Spending $100 for a $700+ weekend in Chicago (thanks primarily to the Amex Bonvoy Brilliant)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Chicago is a terrific winter destination. They call it the Windy City, suggesting nightmarish icy wind tunnels between metropolitan skyscrapers, but that’s just an epithet (I heard it originally spawned from long-winded local politicians, not sure if that’s true).

There’s plenty to see and do for cheap, like:

- Zoolights, where the Lincoln Park Zoo is open at night, draped in 2.5 million lights (and yes, the animals are out)

- The unique ice skating ribbon at Maggie Daley Park (admission is free, but you’ll have to pay for ice skates if you don’t have any)

- Green Mill Lounge, one of the best jazz locations since the great flood, and a regular hangout of Al Capone (cover charges are as little as $4, depending on the band)

I recently wrote how a $100 Marriott credit from Amex Offers was helping me to offset my annual fee. I thought I’d get into a quick specific of how easy it actually is to offset annual fees by stacking credit card benefits.

My wife and I are using three benefits from two credit cards (not welcome bonuses, mind you) to take a $700 trip to Chicago for $100:

- $300 annual Marriott credit (comes automatically with Marriott Bonvoy Brilliant™ American Express® Card)

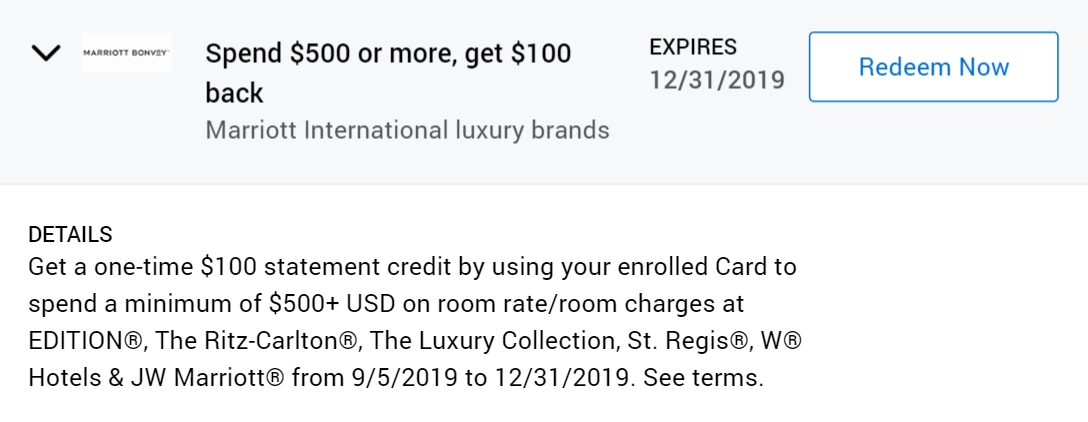

- $100 Marriott credit after spending $500 (targeted deal from Amex Offers)

- Southwest Companion Pass, which allows you to bring a friend for free (plus taxes and fees) every time you fly Southwest (it’s super easy to earn)

Here’s how we’re doing it.

