Guide to Google Pay — a great organizer for miles and points hobbyists

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Google Pay is a mobile wallet option for your smart device that allows you to load payment methods (credit cards, debit cards, gift cards, bank accounts) for quick and easy payments online, in stores, even peer to peer. It’s a fantastic way for miles and points enthusiasts to cut down on pocket bulk and maximize earning rates from rewards credit cards.

Google Pay is for you if you’re the kind of person who has a bunch of credit cards that you strategically use for:

- Grocery shopping

- Gas

- Restaurants

- Entertainment

- Office supply stores

- General non-bonus spending

On top of all these, you’re probably carrying around a new travel credit card and trying to earn its monster welcome bonus. Throw in a Global Entry ID card, and you’re power cleaning your wallet at checkout. Google Pay will store all your credit cards, so all you need to do is select the card you’d like to use and tap it on the credit card terminal.

What is Google Pay?

Google pay is a must-have organization tool in miles and points. It shows all credit cards with recent activity; it automatically populates a list of all travel loyalty accounts, including your loyalty numbers and points balances (according to your email account); you can even link all the loyalty cards you use often, which can dramatically cut down on your keychain bulk (think Kroger Plus, Subway, Planet Fitness, AutoZone, Sam’s Club, etc.).

Here’s everything you need to know about Google Pay!

Which credit cards can you use with Google Pay?

Just about every credit card issuer and major bank supports Google Pay. If you’re loading travel credit cards onto the app, there are very few that won’t work.

Note that some Citi cards may not work (mostly store cards like the Home Depot card or the Macy’s card). Other than that, you’ll have no luck with commercial Visa cards from banks, commercial HSBC cards or Mastercard products from Wells Fargo.

Largely speaking, these are the card issuers you can add to Google Pay (with the above exceptions):

- American Express

- Bank of America

- Barclays

- Citi

- Chase

- Synchrony Bank

- Wells Fargo

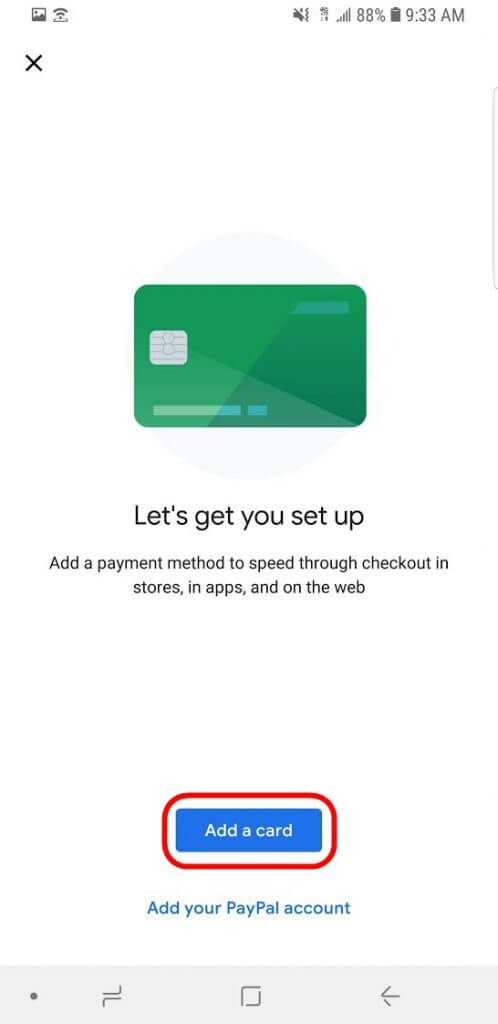

You can also attach your PayPal account to Google Pay.

There is no limit to the number of credit cards you can add to the platform! If you’re like me (I currently have 19 active credit cards), this is a fantastic way to keep track of all cards at a glance. Just note that you can only add two bank accounts.

Where is Google Pay accepted?

Per Google, millions of locations around the world accept Google Pay. You can also use Google Pay for select in-app or online purchases.

Use Google Pay for contactless in-store purchases wherever you see these symbols:

If you’re somehow having trouble finding a merchant that accepts this form of payment, the app can help you find a store near you.

