Samsung Pay: What it is and how to use it

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

I’m not joking, I bought a Samsung phone almost exclusively because of Samsung Pay.

Samsung Pay is one of the most dynamic tools in the miles and points enthusiast’s utility belt. Many of us have a large quantity of rewards credit cards that we use strategically with certain merchants and activities. I currently have 19 credit cards, but I spend on perhaps five at a time, depending on rotating category bonuses, minimum spending requirements, and other variables. Using a virtual wallet like Samsung Pay allows me to carry all my cards around without dislocating my hips.

I’ll explain the virtues of Samsung Pay, show you why it’s hands-down the best mobile wallet for travelers, and give you step-by-step instruction (with pictures) for how to set it up.

What is Samsung Pay?

Samsung Pay is a mobile wallet available for most Samsung Galaxy smartphones, as well as most Samsung Gear smartwatches. It is an Android app that comes pre-installed on your Samsung phone. The feature allows you to pay for transactions with a tap of your phone — no cash or credit card necessary. Just load credit cards to the app, swipe to find the card you want to use, and you’ll be charged to that card. It even works for debit cards, gift cards, and memberships, such as Kroger, Planet Fitness, Sam’s Club, etc. (one notable exception is Priority Pass!).

Can you see why this is such a miles and points superpower? No four-inch thick wallets stuffed with the best travel credit cards in attempts to maximize each unique bonus category. They’re all stored in a device you’d be carrying around anyway.

How is Samsung Pay different from Google Pay or Apple Pay?

While Samsung Pay is just an app, it actually employs unique internal hardware that puts it miles ahead of other platforms like Apple Pay or Google Pay.

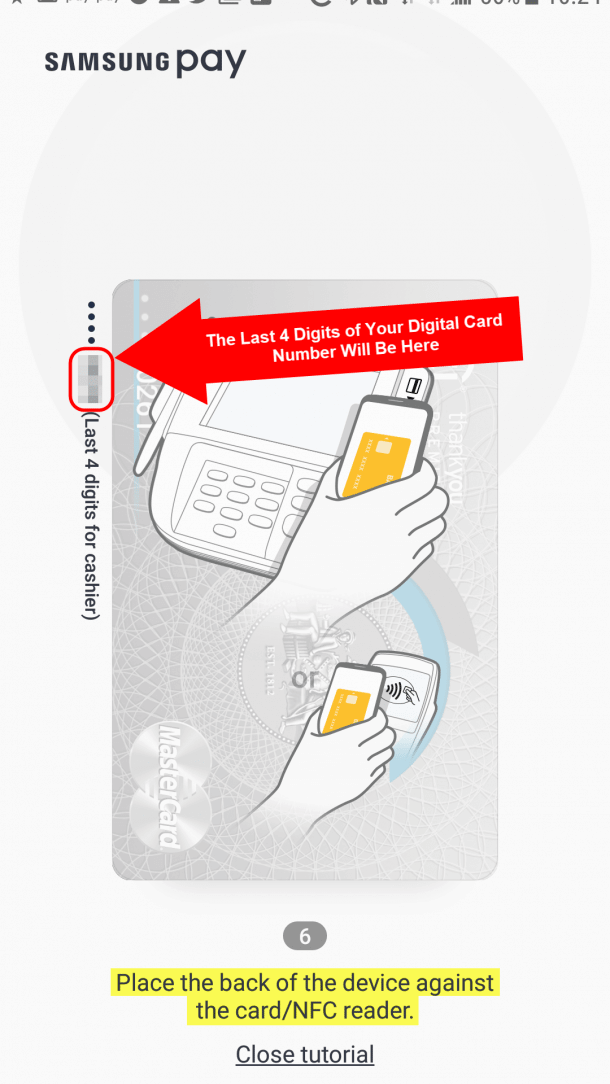

Most mobile wallets implement NFC technology, which allows you to tap your phone on the front of the credit card machine (you may have used this method with your compatible credit card). However, not nearly all merchants have this feature at checkout. If a credit card terminal is older and doesn’t have NFC capabilities, you’re out of luck. BUT NOT WITH SAMSUNG PAY.

