How to Transfer Money To & From Your Bank Account with American Express Bluebird

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers. Don’t forget to follow me on Facebook or Twitter!Bluebird Introduction

One of the best uses of American Express Bluebird is the ability to pay for transactions which can’t usually be made with a miles or points earning credit card. Transactions such as your rent, mortgage, car payment, credit card bill, tuition etc.You load your Bluebird card (which you can order online) with a points earning debit card at Wal-Mart. You can also reload Bluebird with Vanilla Reload cards which you can buy at CVS, Walgreen’s or other locations. Alternate with other credit cards so that you’re not spending too much at buying Vanilla Reloads with any one credit card.

Here’s a post on other credit cards to use with Bluebird, so that you’re not maxing out on just 1 card.

You may also be able to pay for the Vanilla Reloads with a credit card at Walgreen’s, but this isn’t always the case and could be a bit of wild goose chase.

Here’s a post on what a Vanilla Reload looks like and how to load a Vanilla Reload card to your Bluebird account.

Transfer from Bluebird To Bank Account

You can move money from your Bluebird account to your checking account. This could be a great way to maximize earning miles and points because you could earn miles or points while funding your Bluebird account (either via a miles earning debit card or using a credit card to buy Vanilla Reloads), and then withdraw the money to your bank account!

The terms simply say: “The Member may also return funds from the [Bluebird] Account to the Member’s Bank Account.”Many folks may not need to use this option because you can use Bluebird to pay bills which can’t be paid by credit card and for everyday transactions. But this could be useful for some to hit minimum spending requirements or spending bonuses on credit cards.

However, I wouldn’t abuse this option and would make withdrawals to my bank account like an average person would. Which means that I wouldn’t fund my account and immediately withdraw the entire amount to my bank account, but would mix it in with regular transactions, bill payments, and ATM withdrawals.

Transfer from Bank Account to Bluebird

You can link your bank account to American Express Bluebird and use it to transfer money from your bank account to your Bluebird account. At first glance, this may not seem particularly useful especially since you don’t earn miles and points when you fund your Bluebird account from your bank account.

However, this could be useful for folks who want to pay more than $5,000 per month. While your Bluebird can hold up to $10,000, you can’t use a miles earning debit card or a credit card to buy Vanilla Reloads to fund more than $5,000 per month on your Bluebird account.

So you could transfer additional money from your bank account to your Bluebird account to pay large bills. The advantage of this is that you don’t have to worry about splitting the payment of bills between your Bluebird account and your bank account.

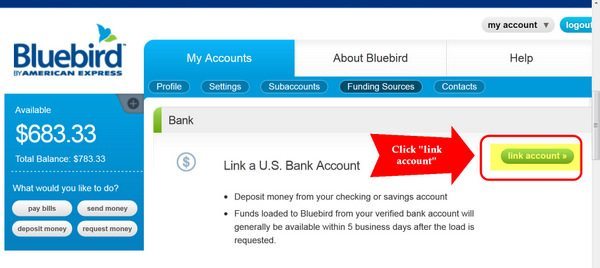

Bluebird says that “Funds loaded to Bluebird from your verified bank account will generally be available within 5 business days after the load is requested.”

How to transfer money from your bank account to Bluebird

You first have to link your bank account to American Express Bluebird. See the section after this on how to do that.

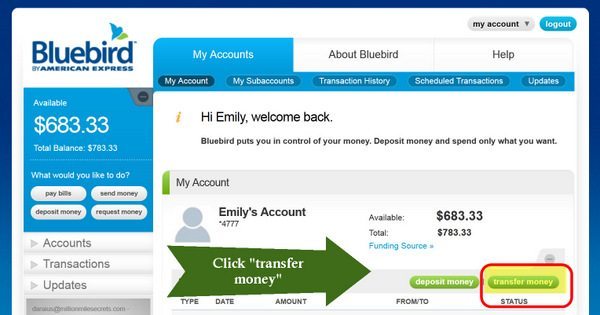

Step 1 – Log in to your Bluebird accountLog into your Bluebird account online.

Step 2 – Click on “transfer money”Click on the “transfer money” button which is on the right portion of the screen, below “My Account“

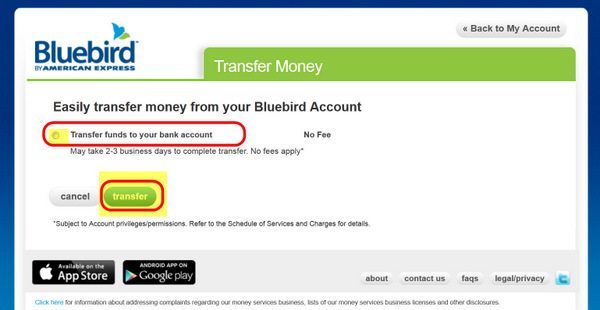

Click on the “transfer funds to your bank account” button and then click

“transfer.”

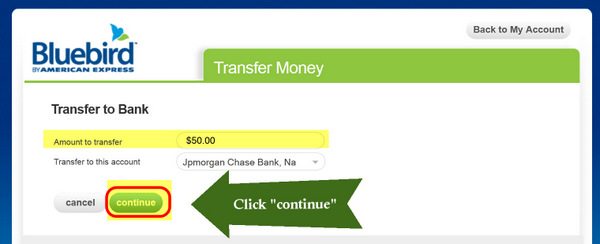

Enter the amount you want to transfer and select your bank account.

