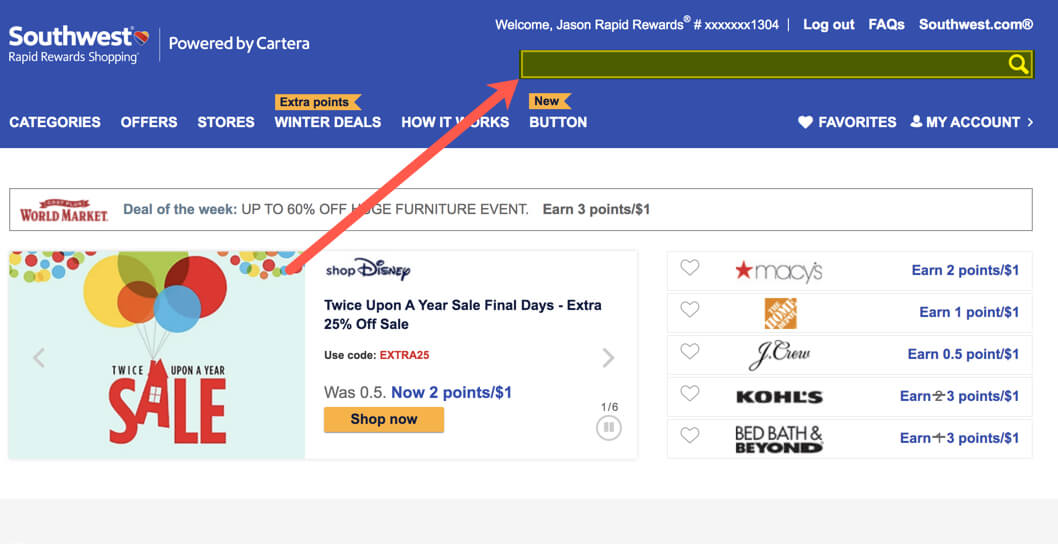

Search for merchants

To get directly to the Rapid Rewards shopping portal, click here. Then, enter the store you want to shop with in the search bar.

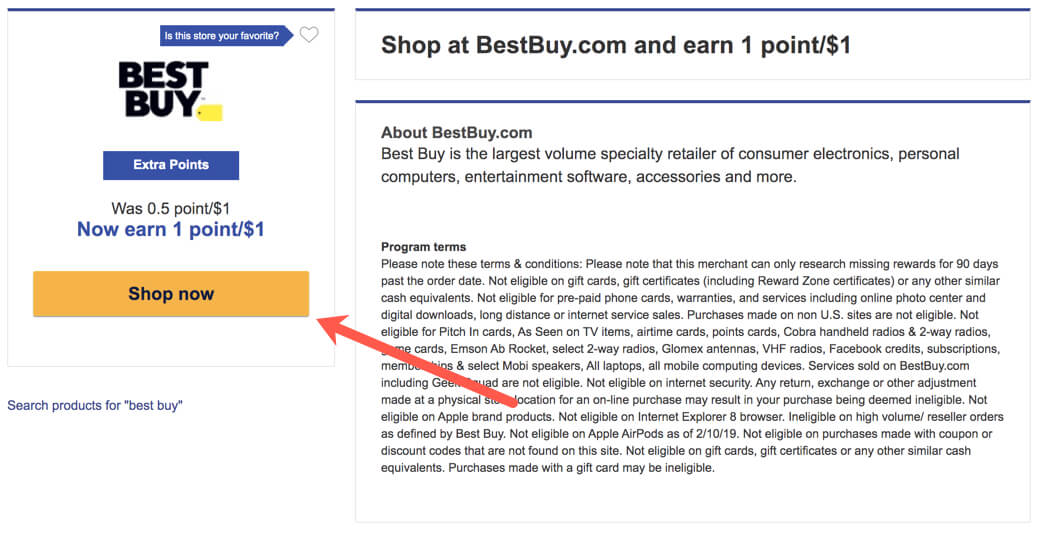

Review the terms and make the purchase

Next, you’ll want to review the specific terms for that particular merchant. These will vary depending on the store and sometimes certain items are excluded. In the example below, purchases like gift cards aren’t eligible, but more specific items including, Apple AirPods, VHF radios, select 2-way radios and Emson Ab Rocket aren’t eligible either.

