Secrets for Avoiding Hidden Airline Fees

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Insider Secret: Airlines love charging additional fees, plain and simple. Your best bet for avoiding these fees is to plan in advance, know the airline policies, and keep a credit card that offers an airline fee or travel credit.

My number one goal for award travel is to minimize out-of-pocket expenses and maximize value and enjoyment of each trip. Unfortunately, it often seems like the travel industry is working against me.

We’ve already discussed the new hotel “resort fees” (which are just a clever marketing ploy), but airlines love to hide fees, as well. To their credit, these fees are normally laid out in the terms and conditions and they’ll mention them, if you ask. But showing up to the airport to learn you misspelled your cousin’s middle and now need to pay $200 to “change” the ticket … is a terrible way to start your vacation.

We’ll discuss some of the most common — and frustrating — airline fees. We’ll also discuss our favorite secrets for avoiding hidden airline fees and overall best strategies for being well-prepared.

Airline Ticket Change and Cancellation Fees

Perhaps the most common and frustrating hidden fees arise when you need to change or cancel your flight. Even though some flights are incredibly low-priced, the change or cancellation fees can cost more than the price of the ticket. In these situations, you might be better off just “throwing away” the whole ticket as opposed to paying the high fee to cancel.

Airlines have different policies and procedures regarding how much they will charge to cancel or change a flight. For example, some airlines will charge ~$100 to change a paid-airfare ticket, or $150 to get a refund of the money you spent. Other airfares are deemed “nonrefundable,” so your only recourse is to pay the hefty redeposit fee (often in the range of $100 to $150) and get the paid amount as a future travel credit that you can only use for flights on the same airline, for the same passenger.

Note: We’ve told you before, and we’ll say it again, Southwest Airlines is, by far, the most generous airline when it comes to cancellation and change fees. There is never a fee to change or cancel your flight, but if you book the lowest level “Wanna Get Away” fare, you can only redeposit the money to your travel bank (as opposed to a cash or check refund). Check out our complete post on airlines that don’t charge cancellation fees.

To avoid these fees, I recommend, first and foremost, that you plan your travel wisely. Although the cost of a specific fare might increase by ~$100 in the next two weeks, it might be worth it to hold off on booking until you’re certain about your travel dates and plans. I also recommend that you know in advance what the fees and penalties are for cancelling or changing your flight. It might not be fun to read through an airline’s cancellation policy terms and conditions, but it’ll be more fun than being charged $100 to change the spelling of your last name (which you entered in a hurry).

I don’t recommend purchasing airline change/cancellation insurance when buying airfare. Although the $39 to $99 fee for “insurance” might seem like an intuitive way to protect yourself, the reality is that these policies are notoriously difficult to use and overly complicated.

The best insurance is well-thought-out planning. If you’re a frequent enough traveler that you know you’ll have some change fees in a given year, I recommend you arm yourself with a credit card that includes a travel or statement credit for airline change or cancellation fees. For example, my wife and I both carry the Chase Sapphire Reserve and make good use of the $300 travel credit — which can be used for airline change and cancellation fees.

Other premium cards like the US Bank Altitude Reserve Visa Infinite Card and The Platinum Card® From American Express offer airline fee credits (enrollment required), but these depend on the type of fee you need to pay. For more information on these cards, check out our full reviews here:

- Chase Sapphire Reserve Review

- US Bank Altitude Reserve Visa Infinite Card Review

- The Platinum Card® From American Express Review

Basic Economy Fees

Basic economy fares are some of the sneakiest when it comes to hidden fees — largely because the fees are hidden in plain sight. That’s because we’ve all grown accustomed to complimentary carry-on bags, seat selection, and other basics (such as earning miles for paid flights).

Basic economy fares are known for charging for anything and everything, other than your actual transportation from point A to point B. If you’re travelling as a family (and with young kids), you can’t even select seats next to your children without paying for them. You also can’t count on a complimentary carry-on bag (to store in the overhead bin) other than a small personal item that must fit under the seat in front of you.

Once again, the secret to avoiding these fees (or, at least, anticipating them) is to read, read, read before you confirm your flight booking. Airlines are within their rights to restrict what’s included as part of your airfare, and in many ways, this “de-bundling” has made air travel more affordable and accessible for everyone. For some folks, these cheap fares (with no carry on and no water included) are a great value that make unreachable trips a reality.