Samsung Pay includes something called MST, or magnetic secure transmission. You can literally just touch your phone to any credit card machine around the area where you swipe your card, and the machine will think you just swiped a card. It essentially mimics what happens when you swipe a physical credit card at a payment terminal.

Where is Samsung Pay accepted?

Magnetic secure transmission is a game changer. Nearly every establishment has a credit card terminal — from Girl Scout booths outside Walmart to small-town bodegas to third-world souvenir shops. Samsung Pay trounces the competition, especially if you travel. You can use Samsung Pay just about anywhere in the world.

You don’t even need internet to make payments. However, you’ll need to use the internet to add cards and see your transactions. And you can make a maximum of 10 payments before you’ll need to hop on Wi-Fi or a data plan.

Is Samsung Pay secure?

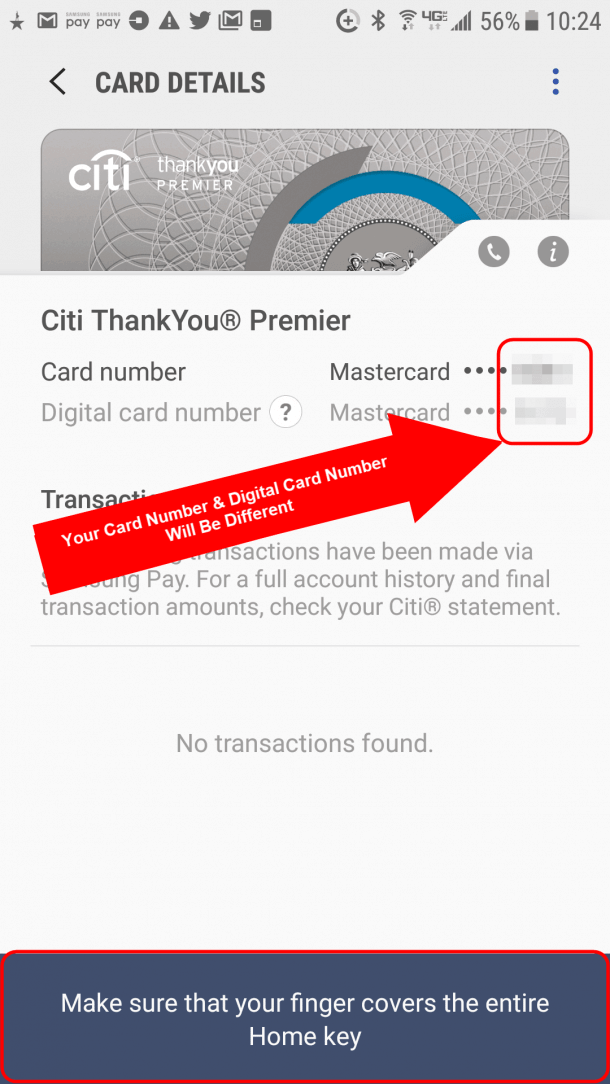

Talking of using Samsung Pay abroad, it’s one of the most secure ways to shop. It doesn’t even store your credit card numbers (or any account numbers, for that matter). It creates its own account number for each card. In other words, when you use one of your cards through Samsung Pay, the credit card machine receives a different 16-digit number representing the card you’ve chosen, as well as a single-use code created by your phone’s encryption key.

Samsung Pay is a proxy of sorts between your credit card and the store.

If you happen to lose your phone, a scoundrel would need your PIN number, fingerprint, or iris to access your credit cards. You can also remotely wipe information on your phone via the Samsung Find My Mobile website.

Which credit cards can you use with Samsung Pay?

If your credit card is either an American Express, Mastercard, Visa, or Discover, you can add it to Samsung Pay.

This means you can load all of the best credit cards for travel, as well as most cash back credit cards, and leave them at home. An example of a good mix of cards on your device would be:

- Chase Sapphire Reserve®

- 3 Chase points per dollar on travel (excluding the $300 travel credit) & dining at restaurants, and 1 point per dollar spent on all other purchases worldwide

- 10 points per dollar on all Lyft rides booked with the card (through March 31, 2022)

- Blue Cash Preferred® Card from American Express:

- 6% cash back at U.S. supermarkets (up to $6,000 in purchases per calendar year; then 1%)

- 3% cash back at U.S. gas stations and on transit

- Cash back is received in the form of Reward Dollars that can be redeemed for statement credits.

