Is It a Good Idea to Use Airline Miles to Buy Merchandise?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers. This page includes information about the Discover it® Cash Back that is not currently available on Million Mile Secrets and may be out of date.Million Mile Secrets reader HP tweeted:

Is it a waste to use miles for merchandise? After having a baby, I don’t have plans to travel, and a new iPad would be nice!

Congrats on your baby, HP!

You will NOT get the best value for your miles by redeeming them for merchandise. But that doesn’t mean you shouldn’t!

Everyone’s situation is unique. You should always use your points & miles in a way that makes sense for your situation. And what makes you happiest!But you should NOT continue to use an airline miles earning credit card if your goal is to use them for merchandise.

I’ll show you better credit card options if you aren’t planning to use your rewards for travel. And also a couple ways to save your miles, in case you think you’ll use them for travel later!

There Is No Wrong Way to Use Your Points!

It’s easy to get caught up in maximizing the value of each point instead of using them in the way that we would enjoy the most!

There is no “right” or “wrong” way to redeem your points & miles. If redeeming them a certain way makes you happy, you are redeeming them correctly!

However, when you redeem your miles for things other than travel, like merchandise or gift cards, you won’t get a great value per point.

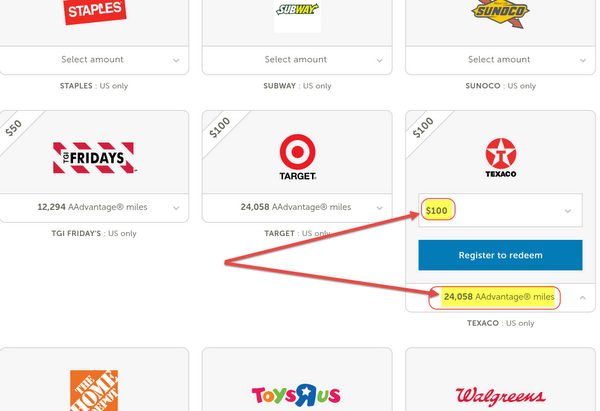

For example, it costs ~24,000 American Airlines miles for a $100 gift card at Texaco.

24,000 miles is nearly enough for 3 full gas tanks when used for a Texaco gift card. But it’s also nearly enough for a round-trip award flight anywhere in the US!

Using your points for a $100 gift card will yield a value of less than half a cent per mile ($100 / 24,058 miles = ~0.42 cents per mile).

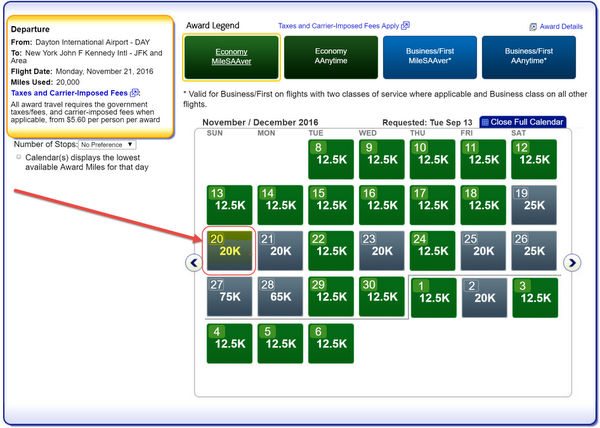

But, a round-trip award flight from Augusta, Maine, to Bellingham, Washington, in September costs $544, or 25,000 miles, yielding a value of ~2.2 cents per mile ( $544 / 25,000 miles = 2.17 cents per mile). More than 5X the value of the gift card!

For many of us, using miles in this way is unthinkable!! But if you find yourself with a lot of miles you can’t use, this is a MUCH better alternative than never using them at all.

Don’t Let Expiration Dates Scare You!

If you are worried about your miles expiring, don’t unload them just yet! There are easy ways to make sure your points & miles don’t expire.

Earn Just a Single Airline Mile!

You do NOT need to fly in order to keep your miles active. Sometimes, all you need to do is earn or redeem 1 mile to reset the mile expiration clock. Buying a pack of gum at the gas station with your miles earning card every several months is enough!

Or, if you don’t have an airline credit card, you can buy an item or make a $1 donation through the airline’s shopping mall.

Transferable Points Don’t Expire

Even if you’re unsure of how you want to use your points & miles, earning transferable points with cards like the Chase Sapphire Preferred® Card or Citi Prestige® Card will give you lots of options later. And they never expire as long as your credit card is open!

Transferable points programs have dozens of travel partners. And you can redeem your points for statement credits and merchandise, too (generally worth between 0.5 and 1 cent per point). You’ll have the flexibility to choose lots of different ways to use your points.Consider a Cash Back Card

For folks who might be transitioning away from travel, cash back credit cards will yield a much better return for everyday spending than a travel rewards credit card.

Chase Freedom

Link: Chase Freedom®

Link: My Review of the Chase Freedom

The Chase Freedom card is a flexible cash back option because it earns Chase Ultimate Rewards points.

If you also have a Chase Sapphire Preferred, Chase Ink Plus, or Chase Ink Bold (no longer available) card, you can transfer points from the Chase Freedom to airline and hotel partners for Big Travel!

With the Chase Freedom, you’ll:

Get a $150 Bonus after spending $500 on purchases in your first 3 months from account opening

Plus another $25 (2,500 Chase Ultimate Rewards points) for adding an authorized user who makes a purchase within the same 3-month period.

And you’ll

Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Enjoy new 5% categories every 3 months like gas stations, restaurants, and wholesale clubs. Unlimited 1% cash back on all other purchases.

Discover it Cash Back

Link: Discover it® Cash Back

The no-annual-fee Discover it Cash Back currently has a $50 bonus after your first purchase within the first 3 months of opening your account. It offers 5% cash back on up to $1,500 in purchases in bonus categories that change each quarter when you sign-up. And 1% cash back on everything else.

And for new cardholders, Discover will match all the cash back you’ve earned at the end of your first year, including the $50 sign-up bonus.Citi Double Cash

Link: Citi® Double Cash Card

Link: My Review of the Citi Double Cash

The Citi Double Cash card earns cash back twice. You earn 1% when you make a purchase and 1% when you pay off your bill. There aren’t any limits on rewards or category restrictions, so it is a good card to use for almost any purchase.

This card does NOT have a sign-up bonus, but there’s no annual fee. So it’s a great card to keep forever and help boost your credit score.

Bottom Line

Use your miles & points in a way that gives you the most satisfaction, even if it isn’t the best value mathematically!

However, using your miles to buy merchandise will not yield you nearly the same value as using them for travel. If you think there is a chance in the future that you will use your miles for travel, it’s a good idea to try and keep them for that purpose.

You can keep your points alive by redeeming or earning a single mile from your account at least every 18 months. And if you are collecting flexible points earned by cards like the Chase Sapphire Preferred, your points won’t expire as long as your card is open!

And if you think your lifestyle is shifting away from travel, you are better served with a cash back card like the Chase Freedom.

Have you ever redeemed your miles for something NOT travel related?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!