If You Don’t Have Amex Cards in Your Wallet, You’re Missing Huge Opportunities to Save Money

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

INSIDER SECRET: Amex Offers, which are targeted deals you can add to your card, can save you hundreds of dollars on everyday purchases. No coupon clipping or swiping a loyalty card required!

Everyone on the MMS team keeps annual-fee cards in their wallet because their ongoing earning and benefits can more than offset the yearly expense. But when a card has no annual fee and offers perks and savings – for free – it’s a no-brainer to hang onto it year after year.

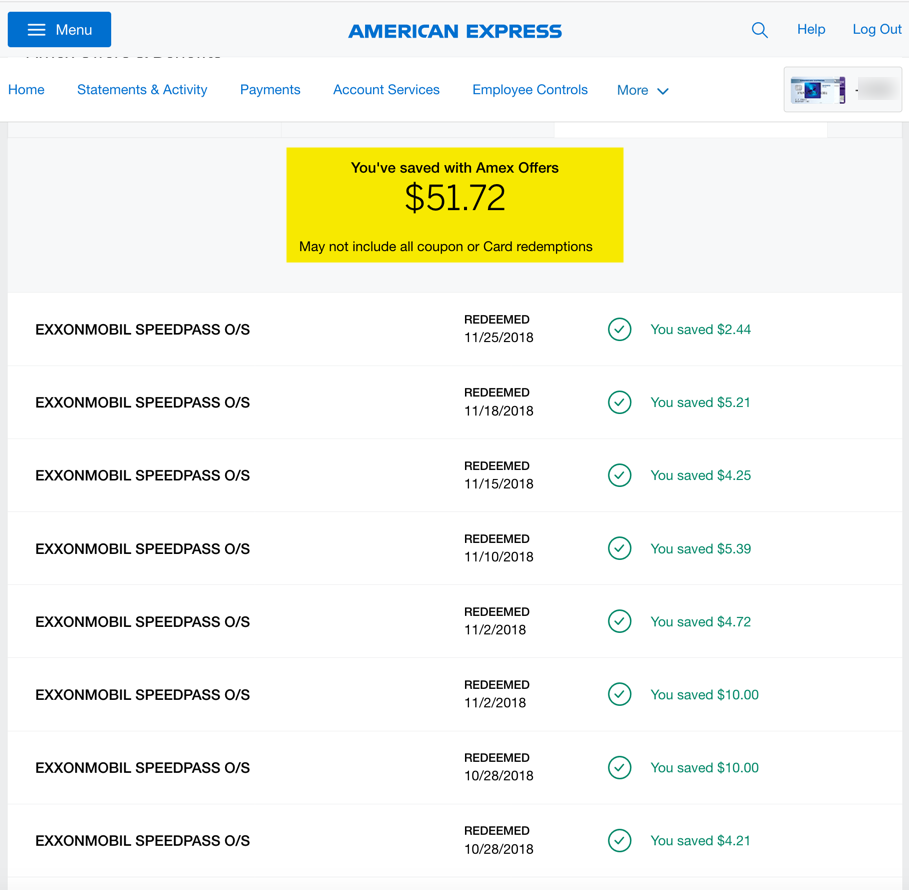

I was having a peek at my Amex accounts and was happy to see I’d saved over $50 just in the past couple of months by adding Amex Offers to my no-annual-fee The Blue Business® Plus Credit Card from American Express (See Rates & Fees). It was really just as easy as clicking to add a couple of offers to my account and making eligible purchases (gas, which I would have bought anyway) and waiting for the statement credits to post.

You can really save money with Amex cards. If you’re not making the most of Amex Offers, it’s like throwing cash away.

