For My Mom’s Birthday, I Got Her … a Credit Card?!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers. Jasmin: Don’t we all have friends and family who are impossible to buy gifts for when birthdays or the holidays come around?My mom is one of those people. She’s retired and is more interested in getting rid of things than acquiring more stuff. Usually, I’ll ask her what she wants, and she’ll say “Nothing! I have everything I need!“ Then, when pressed, she suggests items like new socks (not helpful).

So on her last birthday, it was time for a different approach. As part of her gift, I paid a yearly fee to add her as an authorized user to one of my credit card accounts. And because of the Priority Pass Select airport lounge membership the card comes with, her recent travels have been much more comfortable.

It’s worked out really well for her. And I’ll show you how you can share similar awesome benefits with friends and family who like to travel!

The Gift of Authorized User Lounge Access

Link: Are Airport Lounges Worth It?

Link: Will Authorized Users Get Their Own Priority Pass Membership?

Link: How Do Authorized Users Activate Their Priority Pass Membership With Chase Sapphire Reserve?

There are a number of premium credit cards which offer complimentary lounge airport lounge access to the primary cardholder. But a few also allow you to add authorized users who’ll receive the same or similar benefits.

So if you have loved ones who enjoy traveling, this is a terrific way to take them under your wing and treat them to VIP-style amenities on their future trips.

| Card | Lounges | Guest Policy | Annual Fee (Primary Cardholder) | Annual Fee (Authorized User) |

|---|---|---|---|---|

| Delta Reserve® Credit Card from American Express | Delta SkyClub access when traveling on a Delta coded or Delta operated flight | Up to 2 guests and children under 21 years of age for $29 per person | $450 (See Rates & Fees) Terms Apply | $175 (See Rates & Fees) |

| Delta Reserve for Business Credit Card | Delta SkyClub access when traveling on a Delta coded or Delta operated flight | Up to 2 guests and children under 21 years of age for $29 per person | $450 (See Rates & Fees) Terms Apply | $175 (See Rates & Fees) |

| The Business Platinum Card from American Express | Priority Pass Select, Centurion Lounges, Delta SkyClub (when traveling on a Delta flight), Escape Lounges, Airspace Lounges | 2 guests (except Delta SkyClub which costs $29 per guest) | $595 (See Rates & Fees) Terms Apply | $300 (See Rates & Fees) |

| The Platinum Card® from American Express | Priority Pass Select, Centurion Lounges, Delta SkyClub (when traveling on a Delta flight), Escape Lounges, Airspace Lounges | 2 guests (except Delta SkyClub which costs $29 per guest) | $550 (See Rates & Fees) Terms Apply | $175 for up to 3 additional cards, $175 each for the 4th or more additional card (See Rates & Fees) |

| Citi® / AAdvantage® Executive World Elite™ Mastercard® | American Airlines Admirals Club access | 2 free guests or immediate family (spouse/domestic partner and children under age 18) | $450 | Up to 10 free authorized users |

| Citi Prestige® Card | Priority Pass Select access | 2 free guests or immediate family (spouse/domestic partner and children under age 18) | $450 | $50 |

| Chase Sapphire Reserve® | Priority Pass Select access | Unlimited guests (at lounge's discretion) | $550 | $75 |

| Ritz-Carlton Rewards® Credit Card (card no longer available) | Priority Pass Select access | Unlimited guests (at lounge's discretion) | $450 | Free |

You’ll notice each of these cards has a steep annual fee for the primary cardholder. But keep in mind, in addition to lounge access, some of these cards offer perks like travel credits, Global Entry or TSA PreCheck credits, and other valuable benefits that can offset the annual fee cost.

And some, like the Citi® / AAdvantage® Executive World Elite™ Mastercard® and Ritz-Carlton Rewards® Credit Card, don’t charge anything extra to add an authorized user. So if you have one of these cards, it’s a no-brainer to add a trusted friend or family member and get them into airport lounges for free.