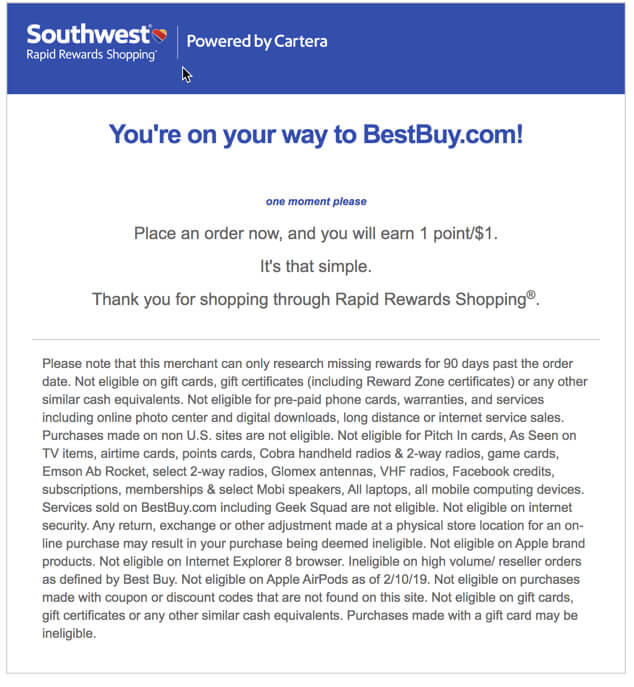

Once you’ve determined that your purchase qualifies, then click “Shop now” and you’ll be taken to the merchants website. While you’re waiting for the store’s page to load you’ll have an interstitial page like this one…

Now you can just make a purchase like you normally would. Keep in mind, that you can only use coupon codes from Rapid Rewards shopping and any other promo codes can invalidate the shopping portal bonus. It’s also best not to click out to another site in between clicking through the Rapid Rewards portal and making the purchase, this could potentially cause the purchase to not track properly.

According to the Southwest Rapid Rewards portal FAQ it can take up to 15 days for the points to show up in your shopping portal account and up to another 7 days for the points to then be available in your Southwest Rapid Rewards account.

How many Rapid Rewards points can you earn?

With most merchants you will earn 1-3 bonus points per dollar and occasionally the bonus will be higher. There are also some deals which offer a set bonus. For example, through Apr. 15, 2020, you can earn 1,000 bonus points for filing with TurboTax through the Rapid Rewards portal.

For the most part, Rapid Rewards shopping points will count toward earning a Companion pass. However, certain promotional bonuses available through the Rapid Rewards portal won’t help you qualify for the Companion Pass. These are usually special offers that require a certain purchase or a certain amount of spending to earn a bonus.

Also, there is no guarantee that the Rapid Rewards portal is the most lucrative shopping portal option. I like to use Cashback Monitor to compare the rewards rates from dozens of different portals at the same time. I was able to find that, at the time of writing, the Chase Ultimate Rewards shopping portal was offering 2x points on Best Buy purchases and the JetBlue shopping portal was offering 3x points. But, you may not value these as highly as Southwest points, especially if you’re working toward a Companion Pass. So be sure to compare the rewards you’ll get before making a decision.

Cards to use with the Rapid Rewards shopping portal

You can use any rewards credit card or travel credit card you’d like to make purchases through the Southwest shopping portal. But it makes sense to use an airline credit card that earns Southwest points because the points you earn from Southwest card spending and (most) points you earn from the Rapid Rewards portal both count toward earning a Southwest Companion Pass.

Right now the personal Southwest cards (Southwest Rapid Rewards® Plus Credit Card, Southwest Rapid Rewards® Premier Credit Card, or the Southwest Rapid Rewards® Priority Credit Card) are offering the opportunity to earn 40,000 bonus points after spending $1,000 on purchases in the first three months your account is open.

You could also open a Southwest business credit card:

- Southwest® Rapid Rewards® Premier Business Credit Card — 60,000 Southwest points after spending $3,000 within the first three months

- Southwest® Rapid Rewards® Performance Business Credit Card — 80,000 points after you spend $5,000 on purchases in the first three months of account opening.

These are all Chase credit cards, so they are impacted by the Chase 5/24 rule. Also, you can only hold one Southwest personal card at a time and if you’ve earned an intro bonus on a personal Southwest card in the past 24 months you aren’t eligible for a new personal Southwest card. But these restrictions don’t apply to the business Southwest cards. So if you can qualify for a business card, you could open a personal card and business card to easily earn a Companion Pass.

Bottom line

The Southwest Rapid Rewards shopping portal is a great way to earn extra points for your online purchases. The best part is that the vast majority of the points you earn through the portal will help you earn a Southwest Companion Pass. So even in the those instances when there are other portals with higher pay-out rates, the Rapid Rewards portal can be a better choice.

| For more travel and credit card news, deals and analysis sign-up for our newsletter here. |

Featured photo by GG Photos/Shutterstock.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!