3 Ways to Turn Paying Taxes Into Free Travel on Southwest!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Lyn blogs about how to fly nearly free on Southwest on her GotoTravelGal.com blog, and has a free guide that walks you step-by-step through how to earn the amazing Southwest Companion Pass. The pass lets 1 person fly nearly free with you for up to 2 years!

As tax time is nearing, I’ve asked her to share how you can earn Southwest points in the process.

Lyn: No one loves shelling out money for taxes each year, but it’ll make things a little easier if you can earn Southwest points that you can use for FREE travel!

From paying your taxes with a credit card to earning points on tax services, I’ve got the scoop on how to make tax time a little less burdensome and allow it to help you toward your goal of Big Travel.

How to Earn Southwest Points at Tax Time

Whether or not you owe the government come tax time, there are several ways you can score Southwest points during the tax process.

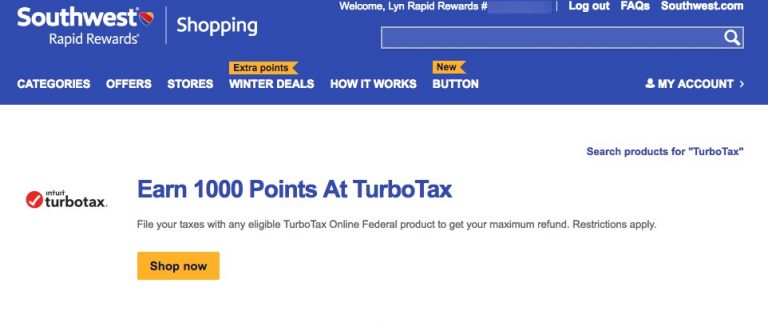

1. Purchase Software Through the Rapid Rewards Shopping Portal

By starting your tax software shopping at Southwest’s Rapid Rewards Shopping Portal, you can earn points for every $1 you spend at no additional cost. Here are your current tax program options on the shopping portal:

TurboTax – 1,000 Southwest points

If you use TurboTax online by starting at Rapid Rewards Shopping, you can earn 1,000 Southwest points, which are considered “bonus” points. So they do NOT qualify for the Southwest Companion Pass, but can be used for free travel.

You can use the free edition, Deluxe, Premier or Self-Employed to earn the points, but it must be the online version, and not downloaded products or CDs. You also must file your taxes online by April 17, 2018, and only 1 tax return per Southwest account can earn the bonus points.

A good strategy here might be to do the taxes of a family member, who has a relatively uncomplicated situation and who may qualify for the free product, such as a young adult, through this TurboTax offer.

H&R Block – 6 Southwest points per $1

H&R Block offers a similar program to TurboTax, which allows you to file your taxes online. The offer is good for TaxCut Premium software and TaxCut online, which range in cost from ~$35 to ~$75 (not including state tax filing fees) for their Self-Employed product, earning you a maximum of ~450 Southwest points.

Also, be sure you don’t use a coupon code from outside Rapid Rewards Shopping, or your points won’t be credited. These don’t say they are “bonus” points, so they should qualify for the Southwest Companion Pass.

e-File.com – 15 Southwest points per $1

e-File.com is a less expensive online filing option, with prices ranging from free to ~$35 (not including the state filing fee), but of course, you won’t earn any points on the free option! You could earn a maximum of ~525 Southwest points with e-File.com.

If you pay for these programs using your Southwest Chase Rapid Rewards Visa card, you can earn an additional 1 point per $1 to stack even more points!

2. Pay Your Accountant With a Southwest Card

If you don’t do your taxes yourself using an online program like TurboTax, ask your accountant or firm if you can pay your tax preparation bill with your Southwest credit card.

Most, unless they are a very small company or individual accountant, will accept credit cards, allowing you to earn 1 Southwest point per $1 of their fee. If they don’t take cards, you can use Plastiq, which I explain below.

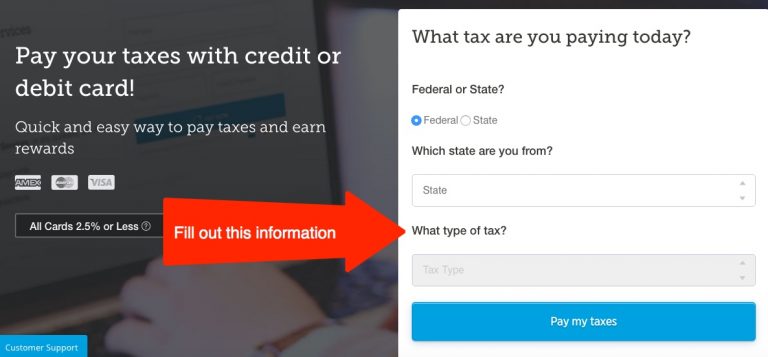

3. Pay Your Taxes via a 3rd-Party Payment Processor

While you can’t directly pay the IRS with a credit card, there is a way around it by using an IRS-approved 3rd-party payment processor. You won’t be charged a cash advance fee, but you will pay a ~2% fee for using the service.

Or consider using Plastiq. Plastiq lets you almost any bill, like rent, mortgages, car payments, accountants, and taxes with a credit card. Essentially, you charge the amount to Plastiq, then Plastiq sends the payee a check and charges you a fee of 2.5% of the amount.

These strategies to earn Southwest points generally only make sense if you’re working to meet the minimum spending requirement to unlock the sign-up bonus on your Southwest Chase Rapid Rewards Visa card. Or need extra Southwest points to earn the Southwest Companion Pass.

You’ll earn 1 Southwest point per $1 when you use your Southwest card to pay your taxes. And Southwest points are worth ~1.25 to ~1.43 cents each when you redeem them for airfare. So paying a fee of ~2 to ~2.5 cents per $1 to use a payment processor negates the value of the points you’ll earn.

Note: If you already have the Southwest Companion Pass, your points are worth ~2X as much because a friend or family member can fly with you for just the cost of taxes and fees.

Bottom Line

While I can’t make your total tax amount go away, you can earn Southwest points for free travel along the way. For example:

- Check for bonuses for tax software purchases on the Rapid Rewards Shopping Portal

- Pay your accountant with your Southwest credit card

- Pay your tax bill with an IRS-approved 3rd-party payment processor or a service like Plastiq

Here’s hoping you get a refund :-)!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!