Amex Cards Will Save You Money – With Little Effort

Read our post with everything you need to know about Amex Offers

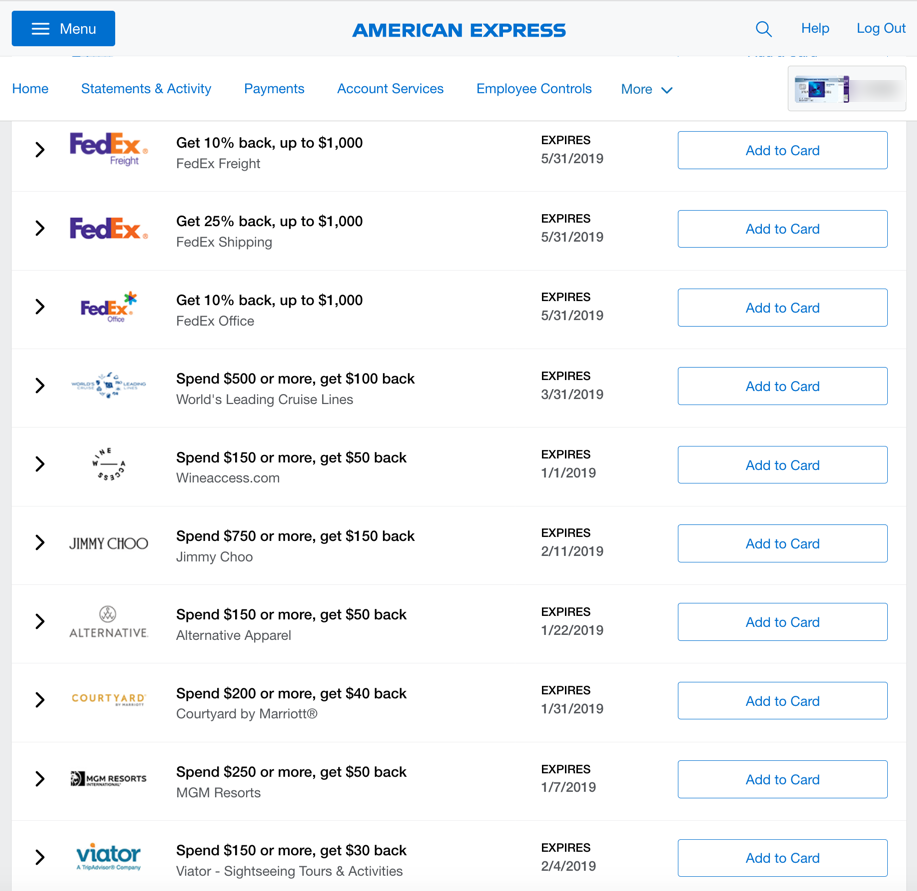

Amex Offers are targeted deals where you can earn statement credits or bonus points by enrolling your eligible American Express cards and making a qualifying purchase. To add offers to your cards, sign into your Amex account online and click on the offers you’re interested in.

Both Amex Membership Rewards earning cards like The Business Platinum® Card from American Express, and co-branded cards, like the Hilton Honors Aspire Card from American Express and Marriott Bonvoy Brilliant™ American Express® Card, are eligible for Amex Offers. The information for the Hilton Aspire card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

You can also check to see how much you’ve saved on a particular card with Amex Offers. For example, here’s the screenshot from my Amex Blue Business Plus Card showing what I saved in under two months. This card has no annual fee (See Rates & Fees) so any savings are pure gravy.

The Amex Blue Business Plus Card is a favorite among many miles and points enthusiasts. The Blue Business Plus earns 2x Membership Rewards points per $1 spent on all purchases (up to $50,000 per calendar year, then 1x).