Close-in Booking Fees

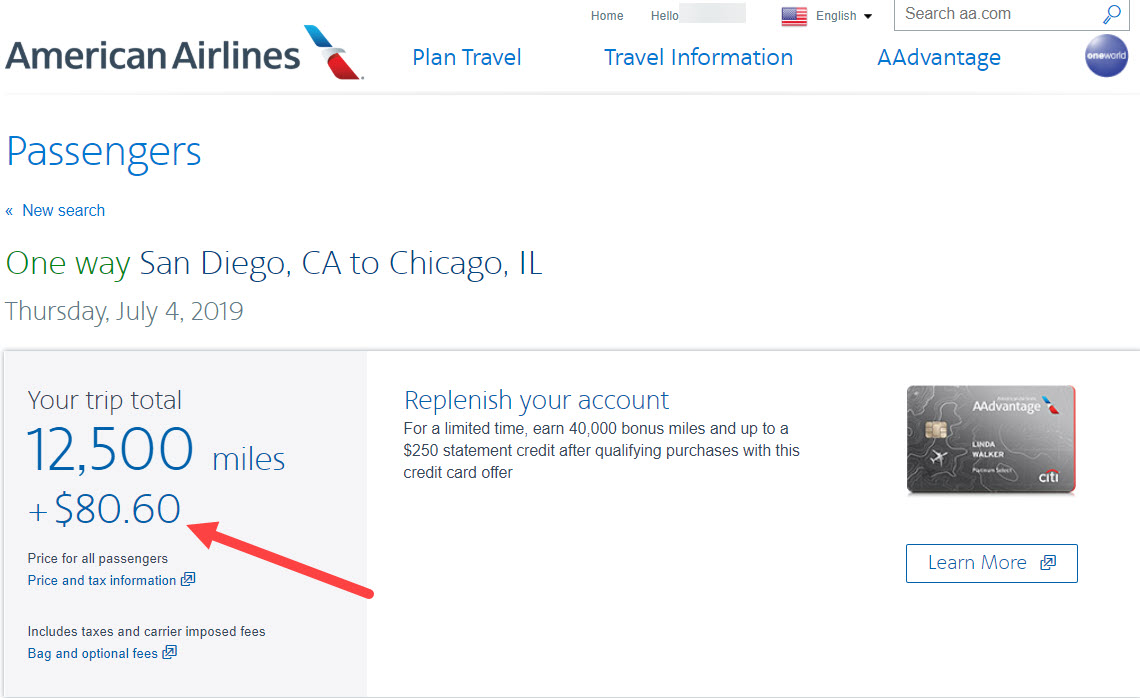

Close-in booking fees are dangerous when booking award flights, because most airlines don’t charge an additional fee for booking a revenue fare in the few weeks before departure (although they certainly like to increase the price). Some airlines offering award flights, like American Airlines or United Airlines, will charge you a $75 close-in booking fee for any award flight booked within three weeks of your travel date.

To avoid these fees, you can simply book your travel in advance or strategically book the same flights with another airline rewards currency. For example, instead of using American Airlines miles to book a flight for next week on American Airlines (and paying the $75 close-in fee), you might use British Airways Avios points for that same flight and avoid the $75 fee. Instead of booking with United Airlines miles, you might redeem Aeroplan miles (a United Airlines partner in the Star Alliance) for the same flight — without the fee.

Keep in mind that some airlines will never charge a close-in booking fee, such as Southwest Airlines and Delta. So if you have last minute travel that needs to be booked, try checking for award flights on these airlines first.

Add-On Fees (Seat Selection, Meals, etc.)

Add on-fees can also catch you off guard if you’re flying an airline for the first time or if you simply didn’t expect them. On several low-cost airlines, for example, you won’t even be given water on board unless you’re willing to pay for it. Ouch.

We already discussed seat selection and onboard meals above (in the basic economy section), but these are valuable things to keep in mind, as well. If you can do some research ahead of time by visiting the airline website, you can typically find information on what is and is not included as part of your fare.

Then, you can be well-prepared by buying water or food and drinks at the airport before your flight. And since you’ll likely be saving more than $10-$15 on the low-cost carrier’s ticket prices, go ahead and splurge for that pricey $4.50 airport bottle of water — you deserve it.

Bonus: Checked-bag fees

Checked-bag fees aren’t exactly hidden, but they’re certainly annoying. We previously wrote about how you can avoid these fees and save a whole bunch of cash. If you’re interested, check out our comprehensive post on saving on checked bag fees.

Bottom Line

Especially for the travel-addicted, learning to avoid and identify hidden airline fees can lead to significant savings. Nothing stings more than a significant fee (up to hundreds of dollars) that wasn’t in the budget at the start of your trip.

With some of these strategies and tricks, you can be a master detective of hidden airline fees, and intentionally plan around or prepare for them. If you can’t avoid fees, at least arm yourself with a travel rewards credit card to help offset some of the charges.

Have you ever been surprised by hidden airline fees? What was your costliest hidden-fee failure?

Love our tips, tricks, and above-average jokes? Subscribe to our once-daily newsletter for more golden content to help elevate your travel.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!