- Capital One Savor Cash Rewards Credit Card:

- 4% cash back on dining (restaurants; including takeout and delivery)

- 4% cash back on entertainment

- 4% cash back on popular streaming services

- 8% cash back with Vivid Seats until January 2023

- Ink Business Cash® Credit Card

- 5% cash back (5 Chase Ultimate Rewards points per dollar) on the first $25,000 spent in combined purchases at office supply stores and on phone, internet, and cable TV services each account anniversary year

- Chase Freedom Unlimited®

- 1.5% cash back (1.5 Chase points per dollar) on all purchases

The information for the Capital One Savor card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

You can cover literally all purchases while getting a decent return with a card mix like this — with your pockets completely empty!

How to use Samsung Pay

Again, you can use Samsung Pay with almost any credit card reader. Once you’ve got it set up, you can use it from your lock screen by swiping up from the bottom and verifying your identity (fingerprint or PIN). You can also use Samsung Pay to make select in-app purchases and you can link it with Visa Checkout to make online payments to 350,000+ merchants.

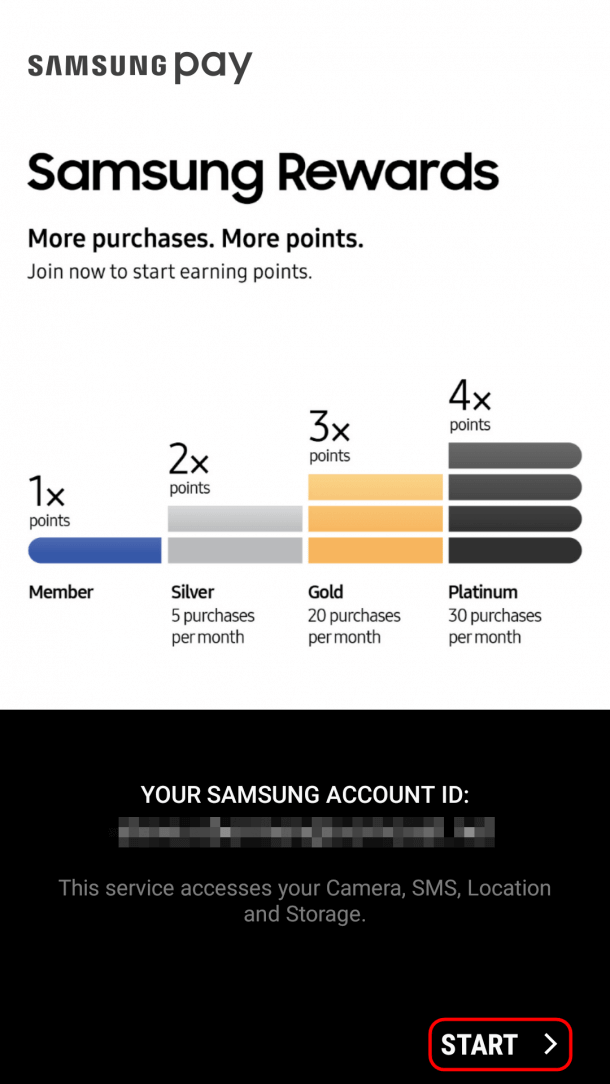

Step 1. Install Samsung Pay

Once you have downloaded Samsung Pay, open the app and click “Start.”