Visiting Chicago for 85% off by stacking credit card benefits

Hotel stay

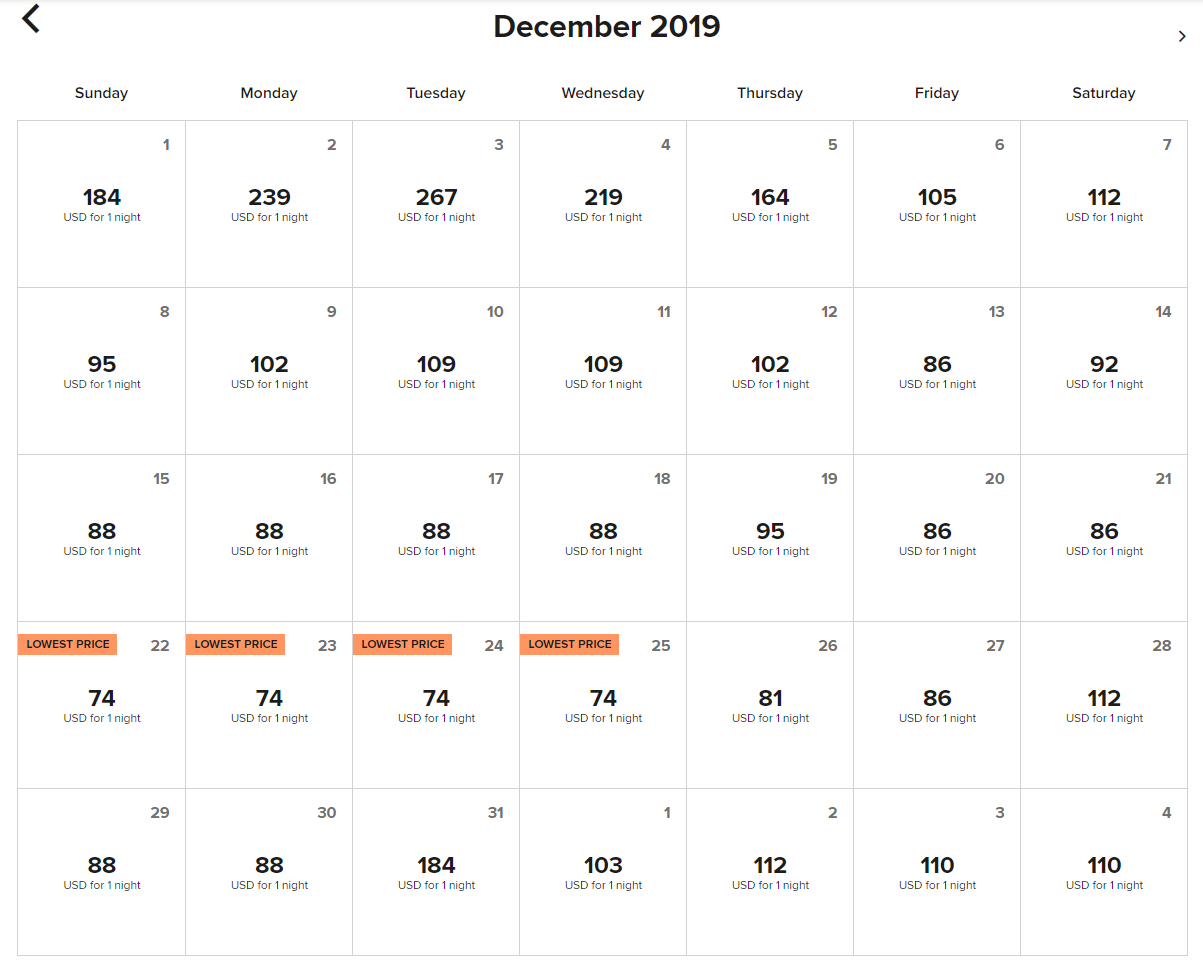

We’re staying at the W Chicago – Lakeshore in late December.

December is surprisingly cheap for this hotel, and we were able to book three nights for under $300 total. The hotel in other months often costs $300+ per night after taxes. W is one of Marriott’s seven luxury brands, after all — the best Marriott has to offer.

The Marriott Bonvoy Brilliant has a $450 annual fee (see Rates & Fees). But it comes with $300 in Marriott credit annually. In other words, you won’t be charged for the first $300 you spend at Marriott each cardmember year. If you know you’ll be spending at least $300 at Marriott every year, this card’s annual fee is effectively $150 (and it comes with at lot of other amazing stuff).

Further reading: Amex Marriott Bonvoy Brilliant credit card review

I had initially planned to use this $300 credit for food during a stay in the Maldives, but decided to use it during this trip, instead. Our $300 stay will be completely refunded by the card’s credit.

Food

By the time we stay at this hotel, I’ll have Marriott Platinum status, which will give us both a free continental breakfast. Not the greatest option, but if we’re trying to do this trip on a budget, that’s the way to go.

Further reading: Marriott Bonvoy Elite Status

When a restaurant is inside a hotel, the credit card transaction usually appears on your statement as a hotel purchase. You can also often charge the meal to your room bill by providing your room number. This is where the Amex Offer comes into play. I’ll receive $100 back for spending $500+ with Marriott.

I’ve already spent $300 for the room itself (refunded by the Bonvoy Brilliant credit), so I’ll need to spend another $200 to trigger this $100 refund.

