How to Use Bluebird “Pay Bills” to Pay Rent, Mortgage, Credit Cards, Utilities, College Tuition, etc.

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Don’t forget to follow me on Facebook or Twitter!As I wrote yesterday, one of the best uses of American Express Bluebird is the ability to pay for transactions which can’t usually be made with a miles or points earning credit card.

You load your Bluebird card (which you can order online) with a points earning debit card at Wal-Mart. You can also reload Bluebird with Vanilla Reload cards which you can buy at CVS, Walgreen’s or other locations. Alternate with other credit cards so that you’re not spending too much at buying Vanilla Reloads with any one credit card.

Here’s a post on other credit cards to use with Bluebird, so that you’re not maxing out on just 1 card.

You may also be able to pay for the Vanilla Reloads with a credit card at Walgreen’s, but this isn’t always the case and could be a bit of wild goose chase.

Here’s a post on what a Vanilla Reload looks like and how to load a Vanilla Reload card to your Bluebird account.

This is a great way to help meet the minimum spending requirement on ANY credit card, or even for earning miles and points for transactions which don’t usually earn miles and points as long as you buy Vanilla Reload cards with your credit card at Office Depot and load them on your Bluebird card.

For example, it will cost you $3.95 for a 500 dollar Vanilla Reload pack. This means that you are paying $3.95 to earn 500 miles or points (assuming you use a card which gets you 1 mile or point per $1 spent).

This works out to paying 0.79 cents per mile or point or earning 0.21 miles or points per $1 spent AND you get the ability to accelerate your minimum spending to get a sign-on bonus. I value most airline miles, Chase Ultimate Rewards & American Express Membership Rewards points at around 1 cent, so I don’t mind paying 0.79 cents per mile or point.

There is NO fee for using Bluebird Bill Pay.

Bluebird Bill Pay

You then use your Bluebird card to pay for Rent, Mortgage, Credit Card Bills, Utilities, College Tuition, Payments to contractors, etc.

Bluebird offers 2 options to pay your bills via their “Pay Bills” system. The first way is to look up the name of the business whom you want to pay. If the business is listed in the Pay Bill system, you can send money electronically from your Bluebird account to the business to whom you owe money. I used this option to pay Sallie Mae student loans and my Chase credit card bill.

Available payees include, for example:

- Most mortgage, car loan, student loans, credit cards and financial institutions

- Most utility companies

The second option is if the business or person whom you want to pay is not listed in the system – say your apartment complex or contractor.

In that case, you enter the name, address, and account number of the payee and Bluebird will mail a check for free with your account information on it.

Unfortunately, you can’t schedule recurring payments so you have to log in each month to make payments which is inconvenient if you have auto pay set up on your bills. If you do decide to use the Bluebird Pay Bill set a monthly reminder on your calendar because it isn’t worth earning miles and points if you have to pay a late fee!

Bluebird Bill Pay – Payee Listed

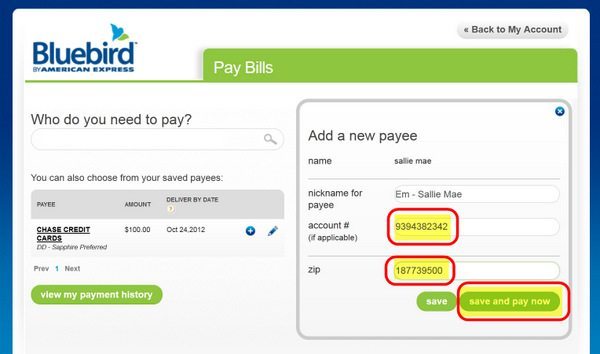

The Bill Pay system is quirky and, in some cases, requires you to enter in the full 9 digit zip code (without the hyphen) of the person or business whom you are paying (not your zip code). This is a check to help ensure that your payment goes to the correct payee.

There is a monthly limit of $10,000 for payments to payees listed in the Bluebird Pay Bill system.

The terms say to allow at least 6 business days for payments but that it *could be* ~4 business days to receive an electronic payment. However, I’d still plan on scheduling a payment at least 6 business days in advance (if not longer).

Step 1 – Log in to your Bluebird accountLog into your Bluebird account online.

