Delta Reserve for Business card benefits – A powerhouse for Delta flyers

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

If you travel on Delta Airlines with any frequency, the Delta Reserve for Business Credit Card benefits and perks will appeal to you. It’s a great candidate for a spot in your billfold and one of the top Delta credit cards.

The card is now offering a welcome bonus of 40,000 Delta miles and 10,000 Medallion® Qualification Miles (MQMs) after spending $3,000 on purchases within the first three months of opening your account. It has a $450 annual fee ($550 if application is received on or after 1/30/2020) (see rates & fees). I’ll show how much value you can receive with this card’s ongoing benefits.

Delta Reserve for Business credit card benefits and perks

Right off the bat, you should understand one thing: With American Express cards, you can only earn the welcome bonus once per card per lifetime. In other words, if you’ve had the Amex Delta Reserve for Business before, you aren’t eligible for the welcome bonus again. You can receive the welcome bonus from other Delta travel credit cards, as long as you’ve not had them before.

Regardless, the welcome bonus isn’t where this card truly shines. It’s in the ongoing perks that make the Delta Reserve Business card worth it. Check them out below.

Delta Sky Club access

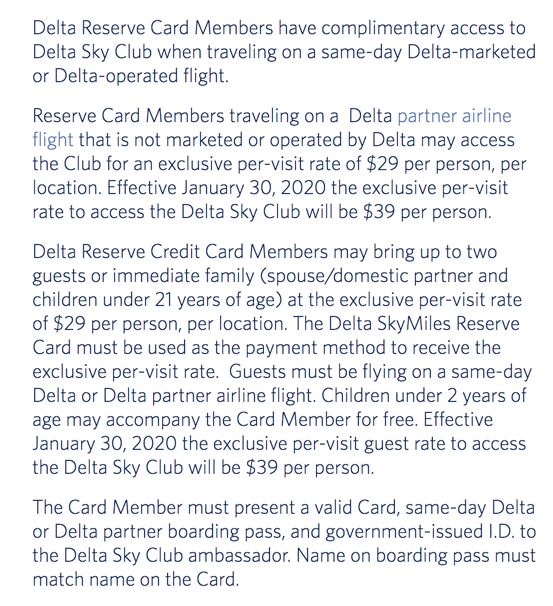

This is a major draw of this card. Delta Sky Club lounges are located around the world for Delta customers, Delta partner customers with certain elite status, passengers in first class and card holders with cards such as The Platinum Card® from American Express (enrollment required). To access the Delta Sky Clubs with the Amex Delta Reserve for Business, you must meet one of the following criteria:

It’s worth noting that Delta Sky Club membership costs $545 per year. This is one of the strongest arguments for keeping this card. The annual fee pays for itself with Sky Club access.

Free checked bag

Paying for checked bags is an absolute waste. On a round-trip Delta flight, you can save up to $60 on checked-bag fees with this card, which provides one free checked bag for you and up to eight companions when you fly Delta. That’s a potential (though unlikely) savings of up to $540 per round-trip flight (9 travelers x $60 round-trip cost per bag = $540).

Annual companion pass

This is another large value perk of this card – a companion certificate – though not to be confused with the highly coveted Southwest Companion Pass. You can use this companion certificate once per year for any type of ticket, including first class as long as the trip is within the contiguous 48 United States. So think of it as a buy-one-get-one coupon (you still need to pay the taxes on the second ticket).

Preferred boarding – Main Cabin 1

I am a huge proponent of bringing a carry-on. It avoids potential hassles from the loss or damage of checked bags. Preferred boarding is a large perk for me to ensure I have space in the overhead bin. Delta has recently redesigned its boarding order. Be sure to review this process if you want overhead bin space and extra time to board and get cozy.

Earn bonus points for purchases

The Delta Reserve Business card’s earning categories are pretty simple. You’ll earn:

- 2x Delta SkyMiles on Delta purchases

- 1x Delta SkyMiles on other purchases

- Terms apply

Standard for an airline card. Certainly nothing special.

Concierge

Sometimes, it is easier to have a pro take care of your plans. Whether you need a dinner reservation, a gift delivered to your significant other, or concert tickets, the concierge service you receive with the Amex Delta Reserve for Business will be able to assist.

