Did you know that Citi cardholders can get exclusive access to concerts, sporting events, dining events, and other experiences?

Citi Private Pass offers Citi cardholders early pre-sale tickets to sports and entertainment events, preferred seating, and VIP access. Occasionally, they’ll have complimentary tickets available!And folks with the Citi® / AAdvantage® Executive World Elite™ Mastercard®, Citi Prestige, and Citi Chairman (closed to new applicants) cards get even more exclusive perks through Citi Private Pass Beyond.

Let’s look at how these programs work!

What’s Citi Private Pass?

Link: Citi Private Pass

Link: Citi Private Pass Beyond

Link: Follow Citi Private Pass on Twitter

Citi Private Pass and Citi Private Pass Beyond are entertainment access programs for Citi cardholders.You’re eligible for Citi Private Pass if you have any Citi American Express, MasterCard, or Visa card. Or if you have a Citi debit MasterCard.

And folks with the Citi AAdvantage Executive, Citi Prestige, or Citi Chairman cards qualify for Citi Private Pass Beyond, which includes very exclusive access to events, personal meetings with artists, sports figures, and entertainers, and VIP experiences you can’t buy anywhere else.

This program is similar to Chase Sapphire Preferred Events and SPG Moments. But Citi Private Pass seems to have many more options for concerts and events!

That said, because Citi Private Pass is open to any Citi cardholder, certain events sell out more quickly.

How Do You Participate?

There’s no sign-up required for either program. You’re automatically eligible by having a Citi card (or the cards mentioned for Citi Private Pass Beyond).

Events are added (and sell out) all the time! It’s best to keep checking back or follow Citi Private Pass on Twitter. Or, you can sign-up for weekly email alerts from Citi Private Pass.

If you’re a Citi AAdvantage Executive, Citi Prestige, or Citi Chairman cardholder, you should automatically receive emails from Citi Private Pass Beyond (unless you opted out of receiving marketing emails in your Citi account).

What Can You Get?

There are a wide variety of events available for every taste! Live music, sports, Broadway shows, and fine dining events are common.

For example, with Citi Private Pass, you can currently buy exclusive tickets to a private Thursday Night Football viewing party (only open to Citi cardholders) hosted by Jason Taylor, a former Miami Dolphins linebacker.

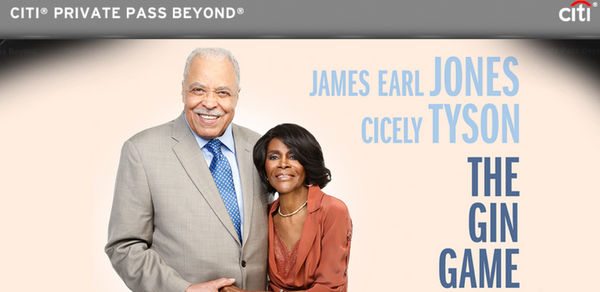

Sometimes there are complimentary tickets available for events. For instance, folks who qualify for Citi Private Pass Beyond have the opportunity (now sold out but there’s a waiting list) to attend the opening night of The Gin Game on Broadway. For free!

These tickets include orchestra seating and a VIP after-party with the cast and crew, including hors d’oeuvres and an open bar.

That’s quite a perk for having the right credit card!

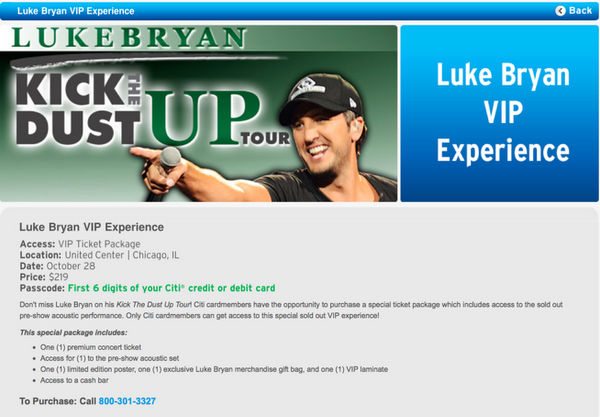

Occasionally there are pre-sale and VIP tickets available on Citi Private Pass that are exclusive to certain Citi card brands.

If you’re a Madonna fan (and have any Citi AAdvantage card), you can buy VIP ticket packages which include premium seats and access to a pre-show Citi VIP lounge in Los Angeles.

If there’s a concert you’re hoping to attend, it’s worth checking to see if pre-sale tickets are available. That way you can buy better seats before the general public has access to them!

Remember, Citi cards have lots of other terrific benefits. For example, all Citi personal credit card holders are eligible for Citi Price Rewind, which refunds you the price difference if an item you’ve bought drops in price within 60 days of purchase.

Bottom Line

If you’re a Citi cardholder, you can access exclusive entertainment events and buy pre-sale and VIP concert, sports, and theater tickets through Citi Private Pass.

It’s an automatic benefit of having any Citi American Express, MasterCard, or Visa. Citi debit MasterCard holders also qualify.

Folks who have the Citi AAdvantage Executive, Citi Prestige, or Citi Chairman cards get even more perks through Citi Private Pass Beyond. This includes exclusive opportunities to meet artists, entertainers, and sports figures.

It doesn’t cost anything to participate. And you can sign-up for email alerts to let you know when new events have been added.

Let me know in the comments if you’ve used either program and what it was like!

Join the Discussion!