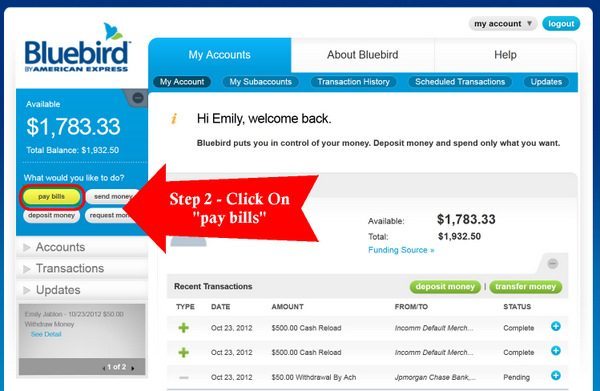

Step 2 – Click on Pay BillsClick on the “pay bills” button which is on the left of the screen.

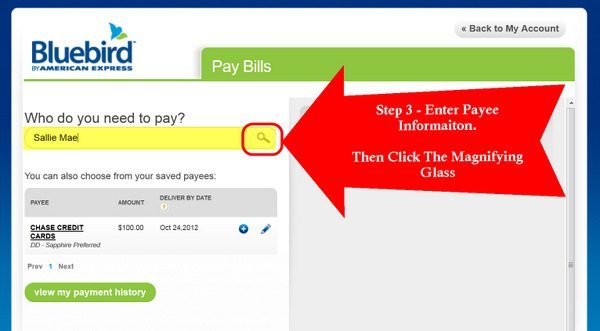

Enter the person or business whom you want to pay in the text box below “Who do you need to pay?“

For example, I entered in “Sallie Mae” to pay my student loans.

Click on the magnifying glass icon at the end of the text box to begin searching.

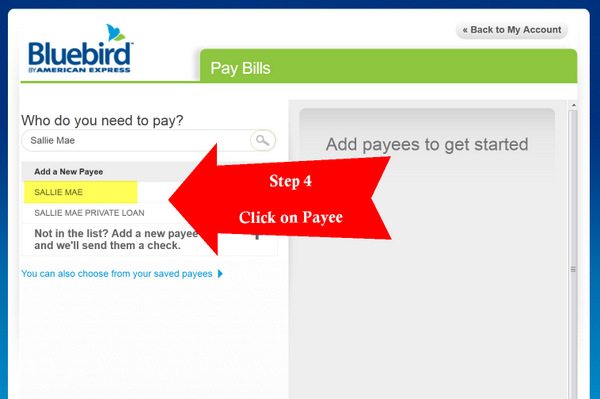

Step 4 – Select PayeeYou will see a list of matching payees who are already in the Pay Bill system.

I clicked on “Sallie Mae“

In this screen you will see a few fields to fill out.

Nickname for payee: Enter a name for the payee which will be stored for easy selection in future. Account #: Enter your loan account number from your billing statement. Zip: Enter the zip code of the payee (not your zip code). You can find this on your billing statement. If the system doesn’t take in the 5 digit zip code, try entering in the 9 digit zip code without the hyphen.

Then click on “save and pay now“

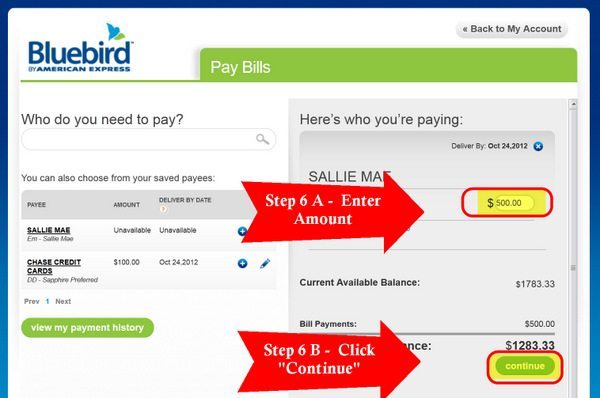

Step 6 – Enter Amount to PayEnter in the amount you want to pay.

Then click “Continue“

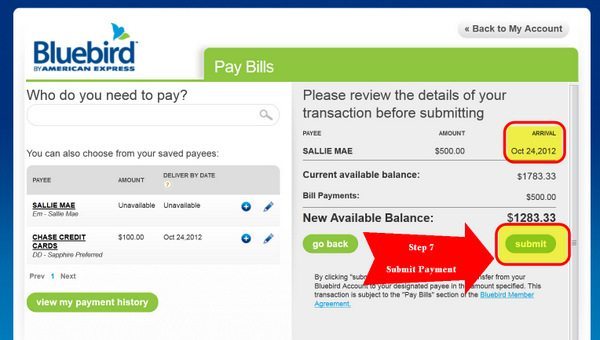

Click on “Submit” to submit your payment.