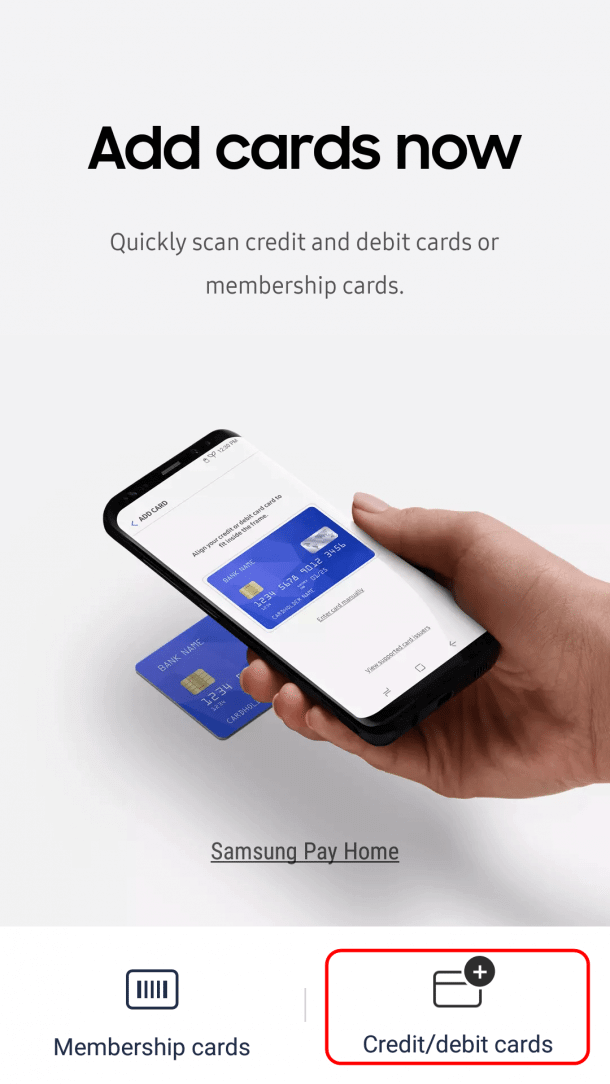

Step 2. Add credit cards

Now click “Credit/debit cards” to begin adding cards to your Samsung Pay account.

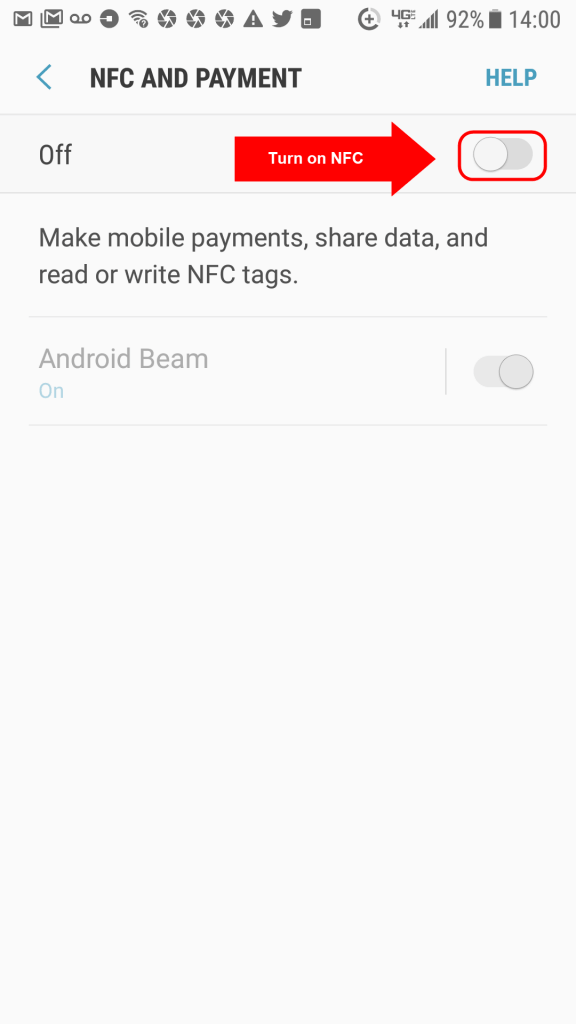

Step 3. Activate NFC

You’ll need to grant Samsung Pay access to certain features of your phone (camera, etc.) and activate NFC for the app to work properly. And if you don’t have a PIN or fingerprint enabled for Samsung Pay, you’ll be prompted to do that as well.