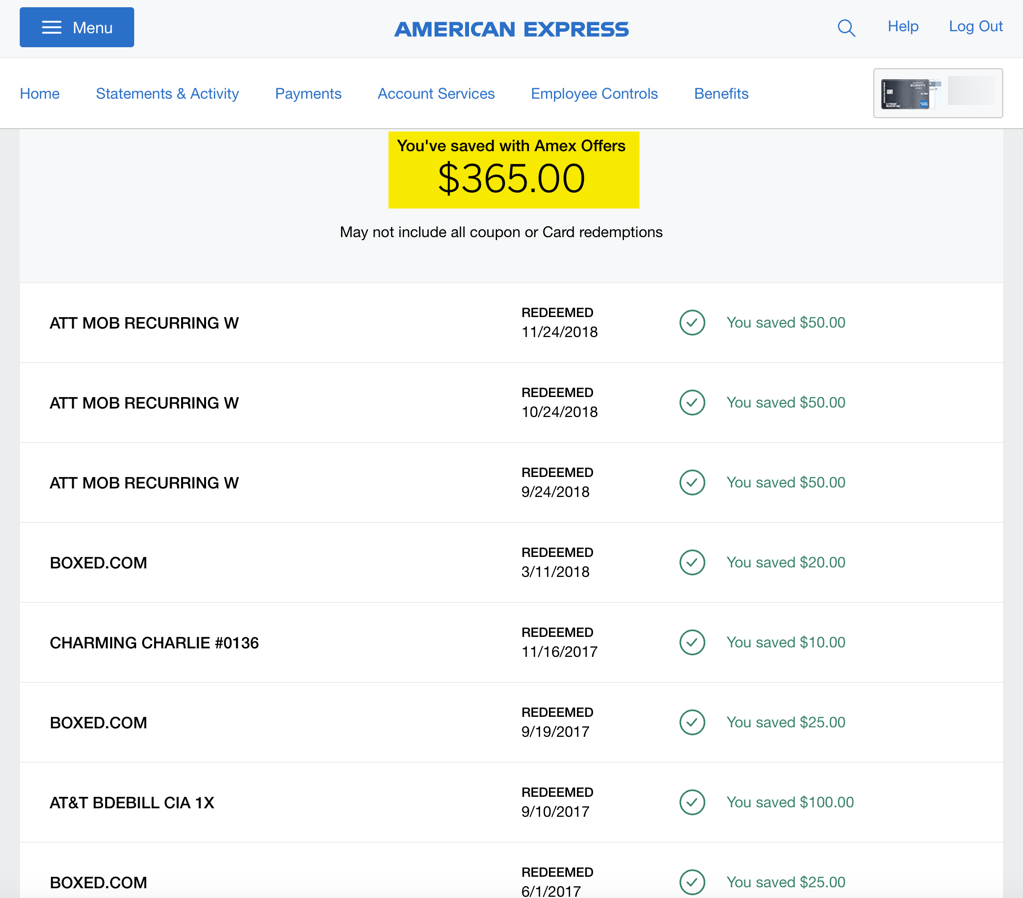

Savings on annual-fee cards can offset the yearly cost many times over, too. For example, here’s what I saved in under 2 years with my Marriott Bonvoy Business™ American Express® Card, which has a $125 annual fee (See Rates & Fees).

Keep in mind, the Marriott Bonvoy Business comes with a free night (at hotels that cost 35,000 Marriott points per night or less) each account anniversary, which can more than offset the annual fee.

I love that these savings are automatic once you add the offers to your card. And sometimes I’ll add offers and forget I’ve done so, then get a pleasant surprise later when I make a qualifying purchase that triggers the deal.

And if you’d prefer Amex cards without an annual fee, consider these cards:

- The Blue Business® Plus Credit Card from American Express (See Rates & Fees)

- Hilton Honors American Express Card (See Rates & Fees)

- Blue Cash Everyday® Card from American Express (See Rates & Fees)

- SimplyCash® Plus Business Credit Card from American Express (See Rates & Fees)

How much money have you saved with your American Express cards and AMEX Offers? I’d love to hear your success stories in the comments!

For rates and fees of the Blue Business Plus Card, please click here.

For rates and fees of the Hilton Amex Card, please click here.

For rates and fees of the Blue Cash Everyday Card, please click here.

For rates and fees of the SimplyCash Plus Business Card, please click here.

For rates and fees of the Marriott Bonvoy Business Card, please click here.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!