“I Can’t Break the Cycle of Debt!” And How a Balance Transfer Helped Harlan’s Friend (Finally!) Get Ahead

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers. Do you know someone who’s carrying a balance on a credit card and feels stuck with it? Maybe that someone is you? Team member Harlan told me about his conversation with a friend in this situation. I asked him to tell you about it! Harlan: My friend John told me how he was carrying a $3,000+ balance on a credit card with a $5,000 credit limit – and a 22% interest rate! After I composed myself, I wondered how I could show him a way out of this situation.

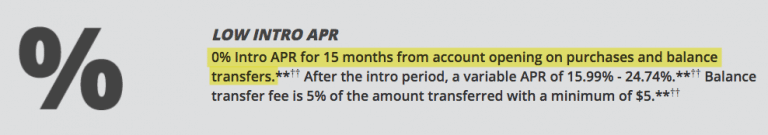

I suggested the Chase Freedom card. There was a balance transfer fee of 5% (~$150 for a ~$3,000 balance) . But also a sign-up bonus worth $150 after meeting the minimum spending requirements and an introductory 0% APR for 15 months (after that 16.24%-24.99% variable applies). The interest savings alone was worth getting the card. And after he pays the balance, he’ll have a great rewards card to use – responsibly!

A Balance Transfer Card to Get Ahead?

John explained he felt stuck.I feel like I’m making big payments every month. But it’s all going to interest. It’s like I can’t break the cycle!

I know that feeling, too. Before I learned to use my credit cards responsibly, I also carried balances and paid interest.

John’s concerns were two-fold. He wanted a card with a balance transfer option. And he wanted to jump into the world of miles & points. I thought of setting him up with 2 new cards – the first for a balance transfer and another for rewards points.

John did NOT like that idea. He didn’t want to go from having 1 credit card to 3. I reassessed and looked at his balance transfer options for a card that might accomplish both tasks.

Why We Chose Chase Freedom

Link: Chase Freedom

There are plenty of cards out there if you want to make a balance transfer. Many of them have fees – usually 3% to 5% of the balance you want to transfer. The Chase Freedom card has a 5% fee when you transfer a balance (as of the time of writing this post).

But you also earn 15,000 Chase Ultimate Rewards points when you spend $500 on purchases in your first 3 months from account opening. That’s worth $150 as a statement credit! John’s transfer fee was ~$150. So between the bonus and the fee, he wouldn’t have to pay much to transfer his balance.

More importantly, the introductory 0% APR period is currently 15 months on balance transfers. John opened the card in November 2017. That gives him the rest of 2017 and ALL of 2018 to pay off his balance. And his entire payment will go toward paying off the balance instead of interest!

When he’s done paying the balance, he’ll be left with a strong rewards-earning card with rotating quarterly 5% cash back categories for things like groceries, gas, and restaurants. And he can watch his points balance grow until he’s ready to add another card to his wallet.

This card seemed like the best win-win for John’s situation. It might work for you. Or maybe another card would work better. John was relieved that 100% of his payments would go toward paying off the balance instead of accrued interest. And now, he can get ahead instead of feeling stuck.An Important Word of Warning

John applied and was instantly approved for the card. But instead of excited, he groaned. “Another big interest rate!” he said. I thought, “Uh oh.”

On the screen, in big black letters, I saw John’s interest rate was, again, 22% after the 0% introductory period.

“That doesn’t matter,” I told him. “You’ll never pay a dime of interest again. Because you’ll never carry a balance again. Right?”

Otherwise, you’ll find yourself in the same situation all over again. And any rewards you will be negated by huge interest fees. Because John knew how bad it felt to feel stuck with a big credit card balance, he committed to never letting it happen again. And if you go this route, so should you. Otherwise, you’ll be right back where you started!

Bottom Line

Team member Harlan helped his friend overcome the sinking feeling of being stuck with a big credit card balance, with monthly payments going mostly to interest.

The solution was a card with a 0% APR introductory offer. But it comes with a huge caveat. To get ahead of your financial situation, you must commit to never carrying a balance again. And always, always pay your credit card balances in full every month. Then you can focus on earning rewards for Big Travel with Small Money! 🙂

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!