Is Google Pay secure?

Yes, it’s secure!! In fact, it’s proven to be safer than using many credit cards. Google Pay doesn’t even provide your card number at the point of sale — it instead concocts a secondary virtual number and pays with that.

Additionally, Google Pay can be locked with biometric information such as fingerprints and facial recognition — and for the extra cautious, you can add a PIN or Touch ID confirmation prompt before any money can be sent from your account.

Are there Google Pay rewards?

You’re thinking like a true miles and points hobbyist!

Unfortunately, Google has no proprietary rewards, which you’ll find on other platforms like Samsung Pay (you can read about other mobile wallet options in our post about how to set up a virtual wallet). But you’ll still earn the same rewards from credit cards that you’d have earned from using a physical card. In other words, you’re not missing out on any miles or points.

How to set up Google Pay

Android Pay and Google Wallet were replaced by Google Pay. Google Pay occasionally has promotions to encourage you to use the service. Here’s how it works!

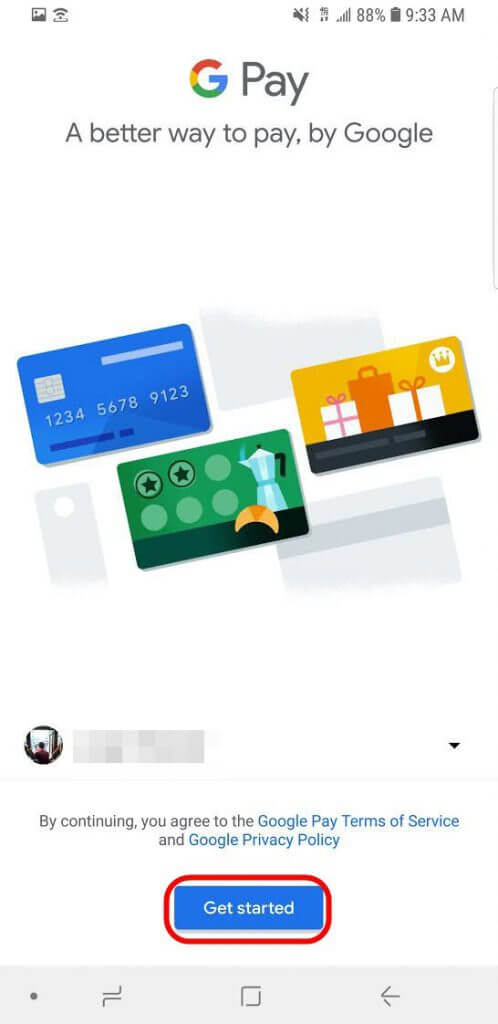

Step 1. Download Google Pay

Install Google Pay and open the app, then click “Get started.”

Step 2. Add a card

Now select the “Add a card” button to continue.

Step 3. Choose a card to add

At this point, you can add a new card to Google Pay or you can add a card that has already been saved to your Google account, then click “Continue.”