Then click “continue”

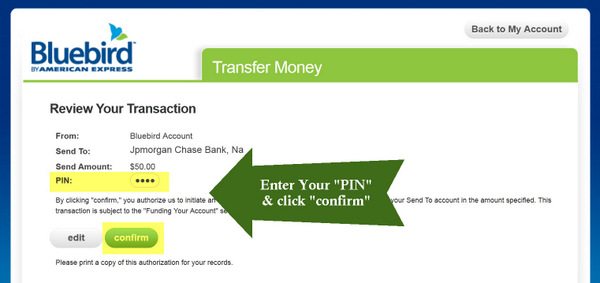

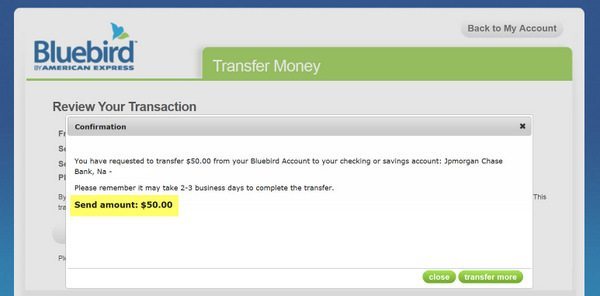

Enter your PIN and click “confirm“

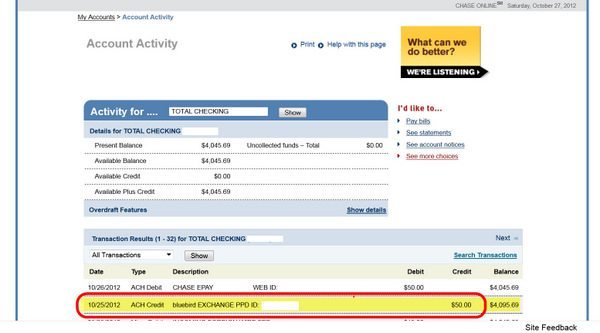

You get a confirmation message and a reminder that it could take 2 to 3 business days to complete the transfer.

How to Link a Bank Account to Bluebird

Step 1 – Log in to your Bluebird accountLog into your Bluebird account online.

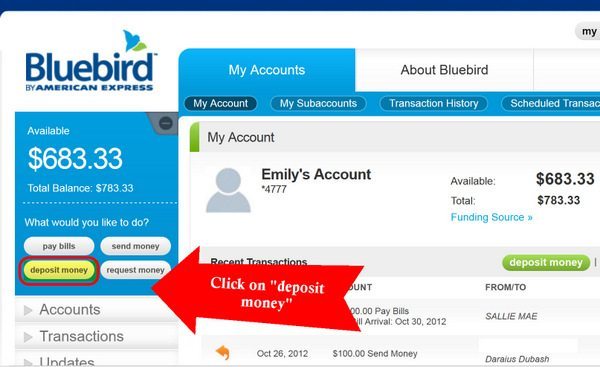

Step 2 – Click on “deposit money”Click on the “deposit money” button which is on the left of the screen.

Click on “add new funding source” to the right.

Click on “link acount” to the right.

Click on “link acount” to the right.

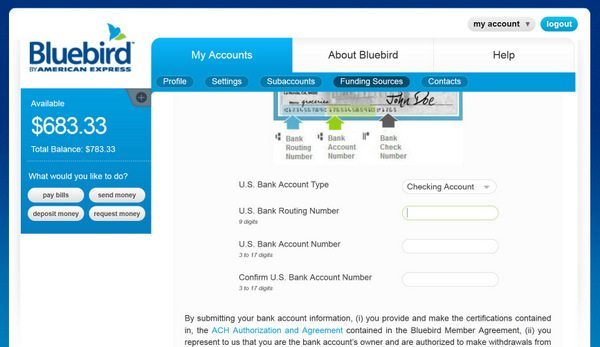

Enter your bank routing number and account number.

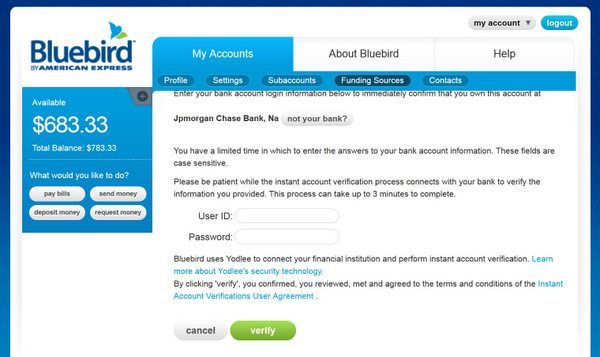

You then get the option to verify your bank account by either entering your bank account user ID & password or by confirming 2 small deposits.

I chose to enter my user ID and password, but I wonder if the 2 small deposits will count towards the direct deposits for free ATMs?

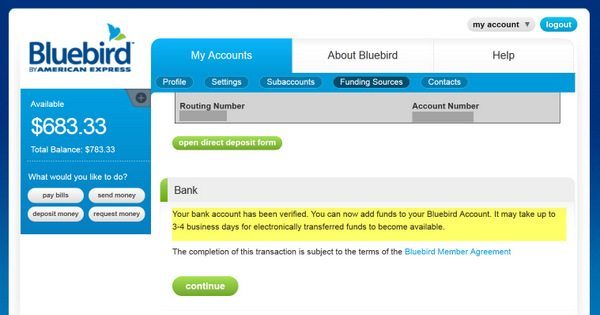

You then get confirmation that you bank account is verified and can now move money into and out of Bluebird.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!