I Added Mom to My Citi Prestige Account

Link: Citi Prestige

I’ve kept the Citi Prestige in my wallet for a few years now. Even though it has a $450 annual fee, it’s worth it for the outstanding travel perks and benefits that come with the card, including:

- Annual $250 air travel credit

- Priority Pass Select lounge access (includes 2 free guests or immediate family traveling with you) at over 1,200 airport lounges worldwide

- 4th night free on paid hotel stays booked through the Citi Prestige Concierge or Citi Travel Center

- Excellent travel protection benefits including trip cancellation / interruption, baggage delay or loss, trip delay, and travel accident insurance

When you take the $250 air travel credit into account, it effectively reduces the annual fee to $200 ($450 annual fee – $250 air travel credit). And I’ve gotten hundreds of dollars back each year by making the most of the 4th night free hotel benefit. Plus, having Priority Pass Select lounge access has saved me a ton of cash instead of spending money on expensive airport food and drinks.

Adding my mom as an authorized user to my Citi Prestige was easy to do online through my Citi account. Her credit card arrived in the mail quickly, but it took ~2 weeks to receive her Priority Pass membership card (which you must present to gain lounge access).

Getting her an authorized user Citi Prestige card has had another benefit as well. My mom loves to bargain hunt and sometimes she’ll call or text – from a store – saying there’s a great sale on kids’ shoes, or athletic gear, or what have you. I’ll often ask her to pick up a few things for me.

Before, I’d just pay her back in cash. But now that she has her own Citi Prestige card, it’s easier for her to use it so that I get billed on my statement. Plus, I get to keep the points from her spending! 🙂

Just remember, you should only add folks you completely trust as an authorized user on your credit card accounts. Because you’re responsible for any charges they make.Mom’s Thrilled With Her Priority Pass Select Membership!

As a retired airline employee, my mom still travels a lot. She’s always jetting off to fun places, like the Philippines for the winter or to Europe with friends or family in the warmer months. Now that she’s got her own Priority Pass Select membership, she’s very much enjoyed the relaxing atmosphere, free meals and drinks, and comfy seating in the airport lounges she’s visited.

So far, she’s tried out:

- Three different Plaza Premium Lounges in Toronto (way to make the most of it, Mom!)

- The Air Canada Maple Leaf Lounge in Paris

- The Plaza Premium Lounge in Hong Kong

- The VIP Lounge at Clark International Airport

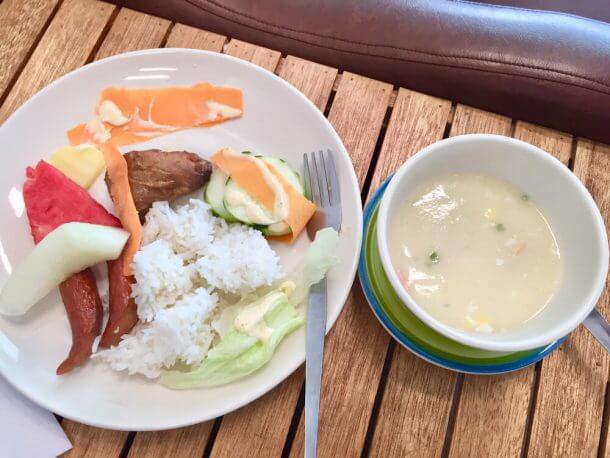

Of course, she didn’t get many pictures of herself in the lounges. Instead, her snapshots are mostly of food and the “very nice” lounge staff who made her feel like a real VIP.

She also loves the complimentary, fast Wi-Fi which makes it easy for her to check her Facebook and chat with friends and family.

Mom’s just getting a big kick out of it. So I guess she knows what she’s getting (again) for her next birthday!

Bottom Line

Adding a loved one as an authorized user to certain premium credit card accounts is a unique and fun way to give the gift of better travel.

For $50 per year, I added my mom to my Citi Prestige account. And now, whenever she travels, she gets complimentary Priority Pass Select airport lounge access. She’s already enjoyed free meals, drinks, and a quiet place to rest at half a dozen lounges around the world!

It’s something to consider if you have friends or family who are super hard to buy birthday and holiday gifts for (if they can use the perk!). Just remember to only add folks you trust as an authorized user, because you’re responsible for any charges they make.

Come back each Wednesday for a new installment in our Family Travel series! For rates and fees of the Delta Reserve Card, please click here. For rates and fees of the Delta Reserve Business Card, please click here. For rates and fees of the Amex Platinum Card, please click here. For rates and fees of the Amex Business Platinum Card, please click here.Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!