“How $6 Dropped My Credit Score 100 Points”

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

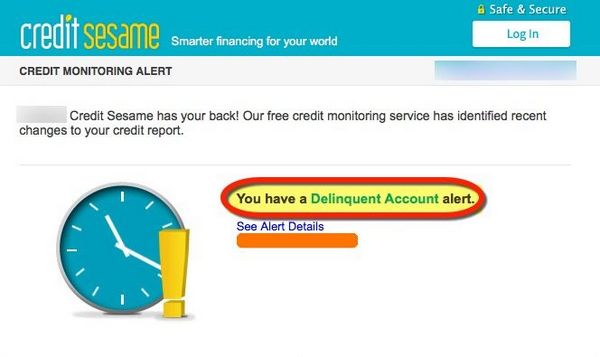

Daraius: Team member Harlan told me a story about how his credit score dropped unexpectedly. So I asked him to share his experience with Million Mile Secrets readers. So they can avoid it happening to them! Harlan: Thanks, Daraius! I clearly remember the day I got an email from Credit Sesame with a “Delinquent Account” alert.

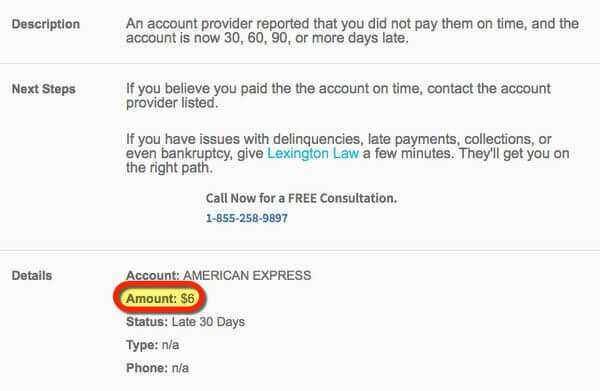

After I clicked through, I saw my credit score had dropped 100+ points because of a recurring charge on a canceled AMEX card!

I knew how important good credit is for earning lots of miles & points with sign-up bonuses. So I immediately called to find out what happened.

Here’s what I learned. I’ll also give some tips so this never happens to you!

How One Small Error Dropped My Credit Score

Until a few months ago, I had an AMEX EveryDay® Preferred Credit Card. When you use your card 30+ times on purchases in a billing period, you get 50% more points on those purchases, less returns & credits.

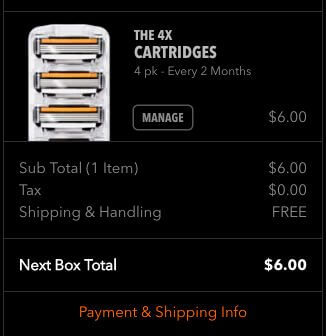

That’s a lot of transactions! So I put many small recurring payments on the card, including my monthly subscription to Dollar Shave Club.

I’m on a plan that costs a flat $6 per month.

I put the plan on pause because I don’t shave enough to use all those razors! While my account was dormant, I closed the AMEX card, and moved to a new city.

Between the move and the time that passed, I forgot to change that card as my payment method. But when I got the email alert from Credit Sesame, I realized what had happened.

My Call With AMEX

I immediately called American Express to figure out how to fix it. The representative I spoke with said they would “re-age” my account so it would appear closed for a date beyond when the charge was due. So that way, it wouldn’t appear late on my credit report.

And of course, I paid the $6 charge over the phone once and for all.

The representative said it would be clear on my credit report in ~ 4 weeks. So I waited.

Over a month later, the error was still on my credit report. So I called again.

A different representative said the account was not properly “re-aged,” but not to worry – she would do it again. I waited another month.

That was a few months ago by now. Now, my credit report says I owe $0, literally nothing. But that my $0 payment was over 30 days late. WHAT?! I’m extremely disappointed AMEX did not help me resolve this error. Especially because they admitted to me several times the charge should have never gone through in the first place!Why My Score Fell So Much

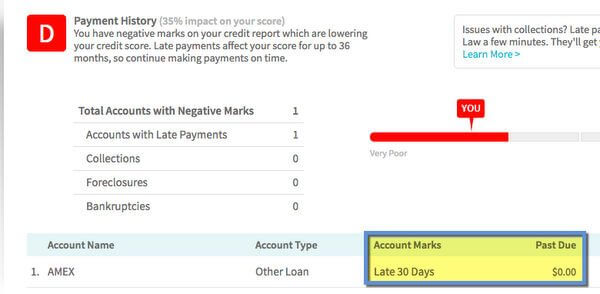

Before this situation, my credit score was around 803. But now, It’s 702 – ~100 points lower!

I have hundreds of on-time payments in my credit file. But it only took one error to mess it all up.

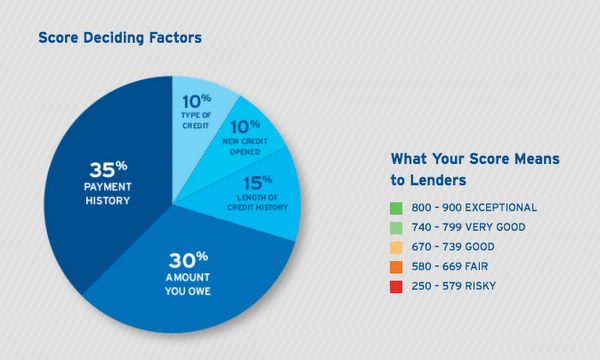

That’s because payment history makes up 35% of your overall score – more than any other single factor. Any late payments are weighted heavily.

Even though this error wasn’t my fault, I still took a huge hit. And AMEX didn’t do anything to help me.

Now I Have to File Claims With the Credit Bureaus

Unfortunately, to fix this I have to contact each of the 3 major credit bureaus directly. And file 3 individual claims to dispute the error.

It’s a lot of hassle and time to clear up such a small charge. Only $6!They each have their own system of handling disputes. But I have:

- Proof I paid the account

- The date I closed the card

- The date of the charge

So it should be obvious what happened. Of course, I’ll let them know I tried to clear it up directly with American Express. And that I have no choice but to file a claim directly. I won’t know the outcome until after a few more months of waiting. This is a long process I don’t want to ever repeat.

Remember to Cancel Recurring Payments

Typically, most issuers won’t charge a closed account. And you can clear up the payment with the merchant.

The best way to avoid dealing with this situation is to always switch recurring payments when you close a card.

Another way is to set up automatic monthly payments from your bank account. Because even if you overdraft, it may be easier to pay the overdraft fee than to ruin your credit score. Plus, most banks are lenient when they realize a charge isn’t your fault, and may reverse the charge for you.

I recommend keeping a spreadsheet or file so you can remember. Or to carefully check your recent account statements and look for recurring charges before you cancel.

Bottom Line

Having a good credit score is the best way to unlock sign-up bonuses on credit cards. So I was devastated when my credit score fell ~100 points because of a $6 charge. Payment history is 35% of your over credit score. So one late payment ruined my 800+ credit score!Don’t let my story happen to you. Be sure to keep good records. And to cancel any recurring charges you have. There are lots of subscription services out there, so check your account statements. And switch your payment when you cancel the card on file.

Does anyone have a similar story, or tips to share? Let us know in the comments!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!