Get Money Back With MasterCard Price Protection

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Did you know that MasterCard credit cards have built-in price protection? It’s a benefit that’s often hidden in the terms and conditions.

MasterCard will reimburse you the price difference if you find a lower price on an item you purchased within 60 days (or more!).

I’ll explain the types of price protection offered by MasterCard. And give you some helpful tips in case you ever need to use it!

What Is MasterCard Price Protection?

Link: MasterCard Price Protection

Link: MasterCard Price Protection Terms & Conditions

According to the MasterCard website, MasterCard credit cards automatically come with 60-day price protection as a standard benefit.

You’ll get a refund for the difference in price if an item you bought drops in price within 60 days of purchase. And some cards even offer 120 days of price protection.MasterCard defines “price” as the actual cost of the item. Shipping, handling, and taxes do NOT count.

The amount you can claim is the difference between the price you paid and a lower advertised price on the same item. You are allowed to make up to 4 claims per 12-month period. And each claim can be for a maximum of $250.

Here are a few items that are NOT included in MasterCard Price Protection:

- Items purchased for resale, rental, professional, or commercial use

- Jewelry, art, used or antique items; collectibles of any kind

- Customized/personalized, one-of-a-kind, or special-order items

- Any items purchased from an auction

- Professional services

- Plants, shrubs, animals, pets, consumables, and perishables

- Motorized vehicles, including, but not limited to, automobiles, watercraft/boats, aircraft, and motorcycles

- Land or buildings

- Pets

How to File a Claim

It is up to you to find a lower advertised price on an item you bought. So if you think an item will drop in price, keep an eye out for advertisements.

If you are submitting a manual claim, you will need to send in proof of the price change. Advertisements must be printed materials like a flyer or newspaper. Or they can be a print-out from a website.

Or if you are submitting your claim online, you’ll need a scan or screenshots to upload.

In either case, the new price must be clearly displayed. And the model and item number must match what you already bought.

When you’re ready to file a claim, call MasterCard at 800-627-8372 to speak to a Benefits Administrator.

They will want to know:

- The price of the item when you bought it

- The new advertised price

- Your credit card number used for the purchase

- Your most recent credit card statement

- Receipt for the item you bought

- And anything else that may help your claim

You must submit a claim within 60 or 120 days of the date you bought the original item. The amount of time you have to submit a claim is up to the issuing bank, like Barclaycard or Citi.

Online Claims

You can also make a claim online.

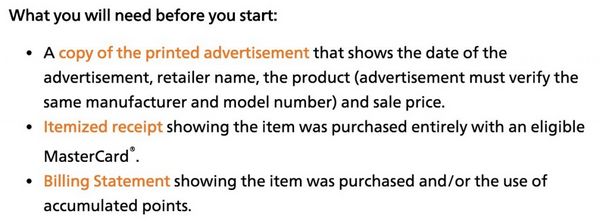

Here’s what you’ll need to get started:

Enter your credit card number and claim details.

Enter your name, information about the item, and its lower advertised price. Upload scans or screenshots of the new price. Then submit your claim directly to MasterCard.

Differences in Coverage

I noticed some MasterCards have 120-day price protection. Instead of 60!

Here’s what MasterCard says about this:

Selection of benefits on your card varies by card type and by card issuer. Please refer to your issuing financial institution for complete coverage terms and conditions or call the MasterCard Assistance Center at 1.800.MasterCard (1.800.627.8372) for details on your benefits or to file a claim.

So even though MasterCard offers 120-day price protection as a benefit, it is up to the individual credit card issuer to select which benefit you will get.

In general:

- Platinum MasterCards have 60-day Price Protection

- World MasterCards have 120-day Price Protection

- World Elite MasterCards have 120-day Price Protection

- Citi offers 60-day Price Protection on ALL MasterCards, but they make it easier to file a claim

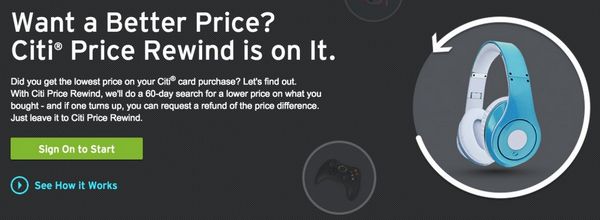

The biggest difference was with Citi. They offer 60-day Price Protection, called Price Rewind, on all MasterCards they issue. Read my review of Citi Price Rewind here.

2 Cards with MasterCard Price Protection

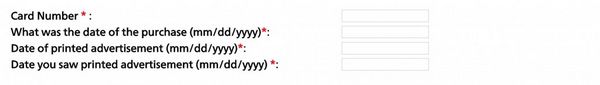

1. Barclaycard Arrival Plus® World Elite Mastercard®

Link: Barclaycard Arrival Plus® World Elite Mastercard®

Link: My Review of the Barclaycard Arrival Plus™ World Elite MasterCard®

The Barclaycard Arrival Plus has a ton of great perks. Like 2X Barclay Arrival miles on every purchase, no foreign transaction fees, and chip-and-PIN capability. Read my review of the card.

In addition to earning 2X Barclaycard Arrival miles on every $1 spent, you’ll also get 120 days of price protection. Instead of calling MasterCard, Barclaycard will help you directly if you call them at 800-553-7520 within 10 days of seeing a lower advertised price.

2. Citi AT&T Access More Card

Link: Citi AT&T Access More Card

Link: My review of the Citi AT&T Access More Card

The Citi AT&T Access More Card offers the 60-day version of price protection through Citi’s Price Rewind program.

This card is great to use with Price Rewind because it offers 3X Citi ThankYou points per $1 you spend at online retailers. If you see a lower price advertised, it’s easy to make a claim directly with Citi.

That way you can earn lots of points from shopping online. And have the assurance of price protection for up to 60 days!

Here’s how to use Citi Price Rewind with cards such as the Citi ThankYou Premier.

Chase MasterCards

Link: Chase IHG Rewards Club Select MasterCard

Sometimes Chase offers their credit cards as MasterCards. And in the past, both the Chase Ink Plus and Chase Sapphire Preferred were issued as MasterCards.

If you still have either card, you are eligible for 90-day price protection. And 5 claims of up to $500 within a 12-month period. That’s double the amount per claim!

And Chase lets you have 5 claims in a 12-month period instead of the 4 that is usually offered. I verified this with a Chase representative.

Keep in mind that Chase still offers Price Protection on the Visa versions of the Chase Ink Plus and the Chase Sapphire Preferred.

Are There Drawbacks?

Just a few:

- The item you are claiming for price protection must be bought new

- Nothing advertised as limited quantity, going out of business, or final sale will count

- Each claim approval is up to the individual credit card companies and MasterCard

You may find the claim process to be a bit long. And you’ll spend time gathering the documents you’ll need.

Except for Citi, the banks put the burden of proof on you to discover a lower advertised price.

If you shop on Amazon.com, sites like Paribus or CamelCamelCamel can help you to track price drops. And then you can start a claim for price protection.

Instead of calling MasterCard directly, you can call the number on the back of your card. You might get better service if you’ve been a long-time customer!Bottom Line

MasterCard has built-in Price Protection on its consumer credit cards. You can get a refund for the difference if the price drops on an item you bought in the past 60 or 120 days (depending on the card).

Citi will help you track price drops through its Price Rewind program. And sites like Paribus and CamelCamelCamel will help you track items on Amazon and other online retailers.

Have you ever filed a price protection claim with a MasterCard credit card? Share your experience in the comments!Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!