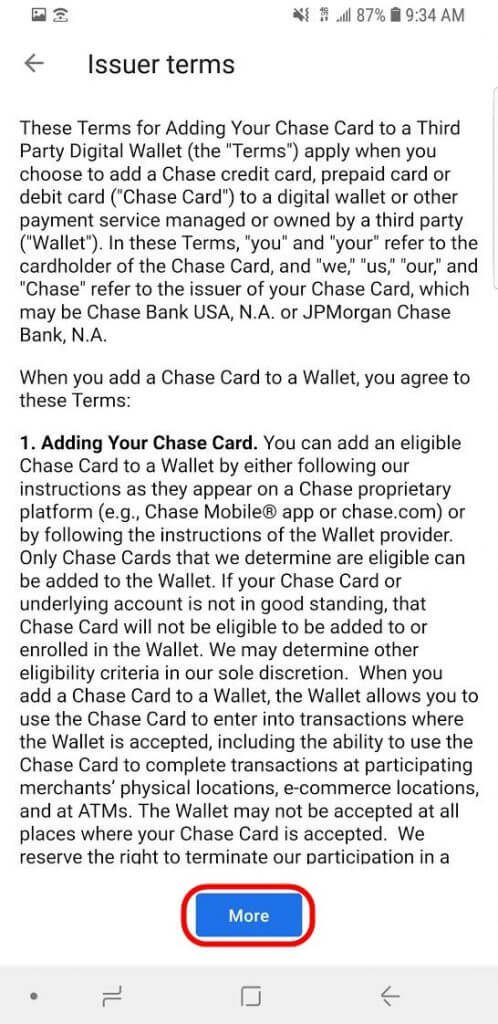

Step 4. Agree to the issuer terms

Review the terms & conditions and click “More.“

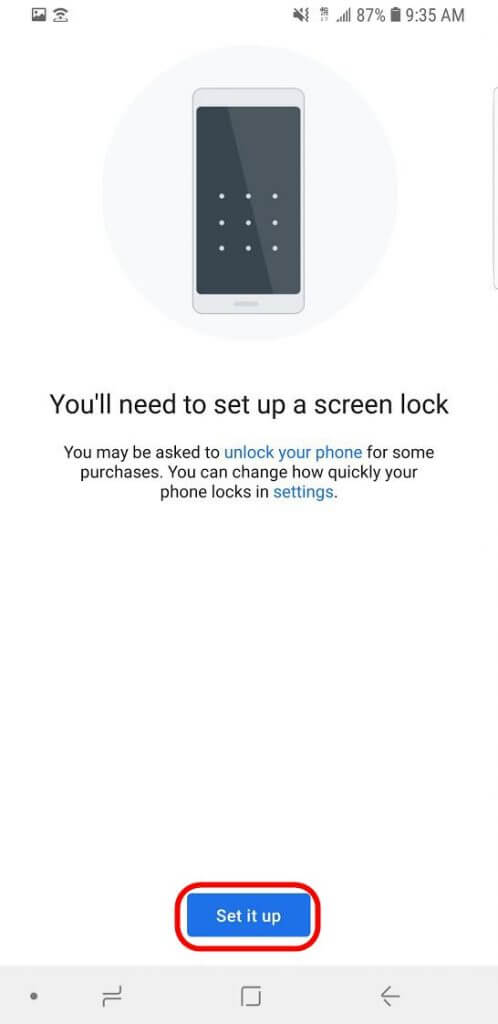

Step 5. Set up a lock screen

If you haven’t already set up a lock screen on your phone, you will need to set it up for security before you continue. To do this select “Set it up.”

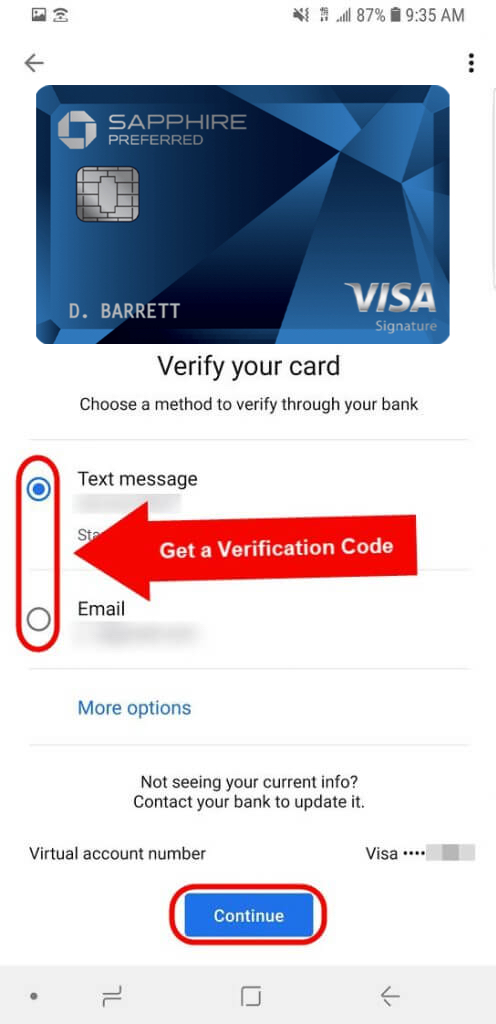

Step 6. Verify your card

Choose how you want to receive a verification code and then click “Continue.”