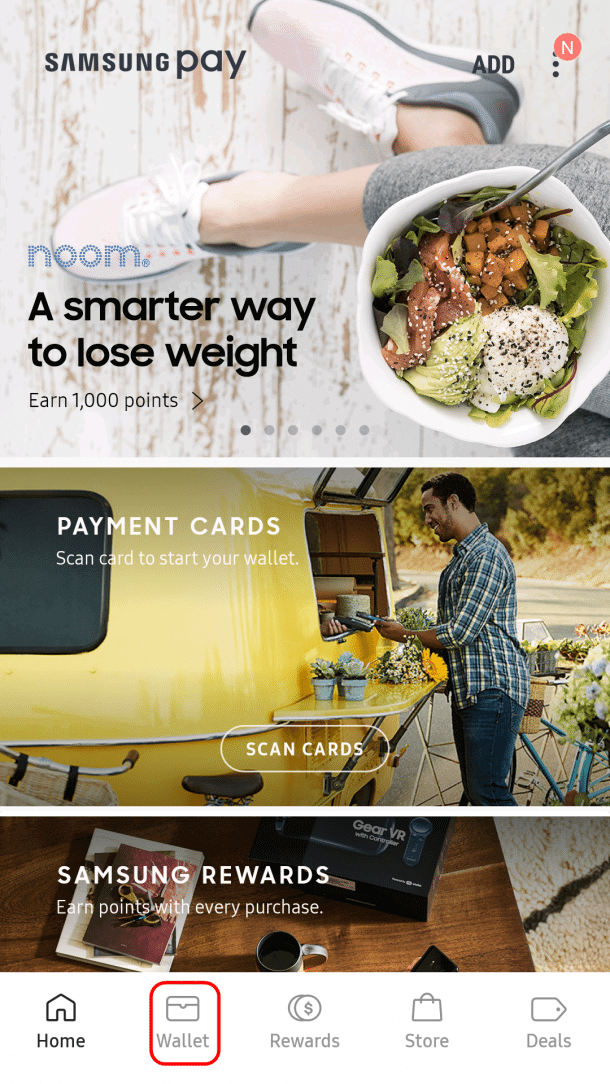

Step 4. Add cards to your Samsung Pay wallet

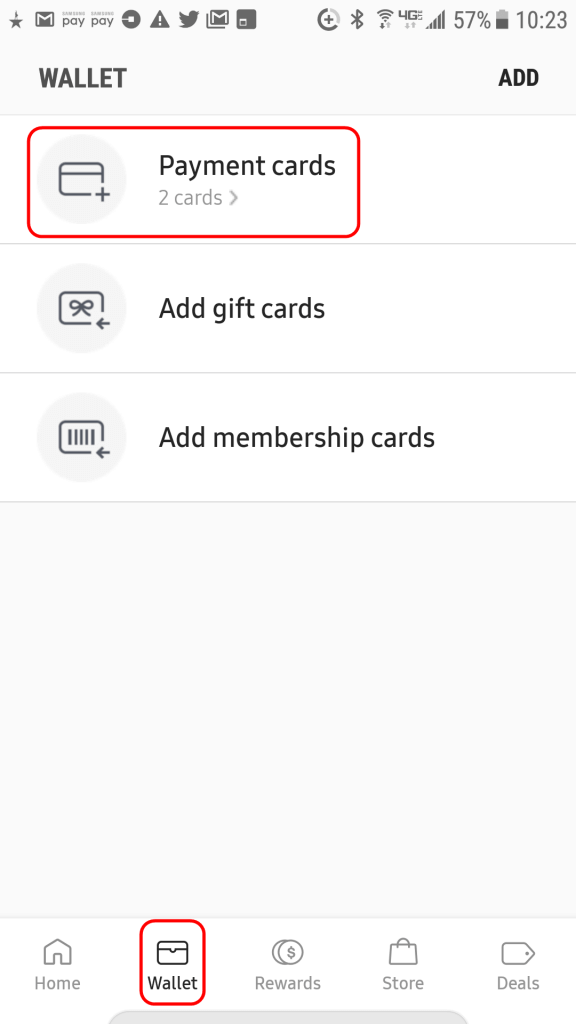

At the bottom of your app screen select “Wallet.”

