Capital One Savor card benefits: Perfect for restaurant and entertainment spending

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

If you like to dine out or see live shows, you’ll love the Capital One Savor Cash Rewards Credit Card – and the welcome bonus. You’ll earn a $300 cash bonus after meeting minimum spending requirements. You can redeem the rewards you earn for gift cards and statement credits. Or you can choose to receive a check in the mail.

You can read about the Capital One Savor card here.

The information for the Capital One Savor Cash Rewards card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

The card’s tempting sign-up bonus is one of the reasons I love this card. But what’s especially great are the Capital One Savor card benefits. And if you find yourself spending money at restaurants or on entertainment, it will become a staple in your wallet. Here’s how the perks can easily offset the card’s annual fee and earn you hundreds in cashback each year. It’s hands-down one of the best cashback credit cards.

Capital One Savor Card benefits and perks

With the Capital One Savor, you’ll earn $300 cash back after spending $3,000 on purchases within the first three months of account opening. In addition to the valuable sign-up bonus, there are other ongoing benefits that make the Capital One Savor card worth keeping for the long haul.

Earning rates

Earn unlimited cash back

The most practical perk is by far the unlimited cashback. The Capital One Savor card earns:

- 4% cash back on dining

- 4% cash back on entertainment

- 4% cash back on popular streaming services

- 3% cash back at grocery stores (excluding superstores like Walmart and Target)

You’ll earn 1% cash back on all other purchases.

Here’s how valuable earning unlimited cash back can be. Let’s say you spend $1,000 a month with your Capital One Savor card:

- 20% at Restaurants or on Entertainment: $200 for $8 cash back

- 20% at Grocery Stores: $200 for $8 cash back

- 60% on general purchases: $600 for $6 cash back

That’s $22 each month, or $264 per year. Plus, at $1,000 a month, you’d also earn the $300 welcome bonus for $564 your first year of having the card.

