How to Get the Most Travel From the Chase IHG Rewards Club Card

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: This offer is no longer available. Check our Hot Deals for the latest offers.Million Mile Secrets reader Gracia writes:

I am new to this hobby and I just got approved for the Chase IHG Reward Club credit card. Are there any great tips for using this card?Do IHG points transfer from 1 credit card to another? Like the Chase Sapphire Preferred or US Airways Premier World MasterCard?

The 70,000 point bonus on the Chase IHG card is a great deal, Gracia!

Let’s see how Gracia can make the most of this card!

Big Travel With the Chase IHG Card

Link: Chase IHG Rewards Club Card 70,000 Point Offer

Until May 31, 2015, the sign-up bonus on the Chase IHG Rewards Club card has been increased to 70,000 IHG points after you spend $1,000 on purchases in the 1st 3 months of opening your account.

Normally, the sign-up bonus is 60,000 points, so this is a better deal!

This card also gets you:

- Free Platinum elite status (free upgrades, priority check-in, and elite rollover nights)

- A free night at any IHG hotel worldwide on each card anniversary

- 5 IHG points for every $1 you spend at IHG hotels

- 2 IHG points per $1 you spend at restaurants, grocery stores, and gas stations

- 1 IHG point per $1 you spend on everything else

- 10% rebate on redeemed points (up to 100,000 IHG points a year)

- NO foreign transaction fees

- Annual fee of $49, waived for the 1st year

The free night on each card anniversary more than makes up for the annual fee! And it can be used at IHG’s top resorts, like the Intercontinental Bora Bora Resort Thalasso Spa. Paid nights at this resort can cost over $700!

3 Tips for Using Your IHG Card & IHG Points

1. Use Your Free Night for an Otherwise Expensive Stay

The free anniversary night from the Chase IHG Rewards Club card can be used at any IHG hotel, including their top category hotels and resorts!

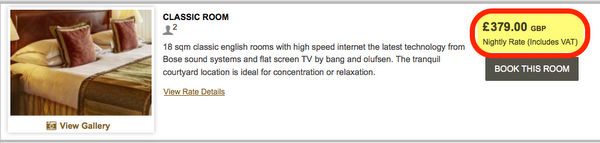

So it makes the most sense to use your free night at a hotel which would otherwise be very expensive or cost a lot of points.For example, the Intercontinental London Park Lane normally costs 50,000 IHG points per night (their highest tier).

A paid night in July costs 379 British pounds, or ~$566!

2. Use Points for Cheap PointBreaks Rooms

IHG award nights normally cost 10,000 to 50,000 points per night. But there are heavily-discounted award rooms through the IHG PointBreaks promotion.

With PointBreaks, you can book certain hotels for only 5,000 points per night. Participating hotels are listed on the IHG website, and change every few months.

This is a great way to get the most nights from your points. And if you use the IHG Points + Cash trick to buy points for 0.7 cents each, it’s like getting the hotel for $35 per night!

3. Stretch Your Points Further With Points & Cash

IHG Rewards Club also has a Points & Cash option for award stays. This allows folks to use fewer points for award nights by combining points with cash.

You can reduce the number of points required for an award night by:

- 5,000 points for $40

- 10,000 points for $70

For example, the Hotel Indigo – New York City Chelsea normally costs 45,000 points per night. But using Points & Cash, you could choose to pay:

- 40,000 points plus $40, or

- 35,000 points plus $70

This can help get Gracia a longer stay (or a room at a nicer hotel) for a relatively small amount of cash. That’s Big Travel with Small Money!

Transferring IHG Points

In addition to earning points from the Chase IHG Rewards Club card and staying at IHG hotels, Gracia can also earn IHG points in another way. IHG is a Chase Ultimate Rewards transfer partner, so Gracia can transfer Chase points to IHG at a 1:1 ratio.

So 1,000 Chase Ultimate Rewards points can become 1,000 IHG points.

Note: You’re allowed to transfer Chase Ultimate Rewards points to partner airlines and hotels (such as IHG) when you have the Chase Sapphire Preferred, Chase Ink Plus, or the no-longer-offered Chase Ink Bold card.

That said, you’ll usually get a better value from transferring Chase Ultimate Rewards points to other partners, like Hyatt or United Airlines. But do what helps you get the travel you want!

Remember, you can also buy IHG points for 0.7 cents per point using the Points & Cash trick. But not everyone is comfortable doing that.

IHG points can also be transferred TO airlines. However, these ratios are generally not favorable and it’s NOT the best use of your IHG points.

For example, if you transfer 10,000 IHG points to United Airlines, you’ll only get 2,000 United Airlines miles! So while you can transfer IHG Rewards Club points to airlines, you will NOT get a very good value for your points.

Bottom Line

With the Chase IHG Rewards Club card, you’ll earn 70,000 IHG points after completing minimum spending requirements. The $49 annual fee is waived for the 1st year.

Plus, you’ll get a free night at ANY IHG hotel on your card anniversary each year. Even at the most expensive hotels!You can get more award nights through the IHG PointBreaks program of discounted hotels. You can also booking rooms with Points & Cash. Or you can transfer Chase Ultimate Rewards points to IHG.

You can also transfer IHG points to partner airlines, but that’s NOT a good deal because the transfer ratios are not good.

Enjoy your travels, Gracia! Thanks for the question!Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!