There is also a field for the “arrival” date. I submitted my payment on October 23, 2012 and Bill Pay suggests that my payment will post to my account on October 24, 2012.

Bluebird Bill Pay – Payee Not Listed

If the person or business whom you want to pay is not listed, you can add them to Bluebird and Bluebird will mail them a check for free!

For example, you can mail a check to your apartment complex, contractor, or even pay (a small bit of) college tuition this way!

There is a monthly limit of $5,000 for payments via checks (likely included in the Pay Bill limit of $10,000 per month)

The terms say to allow at least 6 business days to receive a payment, but I’d add a few extra days as buffer.

Step 1 to 3Steps 1 to 3 are the same as above

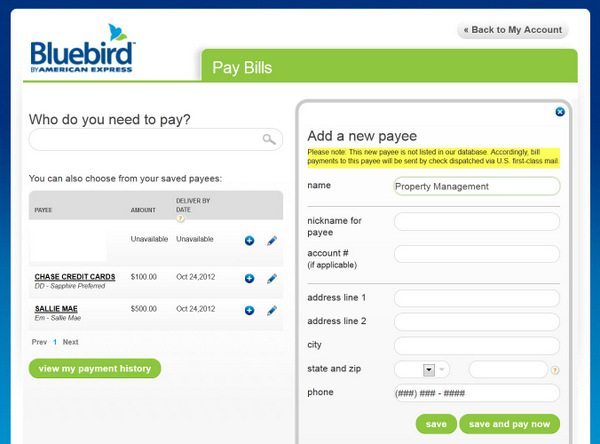

Step 4 – Enter Payee informationClick on: “Not in the List. Add a new payee and we’ll send them a check“

A message at the top of the screen says “This new payee is not listed in our database. Accordingly, bill payments to this payee will be sent by check dispatched via U.S. first-class mail.“

Enter in the payee information. Be sure to enter in the address correctly!

Click on “save and pay now“

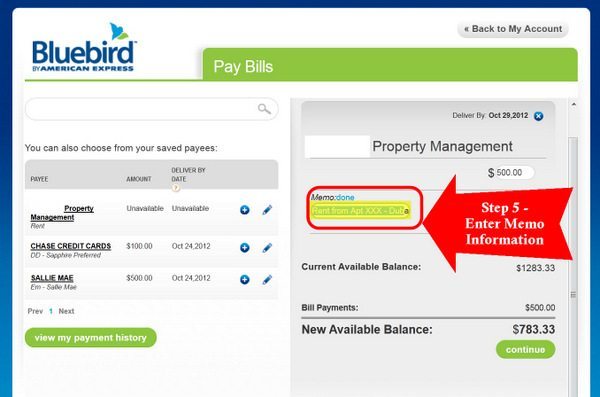

Step 5 – Enter Memo Information & AmountBe sure to enter in the memo information correctly to let the person or business know why you are sending them money. Ideally you should enter in your name, account number if applicable etc.

I entered “Rent from Apt XXX – Dubash” in the memo field. I then clicked “continue”

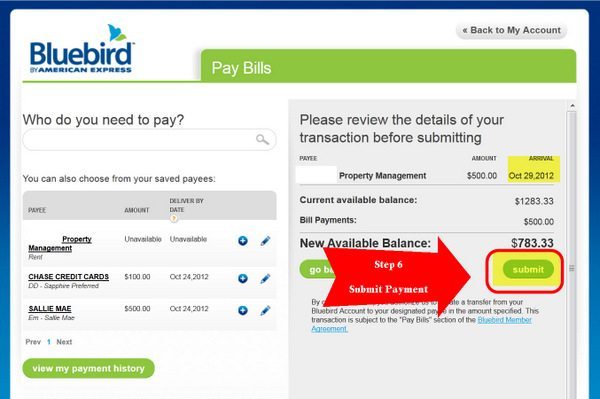

Step 6 – Click SubmitConfirm details of your transaction and click “submit“

It appears to take ~6 days for Bluebird to mail a check, but I’d try to schedule payments at least 10 days before the due date in case it takes longer to mail a check.

Bottom Line

The Bluebird Pay Bill feature is a great way to earn miles and points for bills which usually don’t earn miles and points! But schedule your payment at least 6 days in advance of the due date. There is no option to schedule recurring or automatic payments which is very inconvenient.

And be sure to read my cautions at the end of yesterday’s post before using Bluebird.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!