8% cash back with Vivid Seats

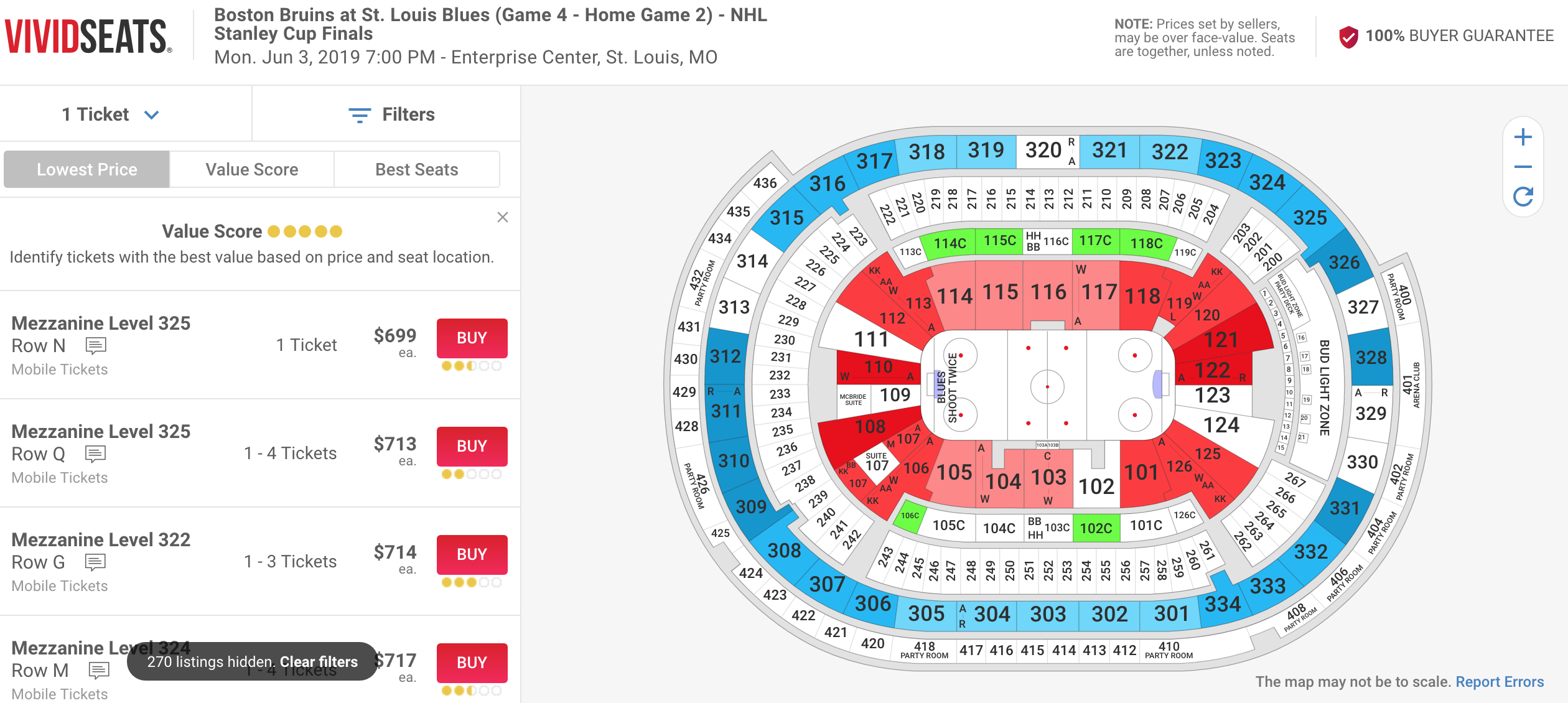

Not only can you earn 4% on your typical entertainment purchases, but you can also earn 8% cashback with Vivid Seats through January 2023. Vivid Seats is a lot like StubHub. You can score cheap tickets to concerts or sporting events.

I managed to snag a pass to Bonnaroo, a music festival in Tennessee, for $325 when tickets on the festival’s website were $400+. Using the Capital One Savor card, I earned $26 for that purchase! That can cover a few beers at the festival.

If you plan on buying tickets to a concert, music festival, or sporting event, I recommend using Vivid Seats with your Capital One Savor card. You’ll earn a nice chunk of your purchase back in cash!

Insurances and protections

Extended Warranty Protection

The Capital One Savor card will extend the manufacturer’s warranty by a year on eligible items. If the manufacturer’s warranty is lackluster with protection only available for three years or less, Capital One will cover your purchase. Coverage is limited to the lesser of the following:

- The cost to repair or replace the item

- The purchase price of the item

- The amount charged to your Capital One Savor card

- $10,000 per item

There are several excluded purchases, like cars, tires, plants, animals, etc. You can check Capital One’s website for more information on warranty protection.

Car Rental Insurance

The Capital One Savor card offers secondary coverage for car rentals. If you already have insurance that covers car rentals, this benefit won’t kick in — but if you do use this benefit, it will cover things like scratches, fender benders, and other damage.

Travel and entertainment perks

Capital One Premium Access

Capital One Premium Access combined with the Savor card is the perfect combination. Capital One Premium Access gives you options for VIP events, exclusive tickets to popular concerts and music festivals, and sporting events (purchases for which you’ll earn bonus cash back).

In the past, Premium Access events have included exclusive access and tickets to the Capital One Jam Fest with Katy Perry, exclusive access to the iHeartRadio Music Festival and tickets to the NCAA Final Four. Upcoming events include VIP treatment for events at the Capital One Arena in Washington and exclusive reservations to top restaurants in cities like New York.

Mastercard World Elite benefits and perks

The Capital One Savor card is a Mastercard World Elite card. This means that all the benefits offered with Mastercard World Elite cards apply. The list of benefits offered to Mastercard World Elite card holders is actually pretty extensive, such as:

Lyft Credits: If you take five or more rides with Lyft during a month, you’ll earn $10 in Lyft ride credit. This benefit resets each month, meaning you can earn up to $120 in Lyft credits each year. This benefit alone can more than cover the card’s annual fee.

Free ShopRunner 2-day shipping: This benefit will save you a lot of time and money if you shop online. ShopRunner offers free 2-day shipping and returns at more than 140 stores including popular retailers like Neiman Marcus, Saks Fifth Avenue and Cole Haan.

World Elite Concierge: This is one of my favorite benefits of any credit card: A dedicated concierge that can take care of dinner reservations, travel plans and you can snag last-minute concert tickets. The service is free and so underutilized by many cardholders. I’ve managed to score some great last-minute reservations at popular restaurants and book amazing seats at concerts thanks to the concierge benefit.

Overall value

The Capital One Savor can save you a lot of money. It currently offers a $300 cash bonus after spending $3,000 on purchases in the first three months of opening an account. Also, you can receive up to $120 in Lyft credits each year. If you’ll use it, you can receive at least $420 in value.

Plus, if you’re someone who often dines out a lot, sees movies, goes to concerts, or just loves cash rewards, you can easily rake in 4% cash back. If you spend $400 per month in these categories, you’d earn another $192 just for using this card.

Bottom line

I don’t think there’s a better card for dining out and entertainment. This ranks near the top of the best Capital One credit cards. After all, it earns unlimited 4% back at restaurants and for entertainment purchases.

It’s also a World Elite Mastercard, which means you’ll have access to extra benefits that’ll come in handy when you’re out on the road, such as Lyft credits, extended warranty coverage, and travel & lifestyle services.

Want more in-depth credit card benefit probes like this? Subscribe to our newsletter for bi-weekly emails of our best content.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!