Did you mess up? Here’s a tip to quickly remove this painful card fee

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

I always recommend paying your credit card balance in full each month. Because the benefits of the miles & points you earn are offset by interest and late charges. But sometimes things happen and you lose track of a due date. And making a late payment means you might also have to pay a fee.

If it’s not a habit and you’re only late one or two days, it may be possible to get the fee waived. Several Million Mile Secrets team members have had this experience, so we’ll explain how to get a credit card late fee refunded. And include a few helpful tips to avoid late fees.

Get credit card late fees refuded

You can earn lots of valuable airline miles and hotel points by signing-up for the top credit cards for travel and using them responsibly. And you can redeem the miles and points for unforgettable trips, like a getaway to Europe or an around-the-world honeymoon. But in this hobby, it’s important to avoid fees and interest to make the most of the rewards you earn.

However, unexpected things can come up that cause a missed payment, like if you misplace a bill or are feeling under the weather. Thankfully, it’s often possible to get a late fee waived.

For example, I accidentally missed a due date by two days on my Alaska Airlines Visa® Business credit card so I quickly called customer service. After explaining that I thought I’d already set up auto-pay on this new account (but clearly hadn’t!) and that I’d pay off the balance immediately, the agent was kind enough to waive the fee. And indicated that I should see the statement credit to my account within the next billing period.

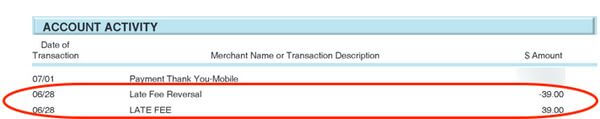

Team member Keith had a similar experience with a Chase card. Instead of calling customer service, he sent a secure message. The bank responded the same day and reversed the $39 late fee.

I can’t promise the bank will refund you a late fee. But if it’s your first time and you have a history of being a good customer, it’s likely the bank will extend a one-time courtesy.

It’s also worth noting that depending on the terms of your card, you might also pay interest charges for carrying a balance past the due date. These are typically not waived by the bank. But it never hurts to ask!

3 ways to avoid late fees

Use automatic payments

Set up auto-pay to avoid credit card late fees. It’s available with most banks and adds convenience to the bill pay process. And you can establish rules for your payment like the amount to pay and the date you want the payment to go through.

But if you change bank accounts, be sure to update your auto-pay settings. Because it’s easy to forget about a bill if it’s been automatically paid for awhile. And it’s also important to keep a balance in your checking account so your payments will clear.

Use a personal finance management app

I know lots of folks who use apps like Mint, which let you link all of your credit card and bank accounts. And you’ll receive notifications about upcoming due dates.

Team member Harlan likes using Mint to monitor bill due dates. And he uses it to track minimum spending for new credit cards.

Sign up to receive alerts

If you prefer to pay your bills manually instead of auto-pay, you can set up account alerts to avoid missing a due date. For example, team member Joe has text and email alerts for his Amex accounts. This way he gets notifications five days before a bill due date.

Bottom line

Earning miles & points through big welcome offers on the top rewards credit cards is a fantastic way to earn free travel. But it’s important to avoid fees and interest, which negate the value of your rewards.

If you accidentally miss a credit card payment, call or write to the bank to request they waive the late fee. They’ll typically reverse a fee if you’re only one or two days late and it’s your first missed payment.

To avoid late payments, we recommend using automatic payments or establishing account alerts. Or try taking advantage of personal finance tracking apps like Mint.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!