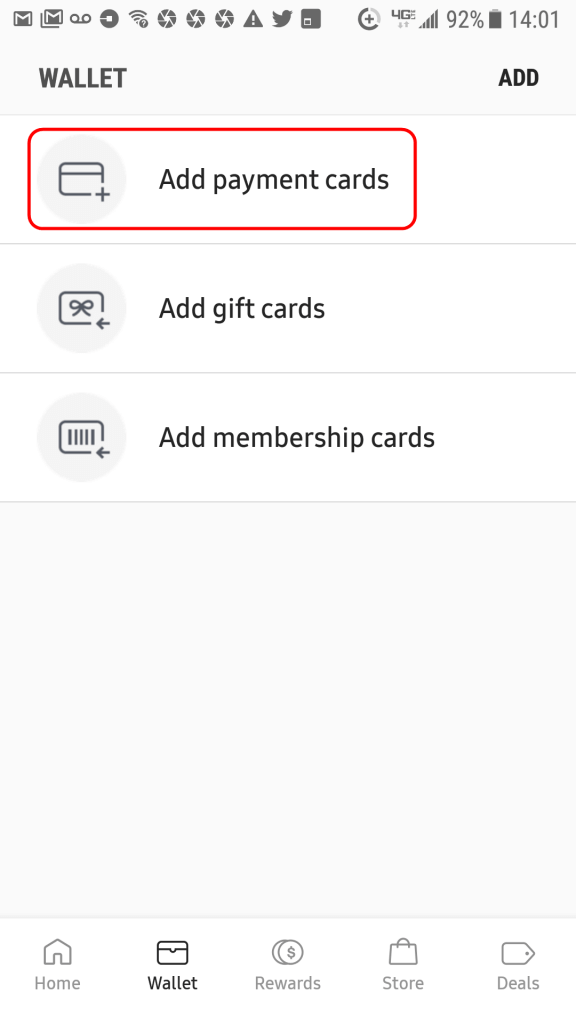

Step 5. Add payment cards

Choose “Add payment cards” to add a card to your Samsung Pay app.

Then you’ll be able to scan your credit card information or enter it manually.

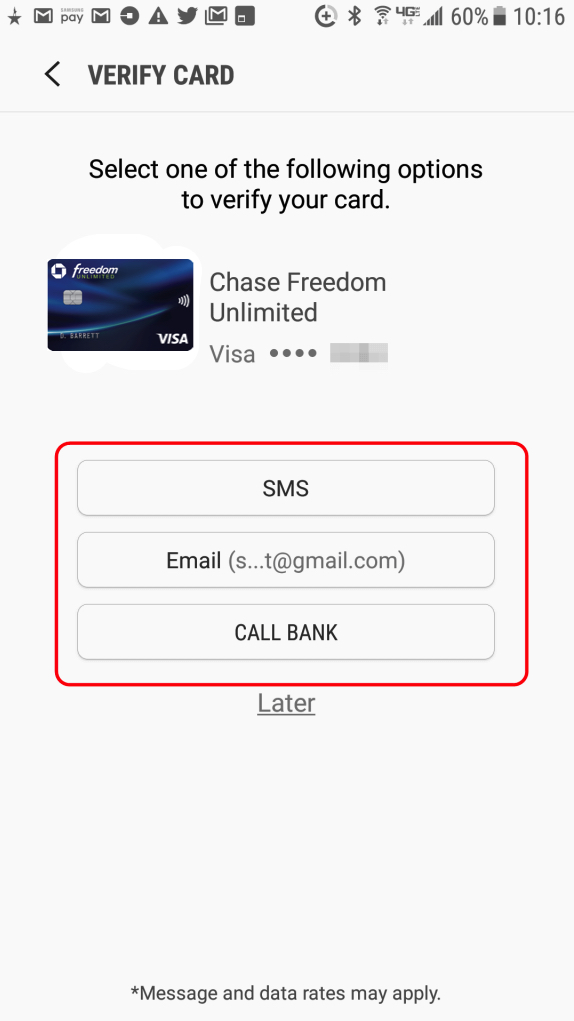

Step 6. Verify the card you added

Once you’ve added your card’s information, you’ll need to verify it by getting a code through either text, email, or by calling the bank.

If you are adding a card you are an authorized user for, the verification number & email will be the primary account holder’s information, not your own. So even though your name is on the card, you’ll have to get the security code from the primary cardholder.

