Minimum Spending Requirements: Have a Plan Before You Apply!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Team member Jason recently helped family members get their first travel rewards credit cards. And they were nervous about meeting the minimum spending requirements.

I asked him to explain how he helped his family meet the minimum spending and earn big bonuses!

Jason: My aunt and uncle want to take a train trip across America. So I helped them get the right credit cards for their travel goals. Before they applied, we talked to make sure they were comfortable applying for new credit cards. And we figured out what was a good fit for their situation.

We ran into a few hiccups along the way. But now, they almost have their bonuses in hand. And they’ll soon be ready to book their first Big Travel with Small Money!

How to Pick the Right Credit Card for Your Situation

Link: Bank of America Amtrak Guest Rewards® World MasterCard®

Link: Starwood Preferred Guest® Credit Card from American Express

The top priority was to save money on train tickets. So they got an AMEX Starwood card and 2 Bank of America Amtrak cards.

This would give them flexibility, because Starwood points transfer at a 1:1 ratio to Amtrak. And even though they only had one AMEX Starwood card, they both signed-up for a Starwood loyalty account. Now they can transfer Starwood points between their accounts for free. And then convert them into Amtrak points.

This will save them money when they book their tickets. Because Amtrak charges a fee to transfer points between accounts.

Plan to Meet Minimum Spending Requirements

Link: 40 Powerful Ways to Meet Minimum Spending Requirements

Before my family members applied for a single rewards credit card, we made sure they would be able to meet the minimum spending requirements AND pay the balance off. Because this was their first experience with miles and points, I wanted to make sure they were only doing what they were comfortable with.

The minimum spending requirements on the Bank of America Amtrak cards were $1,000 spent on purchases within 90 days of account opening. And the AMEX Starwood card had a minimum spending requirement of $3,000 spent on purchases within the first 3 months of account opening.

They got all the cards at the same time. So they had to be able to spend $5,000 within 3 months. We decided on a couple of options to meet this goal.

1. Pay the Mortgage With Plastiq

Link: Review of Plastiq

For me, the quickest and easiest way to meet minimum spending requirements is using Plastiq to pay bills I couldn’t otherwise pay with a credit card. But Plastiq charges a 2.5% fee to pay most bills. And my aunt & uncle did NOT want to pay the fee.

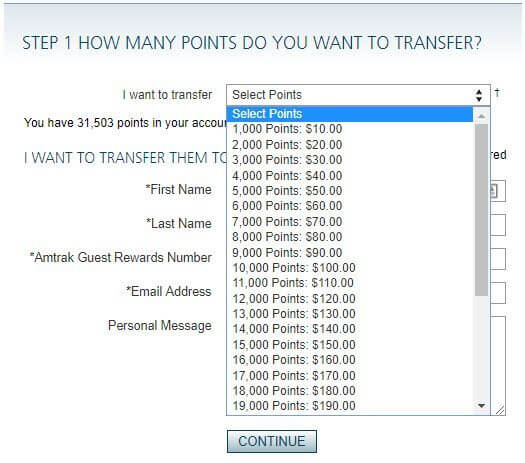

We tried to work around this by using Plastiq’s referral program. When you refer someone to Plastiq they get $500 FFDs (fee-free dollars), and you get $1,000 FFDs after they make payments totaling at least $500. I figured I could refer my uncle, who could then refer my aunt, and they would have $2,000 FFDs ($500 + $1,000 + $500 = $2,000). Which would be just enough to meet the minimum spending requirements on both of their Bank of America Amtrak cards!

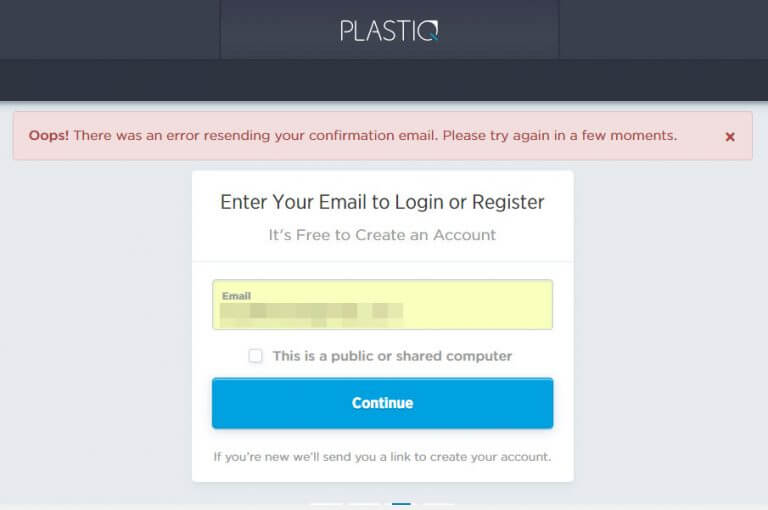

But we had issues signing-up for the accounts with the referral codes. And got the above error message EVERY time we tried to sign-in even though we had already confirmed the email address.

I chatted with Plastiq’s customer service about the issue, and emailed back and forth for a couple of weeks. They said they were having a system issue. Two months later, and it’s still not fixed. 🙁

But it didn’t matter. We had a backup plan in place. I didn’t want to reply only on Plastiq, because the rules can change. And I didn’t want my family to get stuck struggling to meet their minimum spending requirements.

2. The Backup Plan in Action

My aunt and uncle had a large payment on a vacation rental that was coming due. They knew they could make the payment with a credit card and pay no extra fees!

What they didn’t realize was the vendor would allow them to split the payment over 2 different credit cards. So they were able to meet the minimum spending requirements on both of their Bank of America Amtrak cards in one shot!

And with Christmas right around the corner, they were able to put other expenses they were going to pay anyway onto their AMEX Starwood card. Now they’ve meet ALL their minimum spending requirements with a month to spare!

Bottom Line

Team member Jason helped his family members get their first travel rewards credit cards. They worked together to get the right cards for their travel goals.

But first, they made sure they would be able to meet the minimum spending requirements without spending more than they normally would have. They planned on using Plastiq to pay their mortgage with a credit card. But when that didn’t work out, they had a backup plan already in place.

Now they’re waiting for the bonuses to post so they can book their first Big Travel with Small Money!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!