What’s the Best Way to Purchase United Airlines Airfare?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Million Mile Secrets reader, Timothy, commented:

What’s the best way to get the most bang for my buck paying for United Airlines airfare? Should I use the Chase United Explorer or Chase Sapphire Reserve card? Or should I purchase airfare through the Chase Ultimate Rewards travel portal?

Excellent questions, Timothy!

If you’re purchasing a United Airlines flight, you’ll most likely want to pay with your Chase Sapphire Reserve card.

Because you’ll earn 3X Chase Ultimate Rewards points, which are my favorite flexible points to earn! You’ll also get better travel protection benefits, like baggage and trip delay coverage.

But if you don’t have United Airlines elite status, paying with the Chase United Explorer can save you money if you’re checking a bag!

You can also use points to pay for airfare through the Chase travel portal. But you might be better off saving these points for a more valuable award.

I’ll explain what to consider when picking a credit card to pay for airfare!

Which Card to Use for United Airlines Airfare?

Link: Chase Sapphire Preferred Card

Link: Chase Sapphire Reserve

Link: United MileagePlus Explorer Card

If you’re not using miles or points to book an award flight, you’ll want to pay with a credit card that earns you the most rewards or saves you the most money.

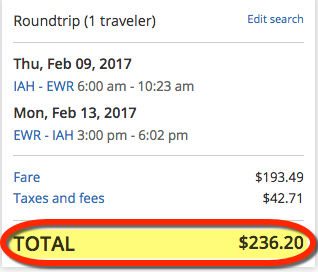

For example, I searched a round-trip United Airlines flight between Houston (IAH) and Newark (EWR), which costs ~$236.

Paying with the Chase Sapphire Preferred or Chase United Explorer gets you 2X bonus points. You’d earn 472 Chase Ultimate Rewards points with the Chase Sapphire Preferred card or 472 United Airlines miles with the Chase United Explorer card.

Folks like Timothy with the Chase Sapphire Reserve get a 3X bonus on travel purchases. So he’d earn 708 Chase Ultimate Rewards points on the same flight purchase.

Paying with the Sapphire Preferred or Sapphire Reserve gives you more flexibility with the rewards you earn. Because you can transfer the Chase Ultimate Rewards points back to United Airlines or other terrific airline and hotel partners like Hyatt or Southwest.

You also get better travel protection benefits with the Sapphire Preferred or Sapphire Reserve. Here’s a post with details about the automatic trip insurance you get with the Sapphire Reserve.

The Chase United Explorer card does have travel benefits, but the coverages are lower than the Sapphire Reserve.

There are some exceptions to using the Chase United Explorer card instead of the Sapphire Preferred or Sapphire Reserve.

1. Free Checked Bag

Without United Airlines elite status, you can get a free checked bag when you pay with your Chase United Explorer card.

This perk is good for you and 1 traveling companion on the same reservation. This can potentially save you $100 on a round-trip flight if you’re traveling with someone else. In this case, paying with the Chase United Explorer card to save money might be worth giving up earning more flexible rewards.

2. Annual Spending Bonus

Purchasing airfare with the Chase United Explorer card might help some folks get closer to the annual spending requirement for bonus miles.

You’ll get an extra 10,000 United Airlines miles when you spend more than $25,000 in a calendar year.

If you’re close to the meeting the requirement, it probably makes sense to put all purchases on the Chase United Explorer card if you want the bonus miles.

3. Priority Boarding

Chase United Explorer cardholders get priority boarding, which usually means getting to board after elite status holders.

This is a perk you won’t get paying with the Sapphire Preferred or Sapphire Reserve, unless you have elite status.

When to Book United Airlines Airfare Through the Chase Travel Portal

Link: Save Points (and Money) Using the Chase Ultimate Rewards Travel Portal

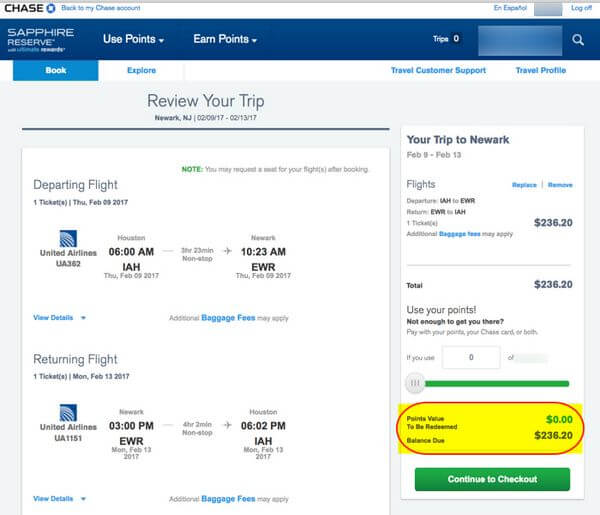

There are no extra bonuses or benefits for booking paid airfare through the Chase travel portal.For example, the sample flight from Houston to Newark costs the same through the Chase travel portal as it did earlier through the United Airlines website.

The benefit in using the Chase travel portal to book airfare is when you’re redeeming Chase Ultimate Rewards points.

Because you get a 50% bonus on your Sapphire Reserve points when booking travel through the travel portal.

For example, the sample round-trip Houston to Newark flight costs 15,746 Chase Ultimate Rewards points. This is good for folks looking to book flights without blackout dates. Because United Airlines would charge 25,000 United Airlines miles for an award seat on this trip!

You’ll usually get the most value by transferring Chase Ultimate Rewards points to travel partners, like Hyatt, Southwest, or United Airlines. But always check to see if you can get a better deal for your points through the Chase travel portal, especially for cheap tickets!

Bottom Line

If you’re purchasing a United Airlines ticket, it usually makes sense to pay with a card like the Chase Sapphire Preferred or Sapphire Reserve. Because you’ll earn flexible bonus Chase Ultimate Rewards points, which you can later transfer to fantastic airline and hotel partners, including United Airlines.

But using the Chase United Explorer card can make sense for folks who want a free checked bag or priority boarding, if they don’t have elite status with United Airlines.

And remember, the travel protection benefits, like trip cancellation and trip insurance, are better with the Sapphire Reserve.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!