How to Freeze Spending on Your Card & Control Authorized User Spending

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Million Mile Secrets reader, swag, asked:

What other cards offer the “Freeze it” option?

swag is referring to a tool for Discover cards that allows you to suspend account activity on your cards, including authorized user cards, without closing your account completely.

And swag wants to know if other cards have a similar option.

I’ve looked into it. And I found out the bank with the best spending controls is actually AMEX! I’ll explain!

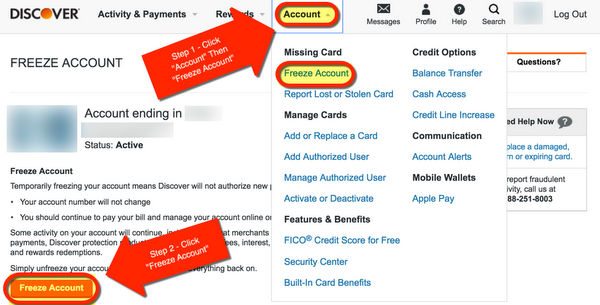

What Is Discover Freeze it?

Link: Freeze it for Discover Cards

Link: Discover it® Cash Back

Link: Discover it® Miles

I wrote about Discover’s short-term plans for its rewards cards. They’ll keep a unique perk called Freeze it, which lets you “freeze” your account if you temporarily misplace your card, and don’t want to change your account number.

You can use Freeze it with your Discover it Cash Back or Discover it Miles card.

The information for the Discover cards has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer

After you log-in, click “Account.” Under the drop-down menu choose “Freeze Account.” Then click the “Freeze Account” button. That’s it! You can unfreeze your card just as easily.

Freeze it is handy when you:

- Don’t want new purchases authorized

- Want to protect your credit line from authorized users

- Misplaced your card and don’t want it to get into the wrong hands

- Want to prevent cash advances for a short amount of time

When you use Freeze it, your card number will NOT change once you unfreeze. And ALL accounts linked to your Discover account will be frozen, including yours and authorized users.

This is an added safeguard that can give you peace of mind. And protect you from potential credit card fraud. Keep in mind you are NOT liable for fraudulent charges made on your Discover account.

But if you think there’s a chance of fraud, using Freeze it is much easier than disputing a charge and having to close your account.

Note that Discover still allows some transactions to post. Discover says:

Some activity will continue, including bills that merchants mark as recurring, as well as returns, credits, dispute adjustments, payments, Discover protection product fees, other account fees, interest, rewards redemptions and certain other exempted transactions.

So the major benefit to using Freeze is to prevent new transactions.

But the downside is that all cards linked to your Discover account will be frozen, including yours.

Do Other Banks Offer This?

Back to swag’s question!

I called the major banks to ask if they offer a version of Freeze it, including:

- AMEX

- Bank of America

- Barclaycard

- Chase

- Citi

- US Bank

Here’s what I found from speaking with each bank’s representative.

AMEX Gives You the Most Control

If you want to prevent spending on an authorized user’s account without affecting your own credit line, AMEX is your best option.

You can set controls directly on the AMEX website.

Option 1 – Set Limits to $0

For personal cards, simply set the spending limit on an authorized user’s card to $0. That way, no new charges will be approved. You can find this option after you log into your AMEX account under the “Account Services” tab.

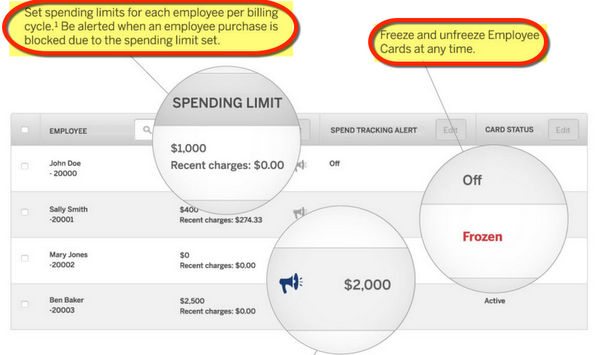

Option 2 – Freeze Employee Cards

AMEX small business cards have this same ability under the “Employee Controls” tab. You can set the spending limit per billing cycle.

If you want to pause purchases for a longer time, you’ll also find an option to “freeze” employee accounts in the same place. This works very much like Discover’s Freeze it, except it’s only available for AMEX small business cards.

Between these 2 options, you’ll have lots of control over an authorized user or employee’s spending limits. And, neither option affects your spending line!

For these reasons, I think AMEX actually has better “freezing” capability than Discover!

Bank of America and Chase Small Business Cards Let You Set Limits, Too

Link: How You Might Qualify for a Small Business Credit Card

When I spoke with representatives from Bank of America and Chase, they told me there was no way to set spending limits on individual authorized user cards. Because the authorized users share your credit line, so they have access to the same amount of credit that you do.

However, they give you much more control over cards attached to a small business card account.

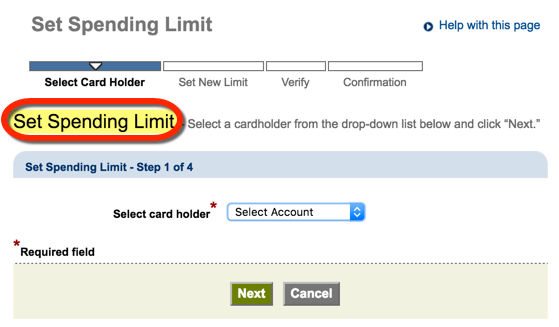

Chase lets you set the limit on their website. After you log-in, select “Account Details,” then “Set Spending Limit.” You can set the limit to $0. Or to a very small number, like $20. Any transaction over the amount you set will be declined.

Bank of America gives you the same ability with small business cards, but you must call the number on the back of your card to set the spending limit.

This is a nice perk of having a small business card with Bank of America or Chase, like the Bank of America Alaska Airlines small business card or Chase Ink Plus.

Here’s how you might qualify for these cards with activities you already do!

It’s Not Possible With Barclaycard, Citi, or US Bank

If you have authorized users on your accounts with Barclaycard, Citi, or US Bank, you don’t have many options to pause transactions on their accounts.

The only way to prevent transactions is to report the accounts to the fraud department. But when you do that, the card will be closed and you’ll have to wait to receive a new one.

And because authorized users at these banks share your credit limit, if you set the limit to $0, you’ll also stop any spending on your own account.

Bottom Line

Discover cards come with Freeze it, which lets you pause new account activity for as long as you want. But keep in mind, when you use this tool, it affects all accounts linked to your card, including your own.

The only other bank that offers a similar option on all its cards is American Express You can set the spending limit on AMEX personal cards to $0, which means any new transactions will be declined.

And you can freeze AMEX small business cards, similar to Discover’s Freeze it feature. Even better, you can adjust individual card limits, which makes AMEX the best bank for controlling authorized user accounts.

Bank of America and Chase let you set the spending limit on employee cards if you have a small business credit card. But they don’t have any similar options for personal cards.

And other banks don’t have the ability to control a user’s spending limit without closing the card completely.

swag, thanks for sparking the conversation with your comment! 🙂

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!