How Can I Use Chase Ultimate Rewards Points to Earn the Southwest Companion Pass?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers. Update: After March 31, 2017, transferring hotel points to Southwest no longer counts towards the Companion Pass. But here’s how to earn Companion Pass points when booking paid nights at hotels.Million Mile Secrets reader, John, emailed:

I’d like to earn the Southwest Companion pass in early 2017 so it will be valid for ~2 years. I currently have 200,000 Chase Ultimate Rewards points. Can I transfer the points to Starwood, then to Marriott so I can take advantage of the Hotel + Travel Package?

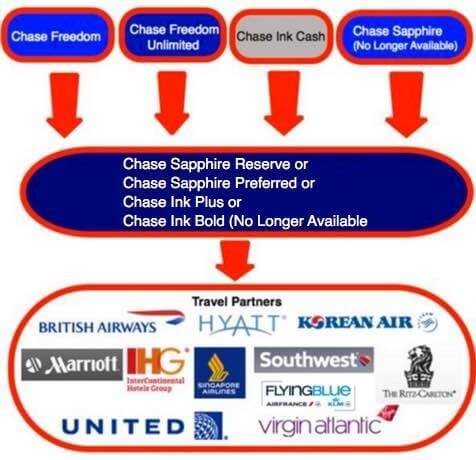

John knows Chase Ultimate Rewards points, when transferred straight to Southwest, do NOT count towards the Southwest Companion Pass. But transferring hotel points to Southwest do count.

While you cannot transfer your Chase Ultimate Rewards points to Starwood, you can transfer them directly to other hotels, like Hyatt, IHG, and Marriott.

I’ll show you which hotel points you can transfer to Southwest. And if it’s a good idea!

Which Hotel Points Transfer to Southwest?

Link: Southwest Companion Pass

Link: Which Hotel Points Transfer to Which Airlines?

The Southwest Companion Pass is THE best deal in travel in my opinion. That’s because a companion can fly with you for only the cost of taxes and fees whenever you travel on Southwest. So lots of folks want to know how to earn it!As a general rule, it is not a good idea to convert hotel points to airline miles. That’s because the transfer ratios are usually extremely unfavorable. And hotel points are much more valuable for hotel stays.

But if you’re really close to an award flight, or an amazing perk like the Southwest Companion Pass, the transfer rate could make sense for you. Here are the hotel points that transfer to Southwest:

| Transfer Ratio | Minimum Points Transfer | Number of Points Needed for Companion Pass | |

|---|---|---|---|

| Best Western Rewards | 25:6 | 5,000 | 458,334 (You must transfer in increments of 5,000) |

| Choice Privileges | 10:3 | 6,000 | 366,667 (You must transfer in increments of 6,000) |

| Club Carlson | 10:1 | 2,000 | 1,100,000 (You must transfer in increments of 2,000) |

| Hyatt Gold Passport | 25:12 | 5,000 | 197,917 (Because you will receive 5,000 bonus miles when you convert 50,000 points). Otherwise, 229,167 (You must transfer in increments of 1,250) |

| La Quinta Returns | 10:1 | 6,000 | 1,100,000 (You must transfer in increments of 6,000) |

| Marriott Rewards | Between 5:1 and 14:5 (depending on amount transferred) | 10,000 | ~308,000 (270,000 by utilizing Flight + Hotel Package) (You must transfer in increments of 10,000) |

| Wyndham Rewards | 5:1 | 6,000 | 550,000 (You must transfer in increments of 6,000) |

As you can see from the list, Hyatt is by far the best deal.

But you’ll still spend at least 1.8 Hyatt points per Southwest point (198,750 Hyatt points (you must transfer in increments of 1,250) / 110,000 Southwest points = 1.8 Hyatt points per Southwest point). That’s not a great use of Hyatt points, because Hyatt points can be worth more than Southwest points!

Because you can transfer Chase Ultimate Rewards points to Hyatt at a ratio of 1:1, it’s like spending 1.8 Chase Ultimate Rewards points per (Companion Pass eligible) Southwest point. Chase Ultimate Rewards points are very valuable, because they have incredible transfer partners. So you’ll have to decide if the Companion Pass is worth it to you.

Note: You can transfer Chase Ultimate Rewards points directly to Southwest at a ratio of 1:1, but those points will NOT qualify for the Companion Pass!The Marriott Hotel + Air Package Could Be a Better Deal

- Link: How to Book a Marriott Hotel + Air Package

- Link: Marriott Hotel + Air Packages (Log-In Required)

Unlike Hyatt points, Marriott points tend to be worth much less than Southwest points.

You’ll need at least 270,000 Marriott points to cash-in on a Hotel + Air Package. That may sound like a lot, but it can be an amazing deal for you.

When you convert 270,000 Marriott points to Southwest points through a Hotel + Air Package, you’ll get 120,000 Southwest points. That means for every 2.25 Marriott points, you’re getting 1 (Companion Pass eligible) Southwest point (270,000 Marriott points / 120,000 Southwest points = 2.25).

But you’ll also get a 7-night stay at any Marriott Category 1 through 5 hotel! This hotel stay could cost 150,000 Marriott points if you stay in a Category 5 hotel.

If you and your Southwest-travel-companion-to-be don’t have the Chase Marriott Rewards Premier Credit Card yet, sign-up before you transfer all your Chase Ultimate Rewards points to Marriott!

Right now, the Chase Marriott card comes with:

- 80,000 Marriott points after spending $3,000 on purchases in the first 3 months of account opening

- 7,500 Marriott points when you add an authorized user who makes a purchase in the first 3 months of account opening

- $85 annual fee (not waived the first year)

If both of you apply and add an authorized user, you can combine your points, and have 175,000 Marriott points. That’s just 95,000 points shy of the 270,000 you’ll need to earn the Southwest Companion Pass!

Applying for Marriott cards first help you save your valuable Chase Ultimate Rewards points for other great travel redemptions.

Bottom Line

If you want to earn the Southwest Companion Pass with Chase Ultimate Rewards points, your best options are:

- Transferring 198,750 points to Hyatt

- Transferring 270,000 points to Marriott and cashing-in on a Hotel + Air Package

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!