I’ve used the American Express Concierge service and really enjoyed my interactions with their staff. They’re accessible 24/7.

Earn Medallion Qualifying Miles (MQMs)

With this card, you will earn 10,000 MQMs when you earn the card’s welcome bonus. Earning MQMs is one requirement you need to meet to qualify for elite status with Delta. You’ll also earn 15,000 bonus miles and 15,000 bonus MQMs after spending $30,000 in a calendar year. Plus you’ll get an additional 15,000 bonus miles and 15,000 bonus MQMs after spending $60,000 with your card in a calendar year.

As a quick rundown, here’s what it takes to earn Delta elite status:

- Silver – Earn 25,000 MQMs or 30 MQSs AND $3,000 MQDs or MQD waiver

- Gold – Earn 50,000 MQMs or 60 MQSs AND $6,000 MQDs or MQD waiver

- Platinum – Earn 75,000 MQMs or 100 MQSs AND $9,000 MQDs or MQD waiver

- Diamond – Earn 125,000 MQMs or 140 MQSs AND $15,000 MQDs or MQD waiver

Unless you are worried about airline status, there is no need to worry about these MQMs. You can read more about Delta status here.

As of Jan. 30th 2020 this benefit will be changing, you will no longer be able to earn redeemable bonus SkyMiles. Instead, you can earn up to 60,000 MQMs each calendar year. You’ll earn 15,000 MQMs for every $30,000 you spend on the card in a calendar year, up to $120,000 in total spending.

20% off inflight purchases

If you are one to enjoy an exorbitantly priced cocktail or extra snacks on a flight, this card can definitely save you some cash. When you pay with your Delta Reserve for Business Credit Card, you will save 20% on inflight purchases.

No foreign transaction fees

This is a great feature if you do a decent amount of international travel. You are able to use your Delta Reserve for Business Credit Card anywhere that American Express is accepted, with no foreign transaction fees (see rates & fees).

I am a huge fan of this, because I am able to continue earning valuable points and miles during my travels, and I don’t have to worry about getting dinged. Note that any rewards credit card worth its salt will have no foreign transaction fees.

Car rental loss and damage insurance

When you pay for your rental car with your Delta Reserve for Business Credit Card, you’ll get secondary coverage if it is damaged or stolen. That means you’ll be covered for anything your personal insurance doesn’t cover. This does not include liability insurance – only damage to your rental car is covered.

Also, not all car types are covered, and this coverage is not valid in all countries, so be sure to talk to customer service to find out if your rental car will be covered.

Baggage insurance

When you purchase your entire fare on your Delta Reserve Business Card, you automatically have coverage on your bag in case it is lost, damaged or stolen. Coverage for a carry-on bag is up to $1,250 and a checked bag is $500. You, your spouse or domestic partner, and your dependent children under age 23 are covered when you pay the entire fare with your card.

There are plenty of exceptions. This insurance is secondary, and doesn’t cover things like:

- Cash

- Living plants or animals

- Food or perishables

- Eyeglasses, hearing aids, contact lenses

This is something you hope you never have to use, but it is always good to have in an unfortunate situation.

Trip delay insurance

Starting for travel purchased on or after Jan. 30th 2020 you’ll get trip delay coverage. Whenever your travel is delayed 6+ hours you can be reimbursed up to $500 per trip (max of two trips per 12 month period).

Trip interruption/cancellation insurance

This benefits is being add to the card on Jan. 30th 2020 and will apply to travel paid for with your card on or after that date. This coverage will reimburse you when your trip is cut short or you can’t go on it because of events like injury/illness, severe weather or jury duty. You’ll be covered for up to $10,000 per trip (up to $20,000 per account per 12 month period).

Bottom line

The Amex Delta Reserve business credit card has a plethora of valuable benefits. If you use two or three of the main benefits (Delta Sky Club Access, Annual Companion Certificate, free first checked bag, etc.), you can offset this card’s $450 annual fee ($550 if application is received on or after 1/30/2020). Just be sure you’ll actually use the perks before you open the card.

Let me know your favorite Amex Delta Reserve for Business benefit.

| For more travel and credit card news, deals and analysis sign-up for our newsletter here. |

For rates and fees of the Delta Reserve for Business Credit Card, please click here.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!