Here’s a Powerful Way to Jump Start Your Retirement Savings!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Want extra time to let your retirement savings grow? How about an extra year? Take advantage of compound interest by maxing out your IRA as early in the year as possible!

Because the new year is a few weeks away, I asked team member Harlan to share his views on earning more retirement savings!

Harlan: Albert Einstein said “compound interest is the greatest mathematical discovery of all time.” Who am I to argue with Einstein? With retirement savings, an extra year of compound interest can add up to staggering amounts over time!

Max out Your IRA as Early in the Year as Possible

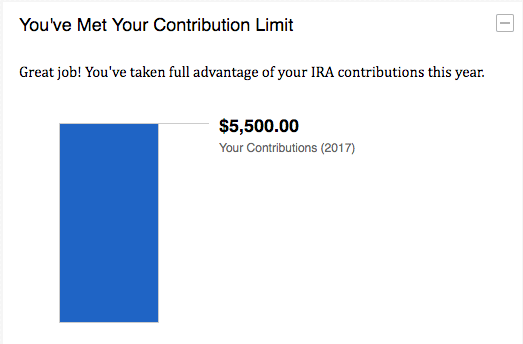

In 2018, you can contribute $5,500 to an IRA (Individual Retirement Account). This account is completely separate from an employer-sponsored account, like a 401k. So you set it up on your own. And you’re allowed to add money at any point during the year.

But thanks to the power of compound interest, you’ll earn the most money over time if you max out your IRA early in the year. For example, if you add the full amount in January 2018, your money will begin compounding right away. And will have the whole rest of the year to grow!

If you add money throughout the year, or at the end of the year, you can still max it out. But your money won’t have as long to compound before the next year.

Over time, the benefit of nearly an entire extra year can add up to thousands over your lifetime. I max out my IRA on January 1st every year. And kick off the new year by earning more amazing compound interest!

Of course, it’s still a good idea to contribute to your IRA even if you can’t max it out early in the year. In fact, the more you can save, the better – no matter when you begin!

Strategies to Add Money to Your IRA

Here are some ideas to make the most of that valuable extra time in your IRA.

1. Savings Account Transfer

If you have money in a savings account, consider moving the cash to IRA funds. And spend the rest of the year replenishing your savings account.

That way, your money grows for almost a full extra year. And you can focus on rebuilding your savings while that happens.

2. Make Contributions From Your Paycheck

Most employers will let you split your paycheck into multiple bank accounts. Send a portion of your check to your IRA (10% is a great place to start!). And when you hit the $5,500 limit, you can focus on saving funds for next year! 😉

The good thing about this method is the money will go directly to your IRA before you ever see it. Paying yourself first is the best way to save money!

3. Borrow From a Family Member

You could ask someone in your family for the cash to max out your IRA. And then pay them back later!

Borrowing money is always a risk. So only ask if you know you’ll pay it back, because no one wants to be stiffed out of cash!

That said, if a family member can help you get a jump start on your savings, it might be worth it to pocket the extra interest.

4. Use Your Cash Back Credit Card Rewards!

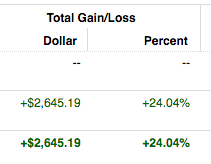

This may be controversial, but hear me out. So far, my IRA contributions have gained ~24% in value! I don’t know of any credit card rewards that offer a 24% return – or even close to that!

So if you have a card that earns cash back, consider transferring it to your IRA.

Of course, your returns aren’t guaranteed. But over time (and with compound interest), your cash back rewards will be worth much more than if you redeemed them for the industry standard of 1 cent per point!

If you earn a lot of credit card rewards, they can really boost the value of your IRA!

Traditional or Roth?

This is the eternal dilemma with IRA accounts.

The most important difference is you can deduct your Traditional IRA contributions each tax year, but NOT your Roth IRA contributions. There are other differences between the 2 types of accounts too, so look to see which option makes sense for you.

You can always switch your account later if you decide. The most important step is to get started as soon as possible!Bottom Line

Team member Harlan makes the most of his IRA contributions each year by maxing out them out as early in the year as possible.

In doing so, he gets nearly a full extra year to take advantage of compound interest. That can add up to LOTS of extra earnings over the years. And you can do it, too!

You can get the funds from:

- Your savings account

- Paycheck contributions

- Borrowing from a family member

- Cash back rewards from credit cards

Whether you choose a traditional or Roth IRA is up to you. But whatever you do, get started as soon as possible!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!