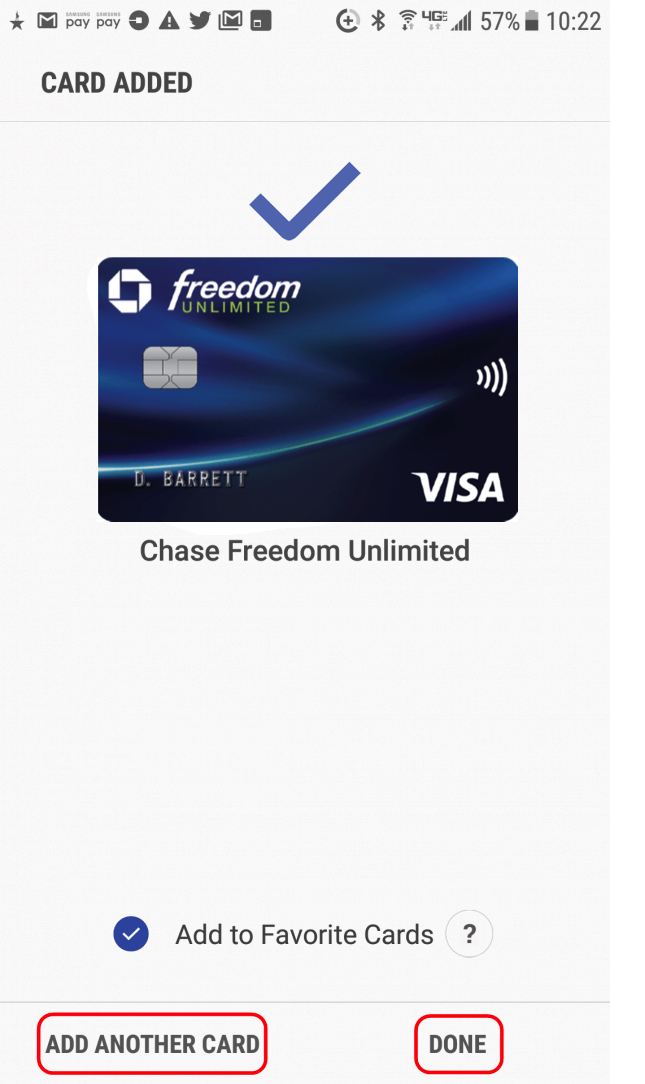

Step 7. Add another card or begin using Samsung Pay

Now you can add another card or start using the app.

