Bank of America Cash Rewards card benefits

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

When you sign-up for the Bank of America® Cash Rewards credit card, you’ll earn a $200 cash bonus after meeting the minimum spending requirements.

Cash back bonus aside, does this card have the benefits and perks to stay in your wallet? If you’re looking for a no annual fee cash back card and not a big spender, then yes. The Bank of America Cash Rewards card benefits, perks and earning potential make it worth keeping.

I’ll show you why the Bank of America Cash Rewards Card benefits and perks make the no annual fee card even more attractive.

Bank of America Cash Rewards card benefits and perks

With the Bank of America Cash Rewards card, you’ll earn a $200 cash bonus after you spend $1,000 in purchases in the first 90 days of account opening.

Plus, the card has no annual fee, so it’s free to keep indefinitely. While that’s a nice benefit on its own, you’ll also get a few other perks that can come in handy should you need them.

Here are the standout benefits of the card.

Pick your own 3% category

My favorite benefit of the Bank of America Cash Rewards card is the ability to pick where you earn your 3% cash back each month. Though the card earns a minimum 1% cash back, you can earn 2% cash back at grocery stores and wholesale clubs.

The 3% and 2% cash back categories are capped at a combined $2,500 in purchases each quarter. Capping how much cash back you earn isn’t great, but the 3% and 2% category spending cap resets every quarter as opposed to every year like with many other cash back cards.

The flexibility of choosing where you earn 3% cash back each month is a big plus. For example, during the summer months, you set your category as travel but during the winter, you set it as entertainment. You’re not ever locked into a single category.

Here’s what you can select as your 3% cash back category:

- Gas stations

- Online shopping

- Dining

- Travel

- Drug stores

- Home improvement and furnishings

Again, you’ll be limited to cash back on the first $2,500 purchases each quarter. That’s for both the 2% and 3% cash back category. So plan your purchases accordingly!

Extended warranty

When you pay for an eligible item with the Bank of America Cash Rewards card, it’s possible to extend the manufacturer’s warranty by an additional 12 months. This is a fantastic benefit if you’re a fan of retail therapy like myself.

There are several excluded purchases. Unfortunately, Bank of America only provides the full terms and conditions of any benefits associated with a credit card once you receive your card in the mail. So be sure to read through the terms and conditions before assuming you’re covered.

BankAmeriDeals

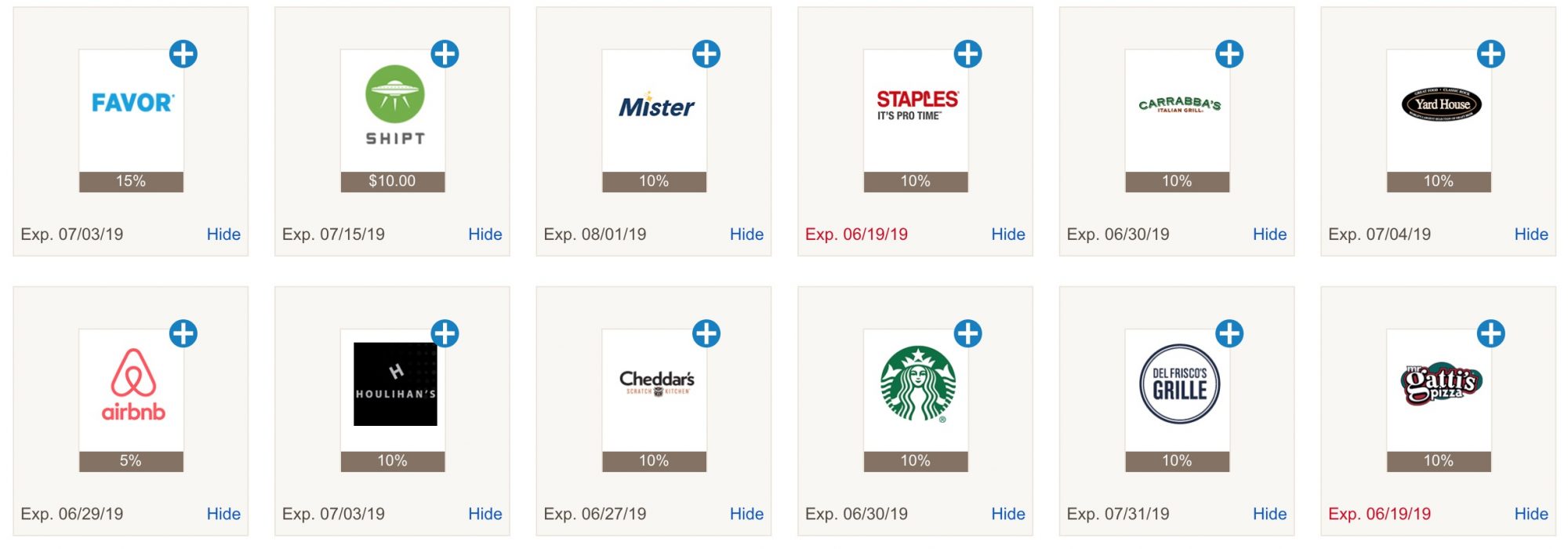

BankAmeriDeals is linked to your Cash Rewards card and allows you to earn up to 15% cash back.

The way BankAmeriDeals works is simple. It’s a separate program offered by Bank of America that works with most Bank of America credit cards. When you enroll in BankAmeriDeals, you’ll be able to see a list of ongoing promotions offered at certain retailers, restaurants, gas stations, etc. Simply add deals that appeal to your shopping habits and use your card.

As noted, you might even be able to earn up to 15% cash back with certain partners.

Travel coverage

When you pay for travel with your Bank of America Cash Rewards Card, you’re covered if the unthinkable happens. To qualify for these benefits, you’ll need to pay for the full amount of your common carrier fare (planes, trains, cruises, ferries) with your Cash Rewards card.

These benefits are only supplementary, so if the common carrier or other primary insurance reimburses you for anything, this benefit will only kick in for the things they don’t cover.

Travel accident insurance

You may be eligible for travel accident coverage through the Bank of America Cash Rewards Card. However, this is not one of those benefits that you’ll ever want to use.

Like most travel insurance policies, the Cash Rewards card covers things like dismemberment or death. When primary insurance or a common carrier does not cover damages, the coverage offered by the Cash Rewards card will kick in for eligible damages.

As always, be sure to read through the full terms and conditions upon receiving your card to determine what is and isn’t covered with the Cash Rewards card.

Car rental insurance

Cruising down the Pacific Coast Highway in Southern California is fun until you’re rear-ended by a distracted driver. Don’t stress out over a damaged rental car. The Bank of America Cash Rewards Card offers rental car coverage.

The coverage offered by the Cash Rewards Card is considered secondary or supplementary. This benefit will only kick in when your primary insurance won’t cover damages or loss.

You can also check out our guide to credit cards that offer rental car insurance for more information about coverage and other cards that offer it.

Bottom line

The Bank of America Cash Rewards card offers benefits without a hefty annual fee. These perks, and the ability to earn a lot of cash back, make it a card you’ll want to keep long-term.

Two of my favorite benefits are directly tied to earning cash back. The first is the ability to chose your 3% cash back category every month. The second benefit is BankAmeriDeals which even allows you to earn up to 15% cash back at certain merchants.

You can apply for the Bank of America Cash Rewards credit card here.

For the latest tips and tricks on traveling big without spending a fortune, please subscribe to the Million Mile Secrets daily email newsletter.Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!