Act fast: Earn a Southwest Companion Pass after taking one flight!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Southwest is an inspiration. They are always multiple steps ahead of any other airline.

At a time when airlines have been strong-armed into adopting more customer-friendly policies by a crippling pandemic, Southwest proactively retains its crown as the most lenient and generous airline on the planet. They don’t charge fees for changes or cancellations; they allow each passenger to bring two checked bags for free; they offer some of the best airline credit cards; they perpetually release fare sales all over the U.S. and Caribbean.

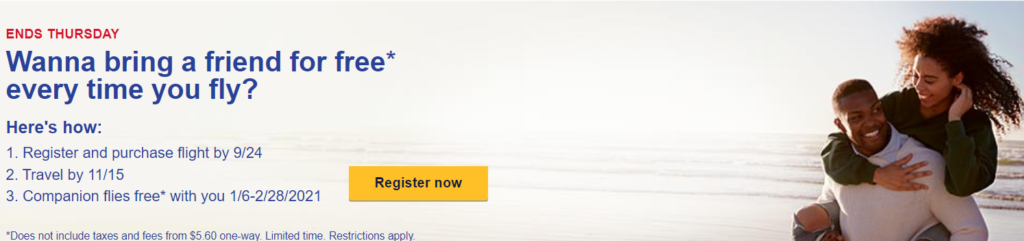

But now they’re giving everyone the opportunity to earn the best deal in travel, the Southwest Companion Pass, with mind-blowing ease. But you’ll have to register for this promotion and purchase a flight by September 24, 2020!

Earn the Southwest Companion Pass after taking one flight

Million Mile Secrets considers the Southwest Companion Pass to be one of the best deals in travel. With it, you can bring a friend or family member with you for free whenever you fly on Southwest. Whether you booked your own flight with cash or with Southwest points, the person you designate as your “companion” can travel for just the cost of taxes and fees (usually ~$6 one-way for domestic flights).

In other words, if you were to fly 30 times within a month, your companion could get 30 flights for free by tagging along. Depending on how often you fly, you and your companion could save thousands of dollars with the Companion Pass. My wife and I used ours for a vacation to Cancun last year and saved $400 on that trip alone.

That’s why this current offer is so amazing. For a very limited time, you can earn the Southwest Companion Pass simply by taking one flight. Here’s what you need to know:

- Register here and book a flight by September 24, 2020

- Your flight must be on or before November 15, 2020 (and yes, you’ll need to actually fly)

- You must register before you book travel

- You must pay cash for your flight (award flights not valid)

- Earn a Companion Pass valid between January 6 and February 28, 2021

You can change your companion up to three times while you have this promotional Companion Pass.

There really is no catch with this deal, other than the fact that this promotional Companion Pass is valid for less than two months. But booking a cheap one-way flight to earn potentially dozens of free flights is definitely worth it — one of the best promotions we’ve seen of late!

How to earn a better Companion Pass

You can get a much better Southwest Companion Pass by earning 125,000 qualifying Southwest points in a calendar year. This standard pass is good for the remainder of the year in which you earn it, as well as the entire following year.

Earning the Companion Pass is a lot easier than it sounds, because Southwest credit card sign-up bonuses count towards the 125,000 point requirement. At the moment, it’s possible to immediately qualify for a Companion Pass by signing-up for one single Southwest card and meeting the minimum spending requirements — the Southwest® Rapid Rewards® Performance Business Credit Card. Read our review of the Southwest Performance Business card for all the details. And read our post on how to earn Southwest points for more ways to reach the 125,000 point requirement.

Bottom Line

This is an amazing deal, especially if you have any travel planned for early 2021. It’s also worth noting that Southwest is blocking middle seats through the end of November, so you can more easily distance yourself from others on a plane.

Let us know if you jump on this promotional Companion Pass deal! And subscribe to our newsletter for more can’t-miss travel deals delivered to your inbox once per day.

Featured photo by Felipe I Santiago/Shutterstock.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!