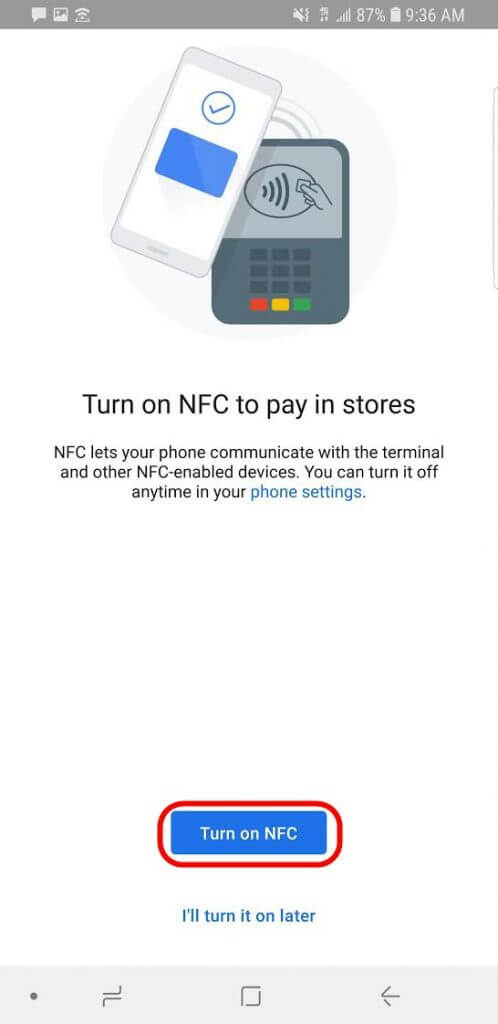

Step 7. Activate NFC

To use Google Pay in stores, you’ll need to turn on NFC.

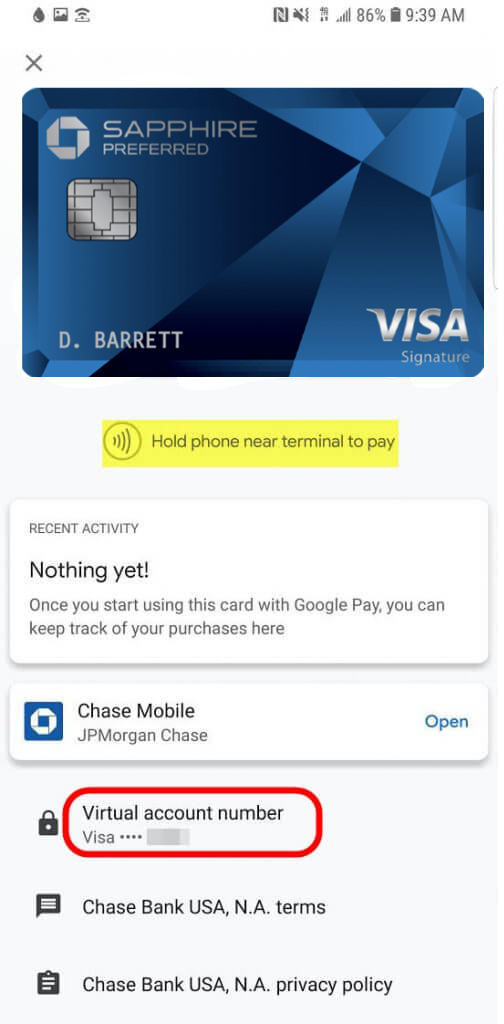

Step 8. Make your payment

Now you can pick the card you want to pay with and hold it near the card reader to complete the transaction.

Take note of the virtual account number because this is the number the card reader will be receiving. So if the cashier asks for the last four digits of your card, give her this number, not the last four numbers from your actual card.

Bottom line

Google Pay is just one of the many mobile wallets free to use in your phone’s app store. It’s a great help to stay organized if you’re like most of us in the miles and points hobby, juggling dozens of credit cards, hotel and airline loyalty numbers, minimum spending requirements, gift cards and more.

Let us know your thoughts on Google Pay — or if you’ve got another favorite! And subscribe to our newsletter for more info like this sent to your inbox once per day.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!