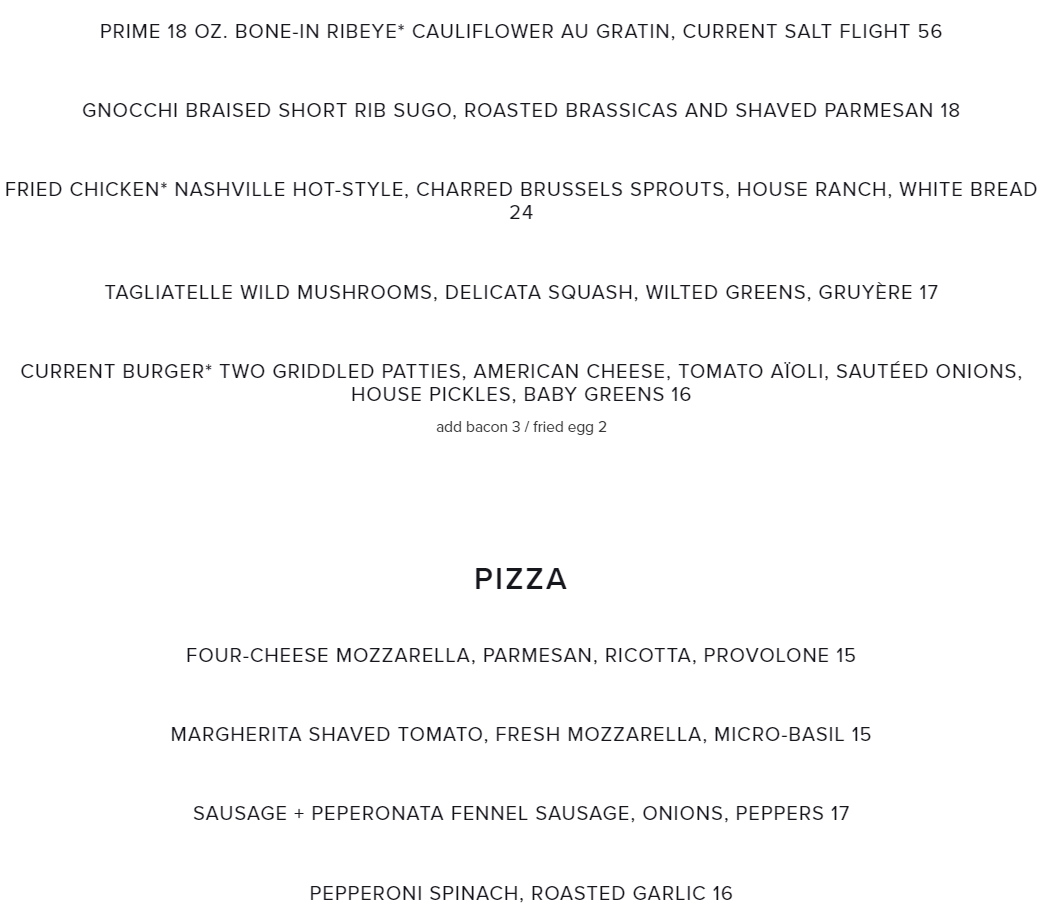

Inside the W is Current Chicago, the hotel’s restaurant. It serves breakfast, lunch, and dinner — and most dishes aren’t exorbitant. Of their sizable menu, only four items exceed $20. Nearly all entrees price closer $15, including pizzas.

If we eat three meals with drinks at the restaurant, we’ll spend $200 on food. That will activate the $100 rebate, and I’ll have effectively spent $100 for three substantial meals. Of course, if we dined more modestly and steered clear of alcohol, we could probably eat five meals here for $200. But pinching pennies that hard will ruin a trip.

Besides, one of the funnest parts of travel is seeking new culinary gems and local dives. There are plenty of joints we want to try in Chicago, like Crisp and Red Hot Ranch (let me know if there’s a must-try in Chicago).

Flights/Transportation

Everyone at MMS considers the Companion Pass to be the absolute best deal in travel. It’s essentially BOGO flights, as often as you fly Southwest.

When you’re a Companion Pass holder, you can take a friend or family member with you for just the cost of taxes and fees. Even if you fly multiple times a day, every single day, your companion can tag along for practically free. That’ll save thousands and thousands of dollars, depending how often you fly.

Further reading: Everything you need to know about the Southwest Companion Pass

We’ve got the Southwest Companion Pass through the rest of 2019. I transferred Chase Ultimate Rewards points to Southwest for a flight (you can instantly transfer Chase points to Southwest at a 1:1 ratio), so both my wife and I are able to fly round-trip to Chicago using points and the Companion Pass. The flights would otherwise have cost ~$200 for the both of us, which is still dirt cheap.

Concerning transportation, we’re going to take… PUBLIC TRANSPORTATION. I don’t live in an area where mass transit is a way of life, and I think it’s fun and novel so I do it whenever I can. Plus it’s practically free compared to renting a car. I do expect to utilize Uber at some point, though.

Bottom line

Alright, after we pay a nominal fee for our mass transit rides and eat a few times outside the hotel, we’ll have technically spent a little more than $100 for this three-night $700+ trip. But you have to admit that $33 per night for a luxury hotel stay with breakfast, dinner, and alcohol included is hard to beat. It’s worth reiterating that this card comes with a $450 annual fee, but with the hundreds and hundreds in value you’ll receive from the card’s other benefits (like an annual free night worth 50,000 points), the card’s a no-brainer. Read our review here.

The Southwest Companion Pass also helped cut down the price of this trip. You can read our Southwest Companion Pass FAQ here. And subscribe to our newsletter for more ideas to take practically free trips with credit cards perks.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!