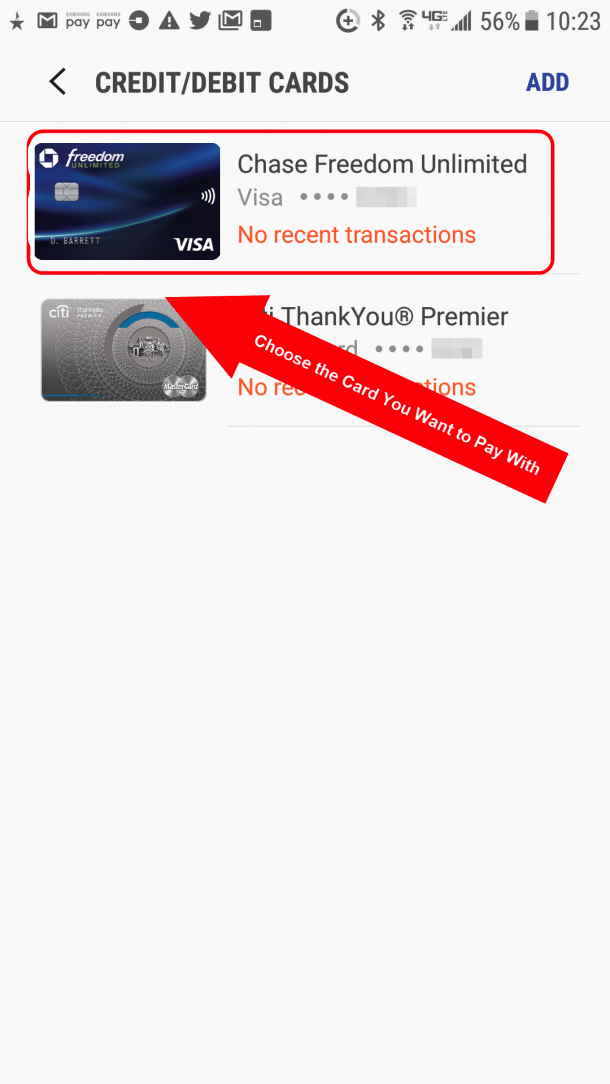

Step 8. Choose the card you want to pay with

To use Samsung Pay, open the app, select “Wallet,” and then click “Payment cards.”

Step 9. Pick a card

Now you’ll see all the cards you’ve added to the app. Choose the one you want to pay with.

Step 10. Enter your PIN or fingerprint

Now you can see the last four digits of your actual card number and you can see the last four digits of the digital card token the app has generated. You’ll see instructions along the bottom to either enter your PIN or hold your finger over the Home key for a fingerprint scan. The security options you have will depend on which ones you set up earlier.

Step 11. The card reader will read the digital card number

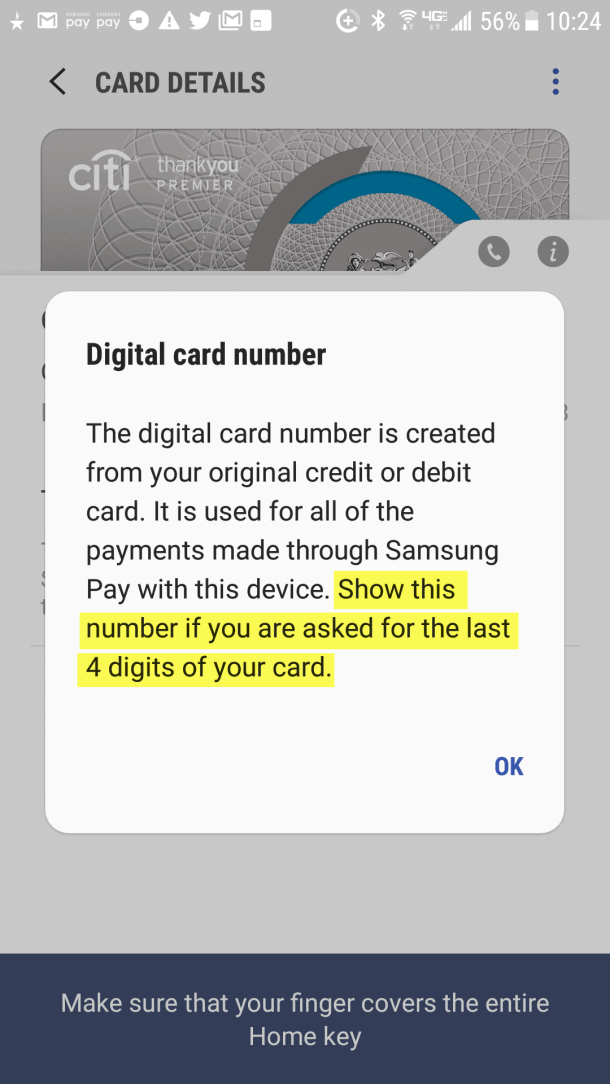

If the cashier asked for the last four digits of your card number, share the digital card number’s last four digits, not your actual card number’s last four digits.

Step 12. Pay for your purchase

Now you can hold your phone close to the card reader to pay for your purchase.

Bottom line

Samsung Pay blows Google Pay and Apple Pay out of the water because of its unique ability to transact with old credit card terminals that aren’t NFC capable. This means you can use it practically anywhere credit cards are accepted.

I will note that there have been some stores that inexplicably will not work with my Samsung Pay. For this reason, I never leave my wallet elsewhere, as I want to keep at least one credit card with me in the event that Samsung Pay doesn’t work. On the whole, the app is fantastic, and a big plus to Samsung smartphones.

Let me know your experience with Samsung Pay! And let me know if you prefer another virtual wallet.

Be sure to subscribe to our newsletter for more recommendations to make your miles and points earning smoother.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!